Nvidia’s Rubin chips are turning AI into cheap infrastructure. That’s why open intelligence marketplaces like Bittensor are starting to become important.

Nvidia used CES 2026 to hint at a major change in the way it runs artificial intelligence. The company hasn’t been at the forefront of consumer GPUs. Instead, we introduced Rubin, a rack-scale AI computing platform built to make inference faster, cheaper, and more efficient at scale.

Vera Rubin is in full production.

We launched the next generation of AI infrastructure using the NVIDIA Rubin platform, integrating six new chips to deliver one AI supercomputer built for AI at scale.

Here are the top 5 things you need to know 🧵 pic.twitter.com/TiQKUK4eY3

— NVIDIA (@nvidia) January 6, 2026

Rubin turns AI into industrial infrastructure

Nvidia’s CES announcement revealed that it no longer sells individual chips. We are selling AI factories.

Rubin is Nvidia’s next generation

Jensen Huang broke the most important rule in the industry.

And it explains why Nvidia controls 95% of the AI chip market.

Last night at CES, he announced Vera Rubin, a new AI supercomputer that is currently shipping.

Full production began a few weeks ago.

But here… pic.twitter.com/INWF8ByP88

— Riccardo (@Ric_RTP) January 7, 2026

This is important because modern AI workloads no longer look like a single chatbot. They increasingly rely on many smaller models, agents, and professional services that call on each other in real time.

Lowering costs will change the way we build AI

Rubin enables a new type of AI economy by making inference cheaper and more scalable. Developers can deploy thousands of fine-tuned models instead of one large monolith.

Companies can run agent-based systems that use multiple models for different tasks.

However, this introduces new problems. As AI becomes modular and rich, someone must decide which model handles each request. Someone needs to measure performance, manage trust, and route payments.

Cloud platforms can host models, but they do not provide a model-neutral marketplace.

That gap is where Bittensor fits

Bitensor does not sell computing. AI models run distributed networks competing to provide useful output. The network uses on-chain performance data to rank these models and pays them in native tokens. Tao.

Thanks to @nvidia CEO Jensen Huang for explaining $Tao Without knowing that @bittensor already exists. https://t.co/508xbAuWjn

— Yvr τrader (@yvr_trader) January 7, 2026

Each Bittensor subnet acts like a marketplace for a specific type of intelligence, such as text generation, image processing, or data analysis. Models that perform well can earn more money. Models that perform poorly lose influence.

This structure becomes more valuable as the number of models increases.

Why Nvidia’s Rubin can realize the Bitensor model

Rubin does not compete with Bittensall. This makes Bittensor’s economic model work at scale.

By reducing the cost of running AI, Nvidia will enable more developers and companies to deploy specialized models. This increases the need for a neutral system to rank, select, and pay for these models across clouds and organizations.

Bitensor provides that adjustment layer. This turns the flood of AI services into an open and competitive market.

Nvidia controls the physical layer of AI: chips, memory, and network. Rubin gives more control over AI by making it cheaper and faster to run.

At CES, our CEO Jensen Huang, along with Rubin, GR00T, Alpamayo, and more, announced how physical AI will power the next wave of factories, robots, and self-driving cars.

Watch the keynote: https://t.co/yUHiDMBXSg

Read the announcement: https://t.co/16BG6MDmD5 pic.twitter.com/1qo9SIqTha— NVIDIA (@nvidia) January 13, 2026

Bitensor operates one layer above that. Handles the economics of intelligence by determining which models are used and rewarded.

As AI moves towards agent swarms and modular systems, it becomes difficult to centralize economic layers.

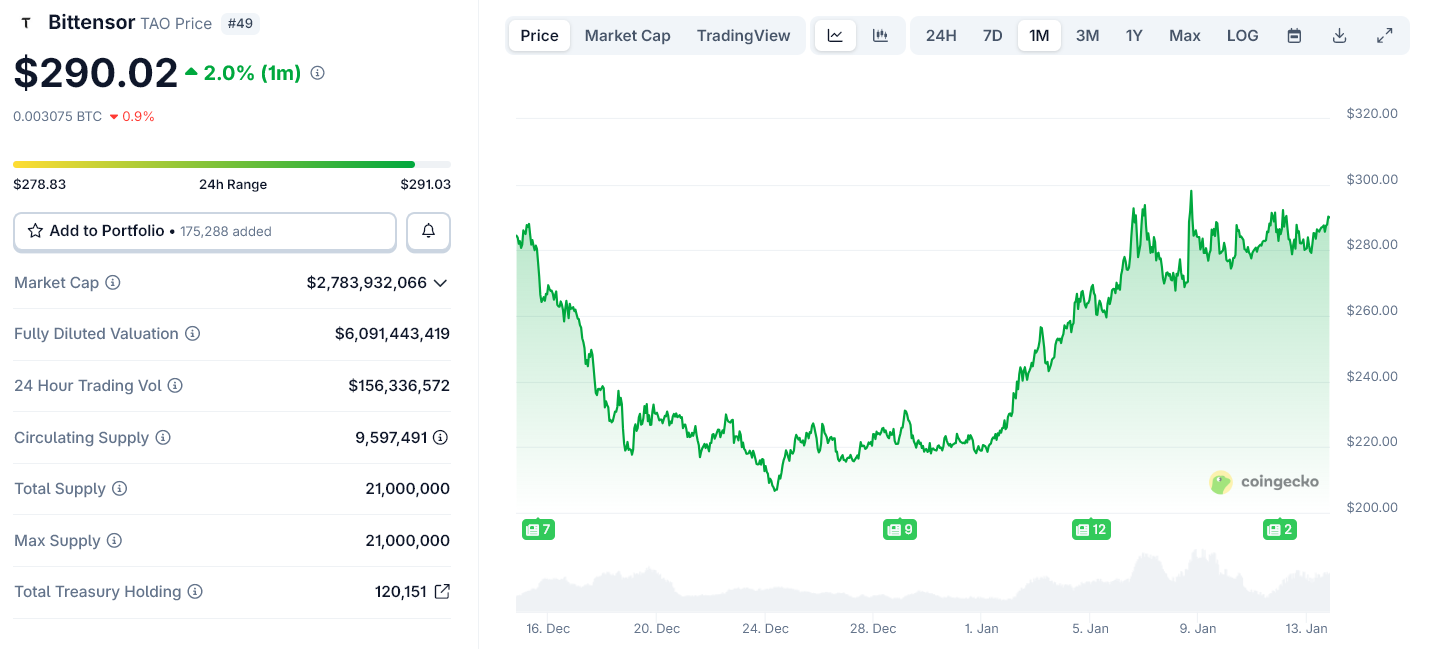

Petitioner (Tao) Price chart for the past month. Source: CoinGecko

What does this mean going forward?

Rubin’s rollout in late 2026 will expand AI capabilities across data centers and clouds. This increases the number of models and agents competing for the actual workload.

Open networks like Bittensor will benefit from that change. They are not a replacement for Nvidia’s infrastructure. They give it a market.

In that sense, Rubin does not undermine decentralized AI. It gives you something to organize it.

The post How Nvidia’s Rubin Chip Could Drive Bittensor Adoption in 2026 originally appeared on BeInCrypto.