In the minds of many investors, Bitcoin (BTC) is like a dream of wealth. It’s a magical asset that can increase hundreds of percent each year and send that value “to the month” at a price of $1 million.

Analyst Willie Wu believes that the Bitcoin boom time may have ended. But not everyone agrees.

Willie Woo predicts that Bitcoin’s CAGR will fall at 8% and will stabilize

Woo shares a chart entitled “Bitcoin Annualized Returns,” indicating that Bitcoin’s combined annual growth rate (CAGR) has dropped sharply from over 100% in 2017 to around 30-40% since 2020.

It was a time when major institutions, including businesses and governments, began to accumulate Bitcoin.

Bitcoin annual return. Source: Willie Woo.

“People think that BTC is like a magic unicorn that climbs endlessly on the moon. Here’s the actual CAGR chart.

Woo predicts that Bitcoin’s CAGR will continue to decline over the next 15-20 years, eventually stabilizing around 8%. This rate is consistent with long-term financial growth (5%) and GDP growth (3%). He emphasized that even with a low CAGR, Bitcoin is still superior to most other stock trading assets.

However, investor and author Fred Kruger opposed. He noted that Bitcoin has increased seven times from its low in December 2022 and is currently trading at $103,000 as of May 2025.

Additionally, in a recent interview, Arthur Hayes went even further. He predicted that Bitcoin would reach $1 million by the end of Donald Trump’s current term. He expects prices to reach $250,000 by the end of 2025, representing a 1,000% increase in just four years.

GDP and Liquidity Growth Viewed as a key driver for future profits for Bitcoin

Woo’s forecasts are primarily based on GDP expansion and financial growth. Meanwhile, RealVision’s social head Paul Guerra provided deeper insight into the issue.

Discussing liquidity, he argued that traditional diversification strategies may no longer work in today’s market environment. This is because assets such as stocks, bonds, Bitcoin and real estate tend to move together, driven by a single important factor: liquidity.

“The real factor in the market is liquidity: the amount that flows through the system,” Paul said.

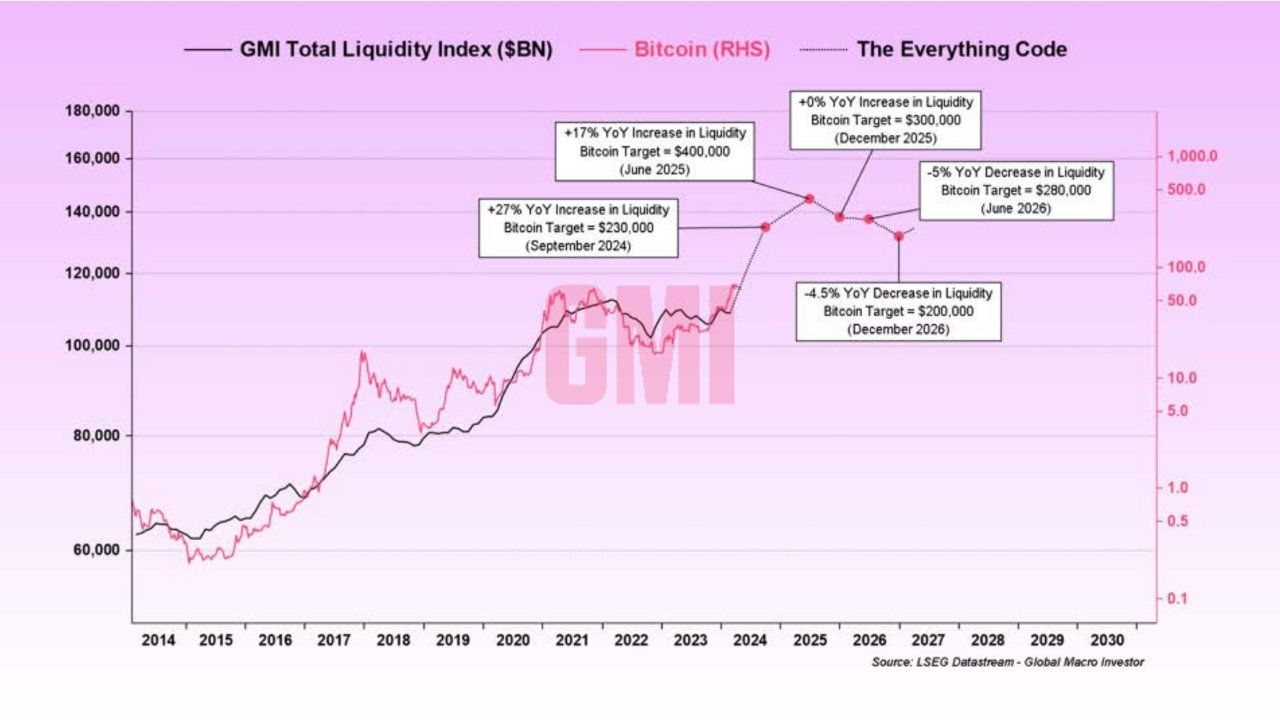

GMI Total Liquidity Index. Source: Paul Guerra.

Currently, the global liquidity index is growing at 8% per year. To understand liquidity, Paul suggested that we must first understand GDP. He presented the formula for GDP growth: GDP growth = population growth + productivity growth + debt increase.

However, today, population growth and productivity are declining worldwide. As a result, the government is being forced to inject liquidity to maintain its GDP and help increase debt.

“The population is aging. Productivity is flat. Debt is exploding. Governments have only one tool to keep GDP alive and serve people’s debts.

Bitcoin Price and GMI Total Liquidity Index. Source: Paul Guerra.

As a result, fluidity is expected to increase at even faster rates. Paul predicted that Bitcoin would reach $300,000 by the end of 2025 and could enter what he called the “banana zone.” The term describes the period of large asset price increases driven by abundant liquidity.

Historic examples include a 19,900% increase in Bitcoin from 2013 to 2017, and a 699,900% spike in Ethereum in previous cycles.

Nevertheless, these analyses focus on macroeconomic factors, while overlooking potential technical risks. For example, there is growing concern that advances in quantum computing could threaten confidence in Bitcoin’s long-term viability.