Ethereum has been gaining institutional interest over the past few weeks. However, the price is integrated In a tough range.

On-chain data reveals that despite the lack of Altcoin prices, sales pressure from US-based whales and agencies has been steadily declining over the past month.

Demand for Ethereum is strong among US investors

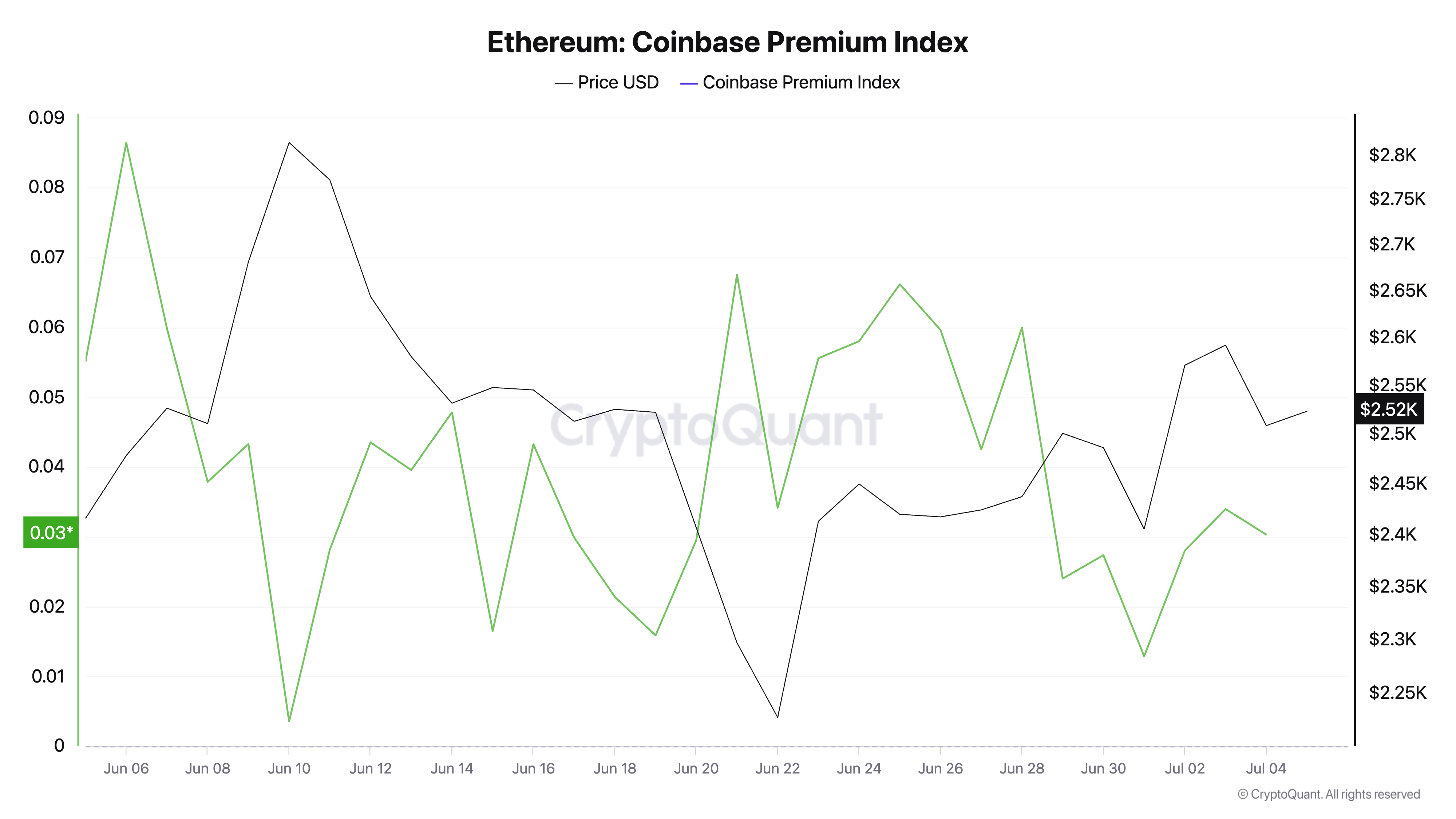

According to data from Cryptoquant, Ethereum’s Coinbase Premium Index (CPI) has consistently surpassed the zero mark for the past month. This is a signal of sustainable purchasing rights from US-based investors.

