Bitcoin has recently shown strong bullish momentum, approaching its record high of $109,000. However, the rally has temporarily suspended, suggesting a potential consolidation or correction phase before the next breakout attempt.

Technical Analysis

Daily Charts

Bitcoin extended its sharp upward movement after surpassing key psychological resistance by $10,000, and rose to an all-time high of $109,000. However, bullish momentum has stalled in this important region and prices have entered a short consolidation. This resistance zone could contain a significant supply as traders begin to recognize profits and predict the corrective phase.

Given the current market structure, a short-term retracement or horizontal integration into a $10,000 support level will likely emerge before attempting a critical breakout of over $109,000 to establish a new ATH.

4-hour chart

In the four-hour time frame, Bitcoin’s weaknesses about $109,000 resistance are even more clear. After testing this level, prices gradually lost momentum, forming a consolidated pattern similar to a potential double-top.

Furthermore, the clear bearish differences between prices and RSI suggest that sellers are gaining traction as bullish momentum fades. These signals indicate the possibility of short-term corrections or consolidation around the $10,000 zone before the market regains strength for another breakout attempt.

On-Chain Analysis

Shayan Market

Bitcoin was nearing an all-time high of $109,000, but profitable activity is expected as traders try to secure profits. As a result, the expanded integration near the ATH level of BTC can be largely due to significant profit realizations by market participants.

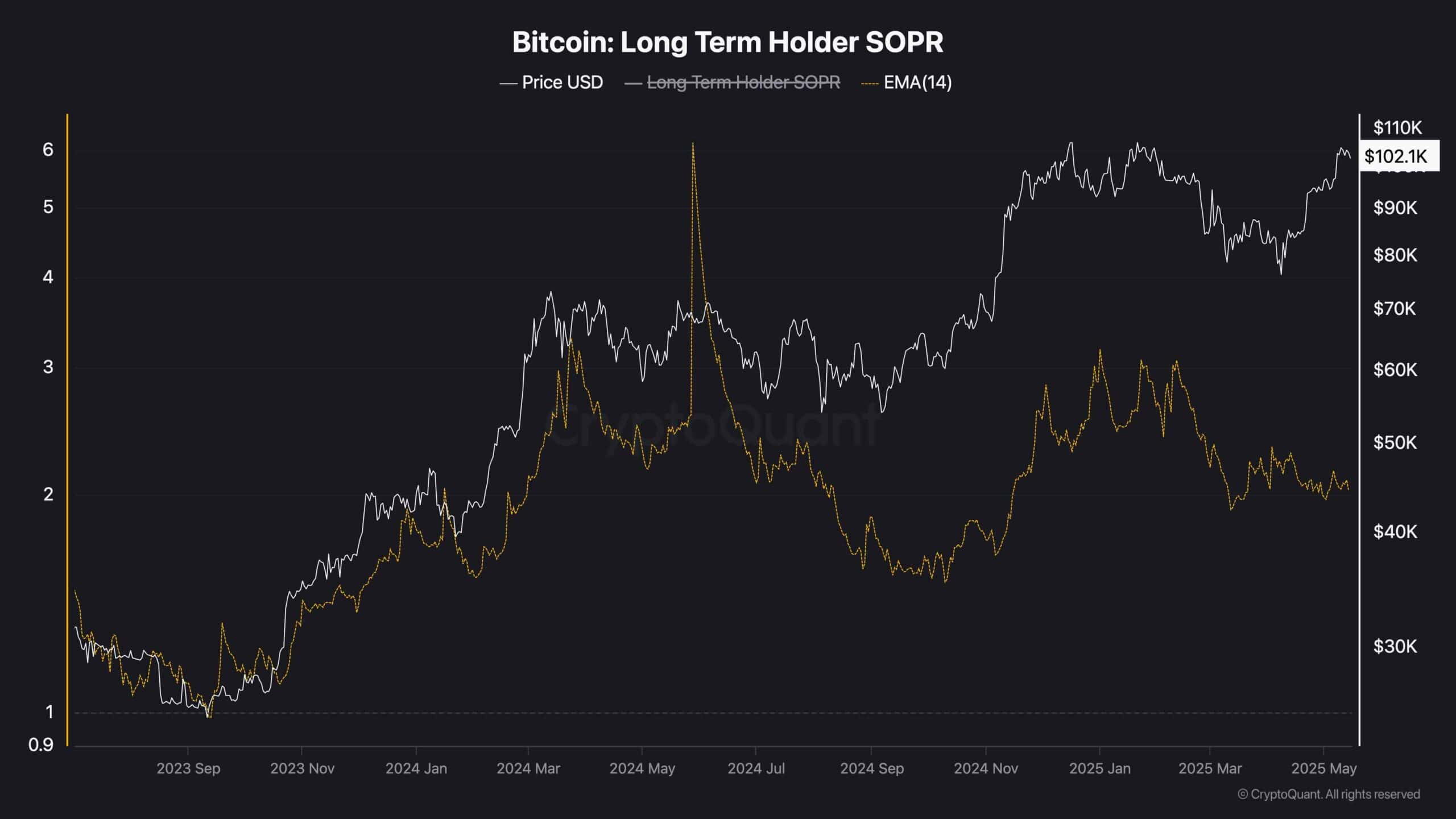

However, the recent actions of long-term holders (LTHS) of investors who have held assets for more than 150 days are discussed elsewhere, as reflected in the LTH SOPR (Used Output Profit Ratio) metric.

Even if prices approach the $109,000 range, it is still on a downward trend. This decline suggests that long-term holders have not yet achieved significant benefits. Instead, they appear to be accumulating, signaling confidence in higher price targets and predicting new all-time highs.

Therefore, the current integration phase appears to be driven primarily by short-term holders and retailers. Based on this behavior, Bitcoin is likely to resume its bullish trend after this pause, leading to fresh impulsive gatherings and a mid-term all-time high.