Bitcoin continued its rally and failed to hit a new all-time high above $126,000, leading to a sharp correction that spooked the market. Investors are showing signs of worry as the recent selloff invalidates the breakout momentum that many expected to extend the bull market and could put the market on the brink of a bearish turn.

Written by Shayan

daily chart

On the daily time frame, BTC failed to continue above $126,000 and plummeted to around $100,000, but quickly rebounded. A rejection from the ATH zone, coupled with a breakdown below the 100-day moving average, signals a loss of bullish momentum.

The next major support is near the $100,000 range, which also coincides with trendline support and the 200-day moving average. The RSI near 41 suggests that although the market is cooling, there is still room for further declines if buyers do not intervene soon.

4 hour chart

The 4-hour chart shows that BTC has found temporary support near the $110,000 zone after a sharp decline. This area previously served as an accumulation zone before the final leg up and was a critical level in the short term.

The RSI is still languishing around 32, indicating limited buyer strength. Immediate resistance is near $117,000, with previous support turning into resistance. A rejection from this zone could trigger another leg downhill towards the $105,000 area, likely coinciding with the lower bound of a major ascending channel. If this channel breaks, the bull market will likely end and Bitcoin, along with the entire crypto market, will enter a long-term downtrend.

sentiment analysis

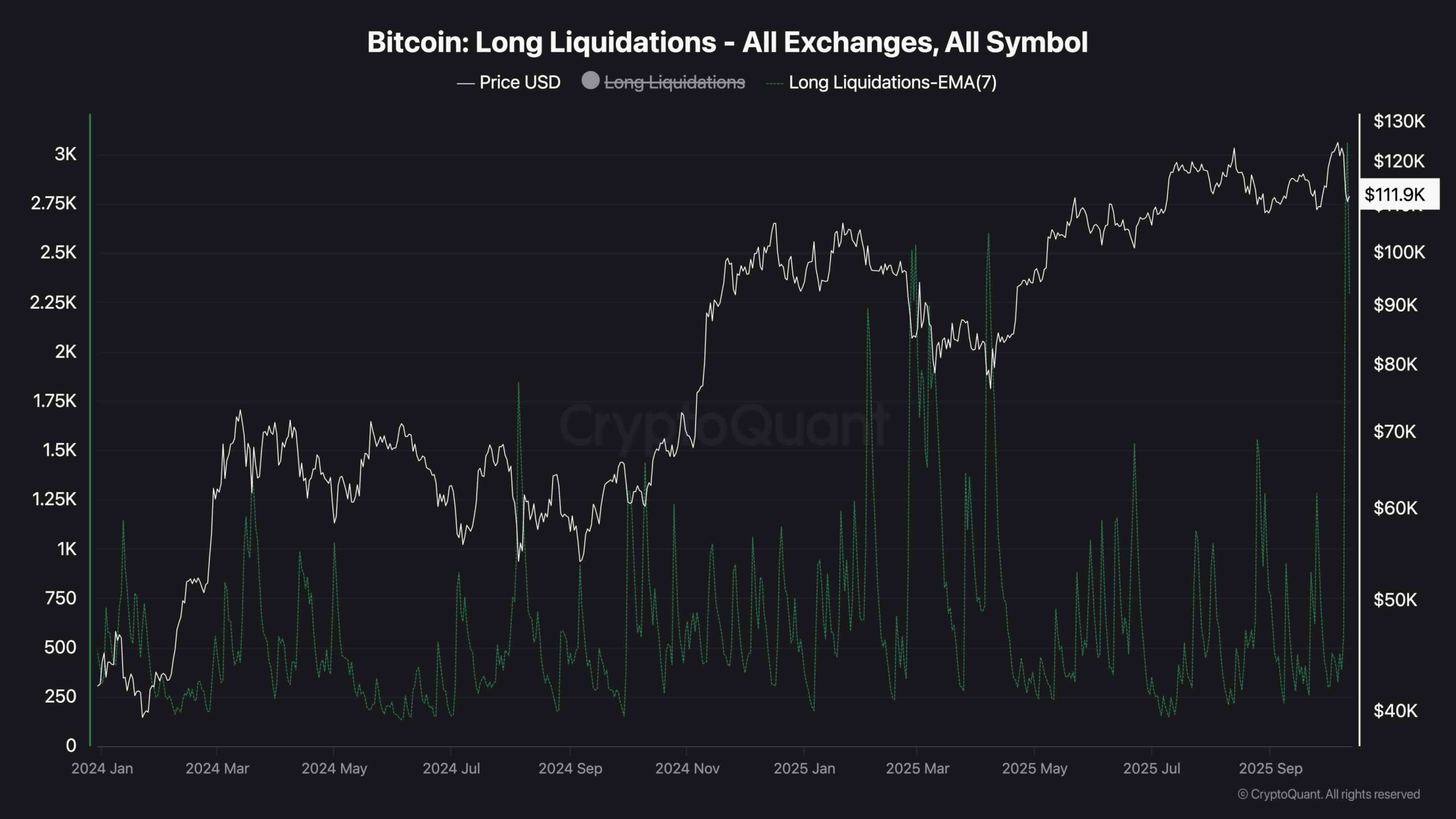

Long-term liquidation (7-day MA)

The liquidations chart highlights a massive spike in long-term liquidations, the largest in history, coinciding with Bitcoin’s failure to reach new highs. This chain of events drove over-leveraged traders out of the market and significantly reduced open interest.

Historically, such liquidation flashes have often signaled short-term troughs, but investors are still hesitant to re-enter aggressively given the fragile sentiment. The market’s anxious tone suggests that while a bailout rebound is possible, confidence in the uptrend is clearly weakening. This could be the beginning of the end of this cycle’s bull market, especially if the price closes below $100,000.