After the recent downturn in the cryptocurrency market, the asset quickly attempted a slight recovery. The hyperliquid whale has entered the altcoin basket with a long bet.

HyperLiquid Whale injected over $3.6 million to go long selected altcoins. Although markets remain volatile and sentiment is low, whales are betting on directional movement, or at least a short-term recovery.

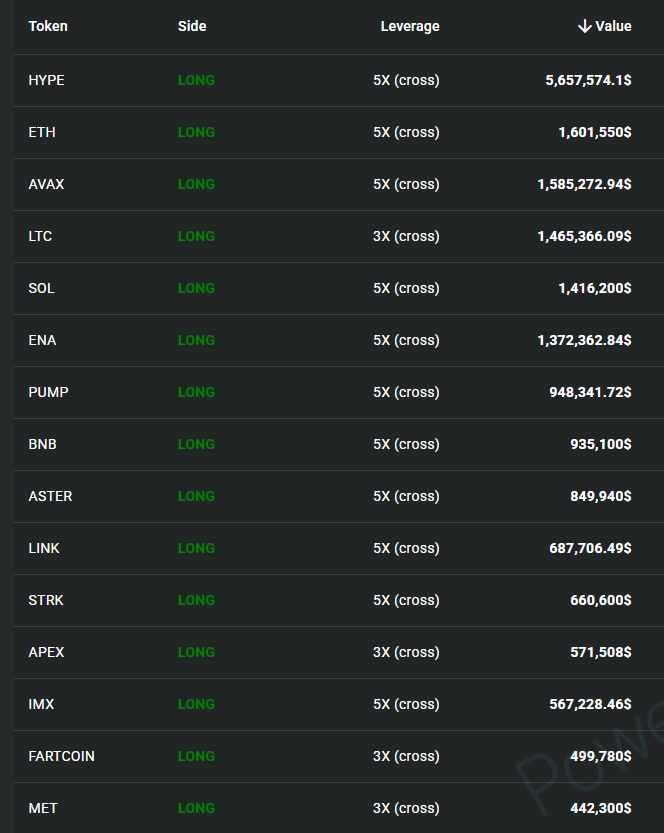

HyperLiquid Whale selected the altcoin and allocated $3.6 million to a long position. Whales selected trending tokens as well as risky memes with the potential for rapid recovery. |Source: Hyperliquid.

Whales selected blue-chip tokens such as ETH and BNB, as well as recently active coins such as LTC. This mix also includes meme tokens and we expect directional movement for FARTCOIN, PEPE, BONK, PNUT, and POPCAT.

Whales also picked up startups like ASTER and MET, as well as older asset AVAX in hopes of a breakout. Whale selection suggests that a market-wide rally may not be possible, but some altcoins still appear to have the potential to move forward with clear moves.

Whales maintain their positions despite unrealized losses Net amount of $276,000offset by a portion of the altcoin’s smaller profits.

Super liquid whales bet on HYPE

Overall, Whale had a net unrealized loss primarily based on HYPE’s performance. The position had an unrealized loss of $293,000, but Whale paid more than $8,400 in fees to continue holding it. HYPE is trading close to its normal range at $38.49 and is awaiting another big breakout.

After a series of liquidations, HYPE’s open interest has fluctuated around $1.4 billion. HYPE holds over 68% long position in Hyper Liquid Whale, ranking third after BTC and ETH.

This coin has always been favored by traders despite its value. mind share Recently, it has decreased by more than 46%. The whales’ return to hyperliquid also shows that the risk of perpetual futures DEXs has not discouraged all traders.

HyperLiquid currently has $7.4 billion in open interest, of which approximately $2.5 billion is allocated to smaller altcoins.

Traders wait for breakouts and look for forgotten coins

The altcoin seasonal index recently rebounded from a local low of 25 points to 43 points. While not all of the top 100 assets are expanding, there are enough coins and tokens that are showing directional gains.

Long bets on AVAX also increased on HyperLiquid, with trading volume increasing to a one-month peak. Open interest also increased to $257 million from a recent low of $200 million.

Altcoins come with risks, but when combined with leveraged trading, a rebound from recent lows can yield greater profits.

Perpetual DEXs allow traders to bet on breakouts without holding on to their tokens. Trend tokens also ensure sufficient liquidity to complete trades.

Other recent changes in sentiment indicate that traders see the altcoin as viable again after the October 11 liquidation. Among potential runners: Uni is expected to leap into new scope based on the platform’s success and eventual profit distribution in 2025.