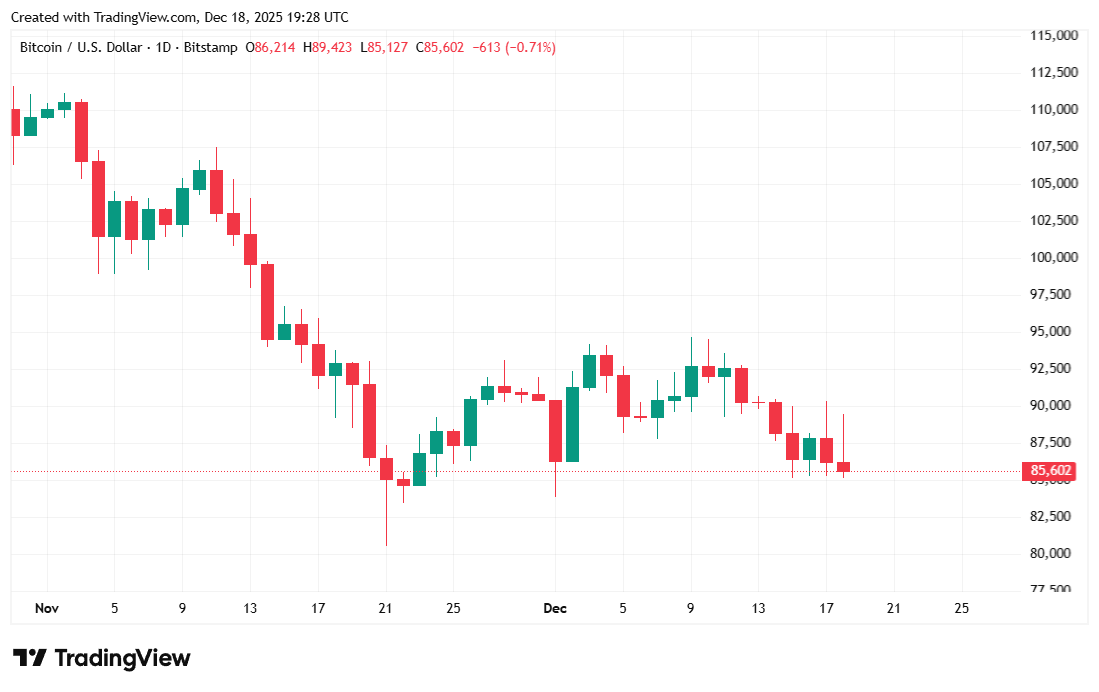

The cryptocurrency briefly rose on Thursday morning, but fell to $85,000 later in the day.

Why is Bitcoin stuck with subdued inflation and rising inventories?

The U.S. Bureau of Labor Statistics (BLS) released its long-awaited Consumer Price Index (CPI) report on Thursday, revealing lower-than-expected inflation data. Stock prices rose in response to this news, and Bitcoin also rose, albeit temporarily. The cryptocurrency soared to $89,000 before plummeting to $85,000, once again reinforcing an unpredictable pattern that has left experts somewhat frustrated.

“We need to know what happened on October 10th,” wrote crypto trader Elliot Weinman. “Obviously the market crashed that day, but nothing has changed since then.”