At the time of writing, the CPI is 0.03.

Ethereum Coinbase Premium Index. Source: Cryptoquant

This metric is a good indicator for measuring differences in ETH prices on Coinbase and Vinance and tracking US investor sentiment.

When CPI rises, ETH trades at Coinbase premium compared to international exchanges. This reflects stronger purchasing pressure from US-based investors.

Conversely, if CPI falls or even worse, negative, it signals that Coinbase demand is lagging behind the global market as it is profiting and declining among US buyers.

Therefore, despite low price performance in recent weeks, the stable CPI of ETH on the zero line suggests that US investors continue to buy rather than leave the market. This refers to measured accumulation trends rather than sale.

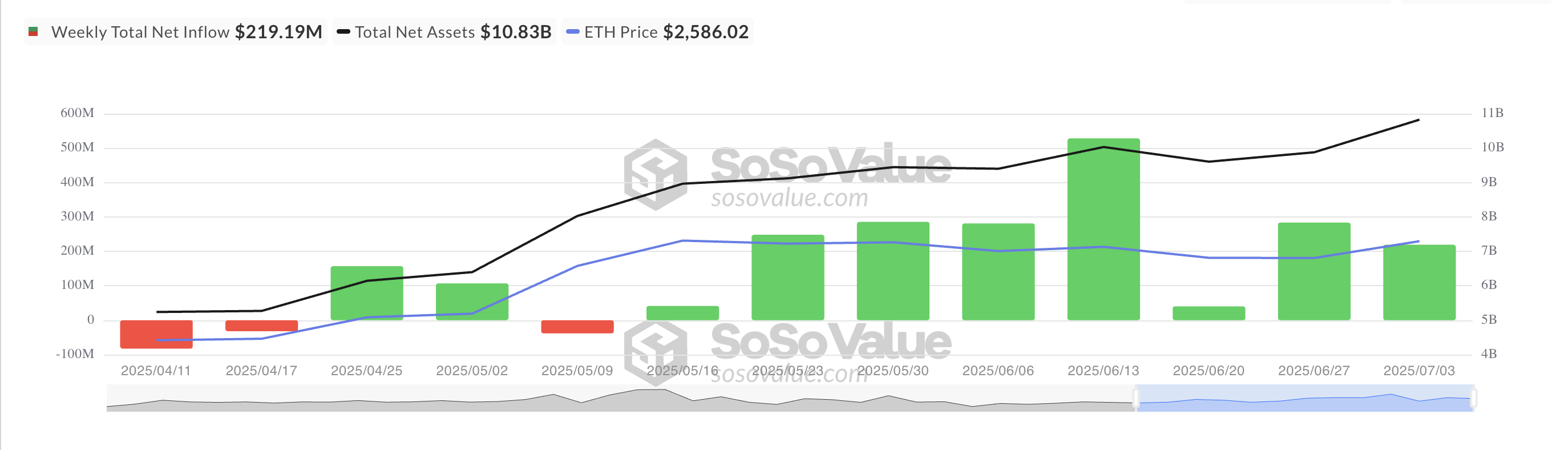

Additionally, consistent weekly inflows into ETH-backed exchange trade funds (ETFs) confirm sustained returns from key investors. For each sosovolu, these funds have recorded a consistent weekly net inflow since May 9th.

All Ethereum spot ETF net flow. Source: SosoValue

This reflects a sustained appetite among institutional investors for exposure to ETH, even if price action is relatively suppressed.

ETH trapped in a narrow area

ETH/USD Measurements from the daily chart confirm that ETH is consolidated in the price range of $2,750 to $2,424 since early May. If institutional investors increase buying pressure and broader market sentiment improves, the coin could rally towards a $2,750 resistance level and attempt a breakout on top of that.

If successful, the price of the ETH could rise to another $3,067.

ETH price analysis. Source: TradingView

However, once investors’ participation weakens and bear pressure builds up, ETH could return to $2,424. If that support is not retained, it could drop to $2,185.