There have been some signs of recovery in the Crypto Market, with Ethereum’s current price at $1,648.6, showing a 1.8% increase over the last 24 hours. Even if Bitcoin exceeds the $84,000 threshold, Ethereum has been captured within the descending channel since December 2024.

Ethereum prices have plummeted more than 65% from around $4,000 at its peak, as they do today.

Ethereum price analysis

According to the Daily Chart, Ethereum prices have been on a strong bearish trend since December 2024. Cryptocurrency develops a descending channel. However, recent price actions show that ETH has bottomed at $1,465 near the lower boundary of the channel.

The descending channel has earned ETH prices for almost five months, with prices testing numerous boundaries and lower boundaries. Ethereum appears to be trying to break short-term resistance now, and could form the start of a recovery rally.

TradingView

Fibonacci’s retracement levels, drawn from December highs to April lows, indicate the important areas of resistance ahead. The 0.236 FIB level of $2,063 represents the initial significant resistance, with 0.382 suggesting resistance at $2,433. These levels are important for sustained recovery.

All Emma is bearish now. Prices are currently facing immediate resistance of 20 EMA at $1,722, while more resistance is at 50 EMA ($1,988) and 100 EMA ($2,324).

The MACD shows a slight improvement in momentum at the current reading of 5.7, but both signal lines are below zero at -120.0 and -125.7. This indicates that overall momentum is still weak while sales pressures subside. Possible bullish crossovers could form, which could mean recovery for a very near period of time.

Immediate support is at the lower limit of the channel, close to $1,465, an area tested twice in April. Important resistance levels are 20 EMA, $1,722, and psychological levels are $2,000. Above these levels is essential to confirming trend reversal.

Price target

If the current integration is split into the benefits of a downward channel, Ethereum will target $2,063 at the 0.236 Fibonacci level. If purchasing pressure is maintained, the price could reach 0.382 FIB level at $2,433.

Conversely, if current support fails, Ethereum will either retest its April low at $1,465 or drop towards a $1,300 territory, indicating a complete setback in the 2023-2024 bull cycle.

Ethereum whales drive the curiosity of the spark market

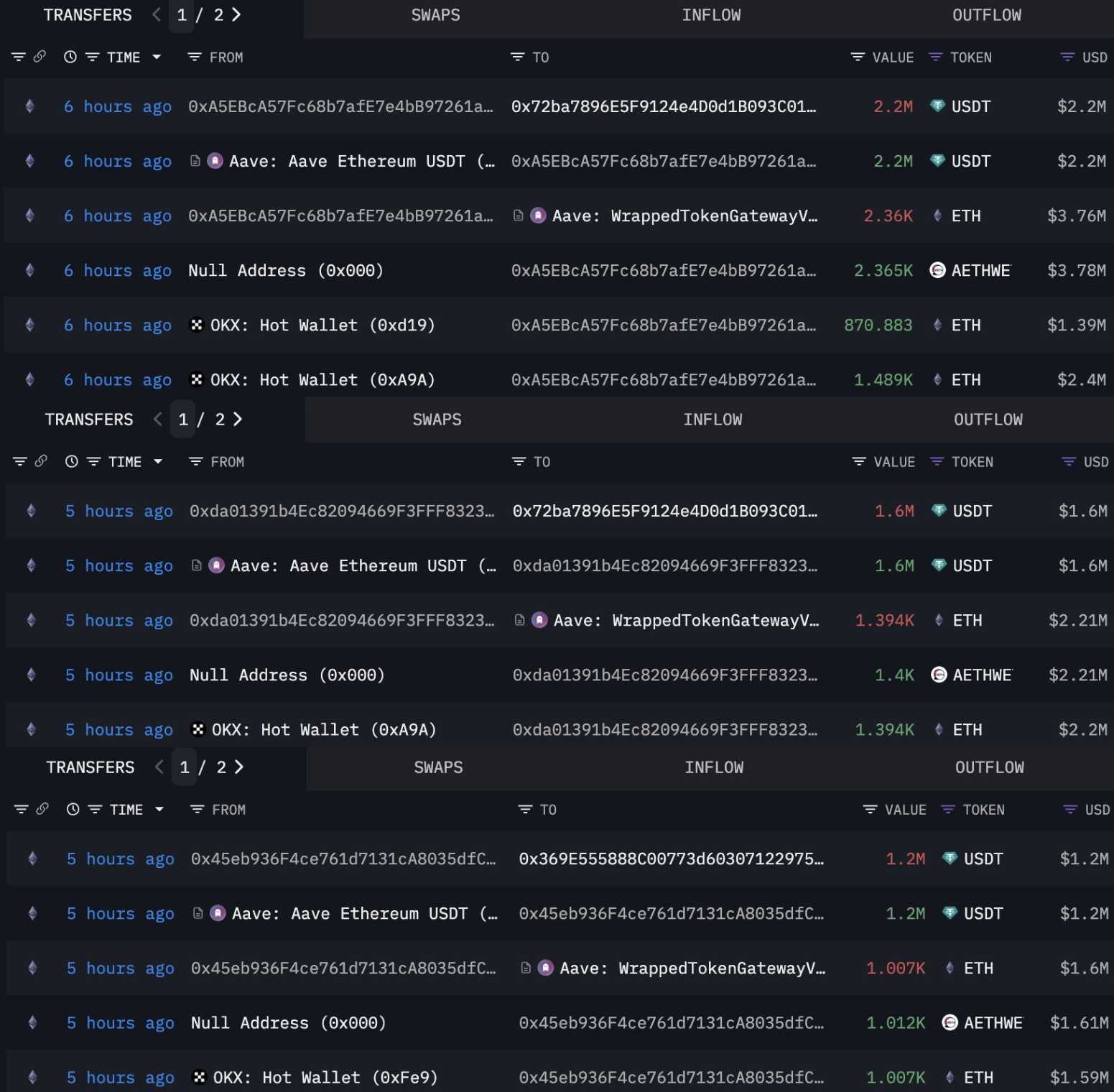

The Mystical Whale/Facility accumulated $15,953 ETH (26.16mm) ($26.16M) five hours ago. Six wallets (which are likely to belong to the same whale) have withdrawn their $15,953 ETH ($2616 million) from OKX and deposited it with Aave. They then borrowed 15.4m$USDT from Aave and deposited it in OKX.

This giant whale deposited another 20k of ETH (32.4m) on Kraken five hours ago. The whales still have 30,874 ETH$ETH ($50.7 million), with an estimated gross profit of $104 million (+52.4%).

As the Bulls regain confidence, their funding rates will be positive

As Ethereum prepares for a breakout rally, bullish forecasts rise in the derivatives market. Open interest increased 4.70% to $187.9 billion, with volume increasing 30% to $511.5 billion.

Funds teeth 0.00601.0288 long ratio % last 24 hours.

Very The strong feelings of short There is a time frame I saw it a strong undulationin a long position Expression 52.81% in last 4 hours. this rise 1.1191 long short ratio, Shows strong bullish feelings trader I look forward to it strong tendency Ethereum.