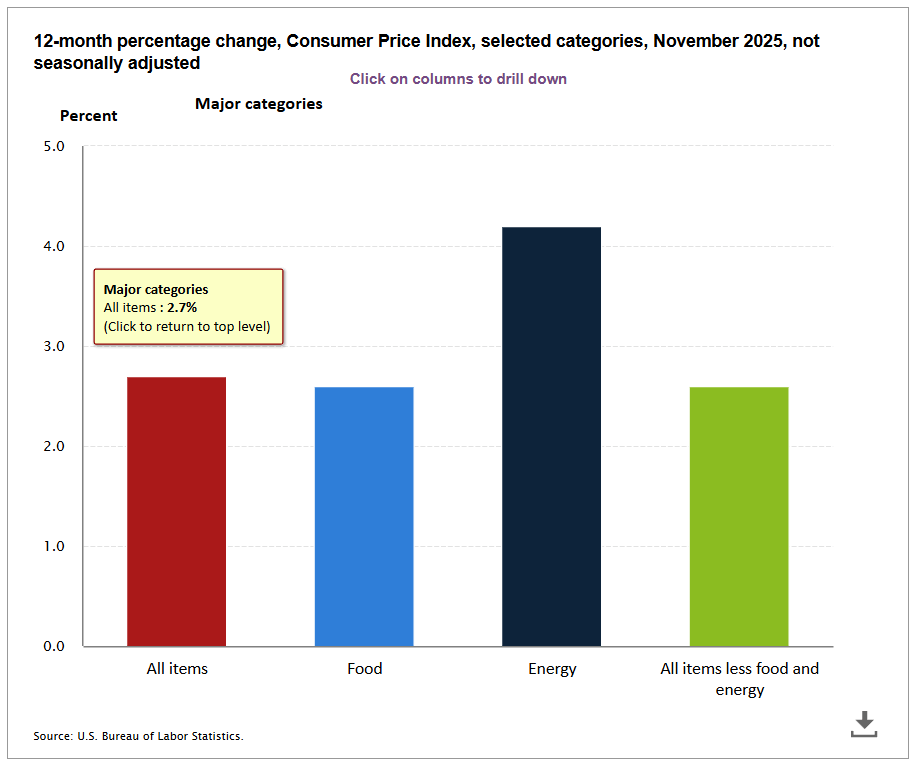

The headline inflation rate in November was 2.7%, lower than economists’ expectations of 3.1%. The last reading in September showed CPI at 3%. Data was not collected for October due to the 43-day government shutdown. The closure also delayed publication of the November report by eight days behind schedule. Core inflation, which excludes the volatile food and energy sectors, rose 2.6%, also below expectations.

(The inflation rate in November was 2.7%, lower than the 3.1% expected by economists. / Bureau of Labor Statistics)

The Federal Reserve, which is struggling to meet its dual mandate of maintaining price stability and full employment, could take a more dovish stance in 2026 if inflation continues to slow. Despite today’s report, Fed Chairman Jerome Powell is caught in the middle as both inflation and unemployment rates have trended upward over the past few months.

read more: Shutdown job data finally released, but it’s not very good

However, while the probability of a January rate cut remains relatively low, most experts seem to agree that a March rate cut is likely, according to the CME FedWatch tool. While the S&P 500, Nasdaq, and Dow rose 0.85%, 1.44%, and 0.23%, respectively, Bitcoin stalled, down 0.37% at the time of reporting.

“I haven’t seen Bitcoin or Artz trade like this since 2018,” Weinman said. “I need answers.”

Overview of market indicators

At the time of writing, Bitcoin was trading at $85,472.12, down 0.37% for the day and 6.02% for the week, according to data from Coinmarketcap. The price of this digital asset fluctuated between $85,242.71 and $89,412.66 in the past 24 hours.

(BTC Price/Trading View)

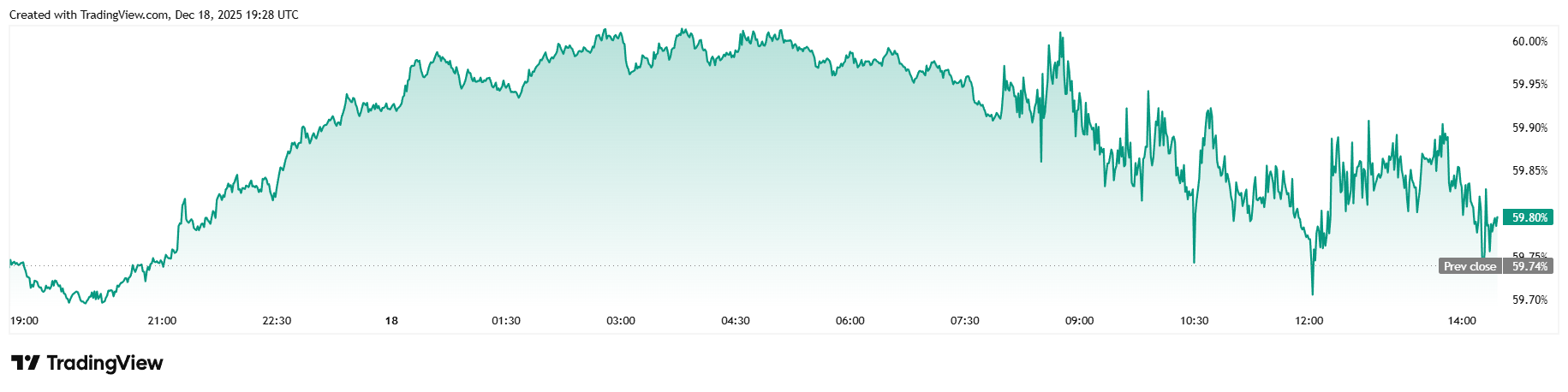

Daily trading volume increased by 14.61% to $48.62 billion, while market capitalization remained unchanged at $1.71 trillion. Bitcoin dominance rose 0.08% to 59.80% as several well-known alternative stocks fell more than 8%.

(BTC Dominance / Trading View)

According to Coinglass, total open interest in Bitcoin futures decreased by 1.20% to $56.35 billion. Liquidations continued to rise on Thursday, totaling $176.22 million. Long investors lost $112.28 million, twice as much as short sellers who liquidated $63.94 million.

Frequently asked questions ⚡

- Why didn’t Bitcoin rise after the CPI report?

Bitcoin briefly rose on the back of cooling inflation data, but quickly reversed, signaling continued market turmoil since October. - What did the latest CPI report show?

Headline inflation slowed to a lower-than-expected 2.7% in November, but core CPI also fell below expectations. - How are stocks reacting compared to Bitcoin?

While US stocks soared on the inflation news, Bitcoin was a laggard and fell toward $85,000. - What are traders blaming for Bitcoin’s weakness?

Some point to structural damage to the market from the October 10 liquidation event rather than current macro data.