After years of silence, SpaceX-related wallets suddenly moved $152 million in Bitcoin, igniting new concerns about what it means for BTC’s next price transfer.

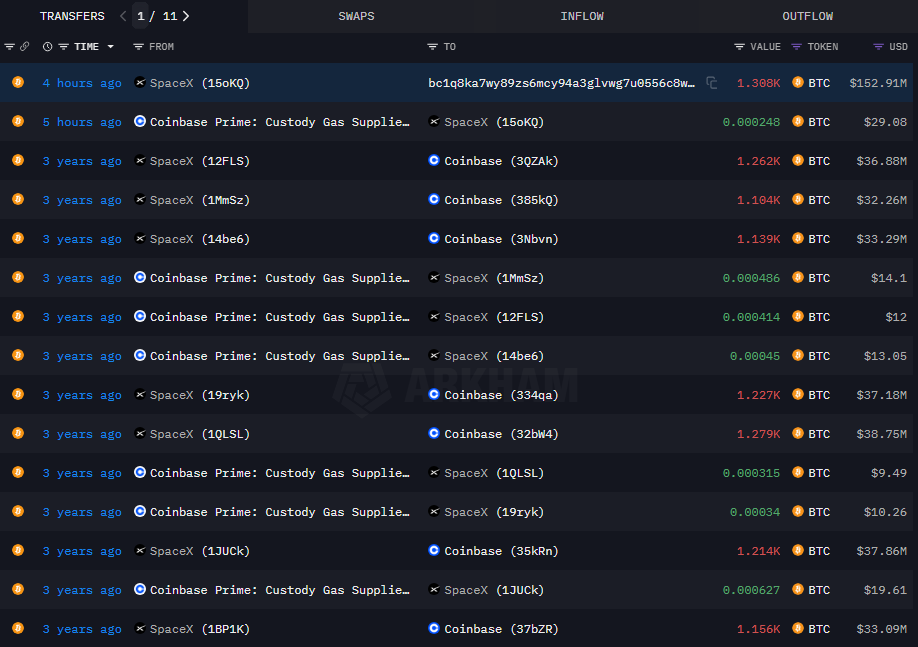

On July 22, a wallet associated with Elon Musk’s multi-billion dollar space company SpaceX transferred approximately $122.91 million in 1,308.45 BTC to its new address, according to data from blockchain analytics platform Arkham Intelligence.

In particular, the transfer continued after SpaceX wallet sent Coinbase Prime a small transaction fee of 0.000248 BTC worth $29.

Source: Arkham

Additional data from Arkham reveals that the wallet last saw the move was almost three to four years ago when it received a single deposit ranging from the Coinbase wallet, in the range of 1,100-1,279 BTC.

For beginners, SpaceX first made headlines in 2021. Elon Musk publicly revealed at a ₿Word Virtual Meeting that aerospace companies were stacking up bitcoin.

The exact amount was never disclosed, but a report from the Wall Street Journal later showed SpaceX had written down the value of Bitcoin Holding to around $373 million and sold the private portion. These events followed a sharp decline in Bitcoin in 2022.

On-chain activity later suggested that the company’s BTC holdings could have been nearing zero by the end of that year, but this remains unconfirmed.

The company gradually restructured its balance, holding approximately 8,285 BTC by September 2024.

You might like it too: Bitcoin’s advantage slides as Ethereum market share jumps to 11.6%

Following today’s massive transfers, SpaceX currently holds around 6,977 BTC, valued at around $822.65 million. This will make the company the world’s largest company Bitcoin holders, including another Musk-led entities such as MicroStrategy (MSTR) and Tesla (TSLA). All SpaceX holdings are currently managed by Coinbase Prime.

In 2021, both SpaceX and Tesla appeared to be keeping their distance from Bitcoin, citing environmental concerns related to energy use, and prompting Tesla to suspend payments for BTC.

But the tech billionaire then changed the tone. Earlier this month, Musk revealed plans to launch a new political party in the United States. This expresses an explicit support for Bitcoin and a new embrace of assets.

So many speculate that SpaceX positions itself alongside other large companies like Trump Media, which employs Bitcoin as part of its financial strategy.

Will Bitcoin prices crash?

At the time of reporting, it remains unknown whether the transfer signals a sale or an internal real location, but traders are cautious as potential offloading can cause fresh sales pressure.

Some market participants downplay the risk, and given the lack of formal explanation, this move suggests that this could be a daily housekeeping or a transition to fresh wallets.

* @spacex just moved Bitcoin for the first time in three years

I think this movement is just the right amount of home care. There is a small chance that this will sell, but there is zero perception of this. So there is the assumption that you will move your BTC into a fresh wallet. pic.twitter.com/6jrpxlolof

– cam (@cryptonews_eth) July 22, 2025

The broader market previously absorbed large liquidation. For example, in mid-2024, the German government offloaded almost 50,000 btc, worth about $2.9 billion within weeks.

The move caused the initial drop to a low of $50,000, but once sales pressure settled, prices quickly recovered above $60,000.

Given the current bullish background, it appears that the market would be better to absorb the sales pressure that could arise from recent transfers without affecting Bitcoin’s price trends for a long time.

During the writing, Bitcoin (BTC) was trading for $118,134. According to analysts at Cryptoquant, retailers are reportedly reducing exposure in the US, South Korea and across the markets they are deploying, so flagship crypto could face some pressure in the short term.

However, the ongoing whale accumulation appears to offset some of the pressurization on the seller side, and the technology suggests that cryptocurrency remains on the upward trend.

read more: Solana’s Defi TVL reaches its highest level at $1 billion, six months high

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.