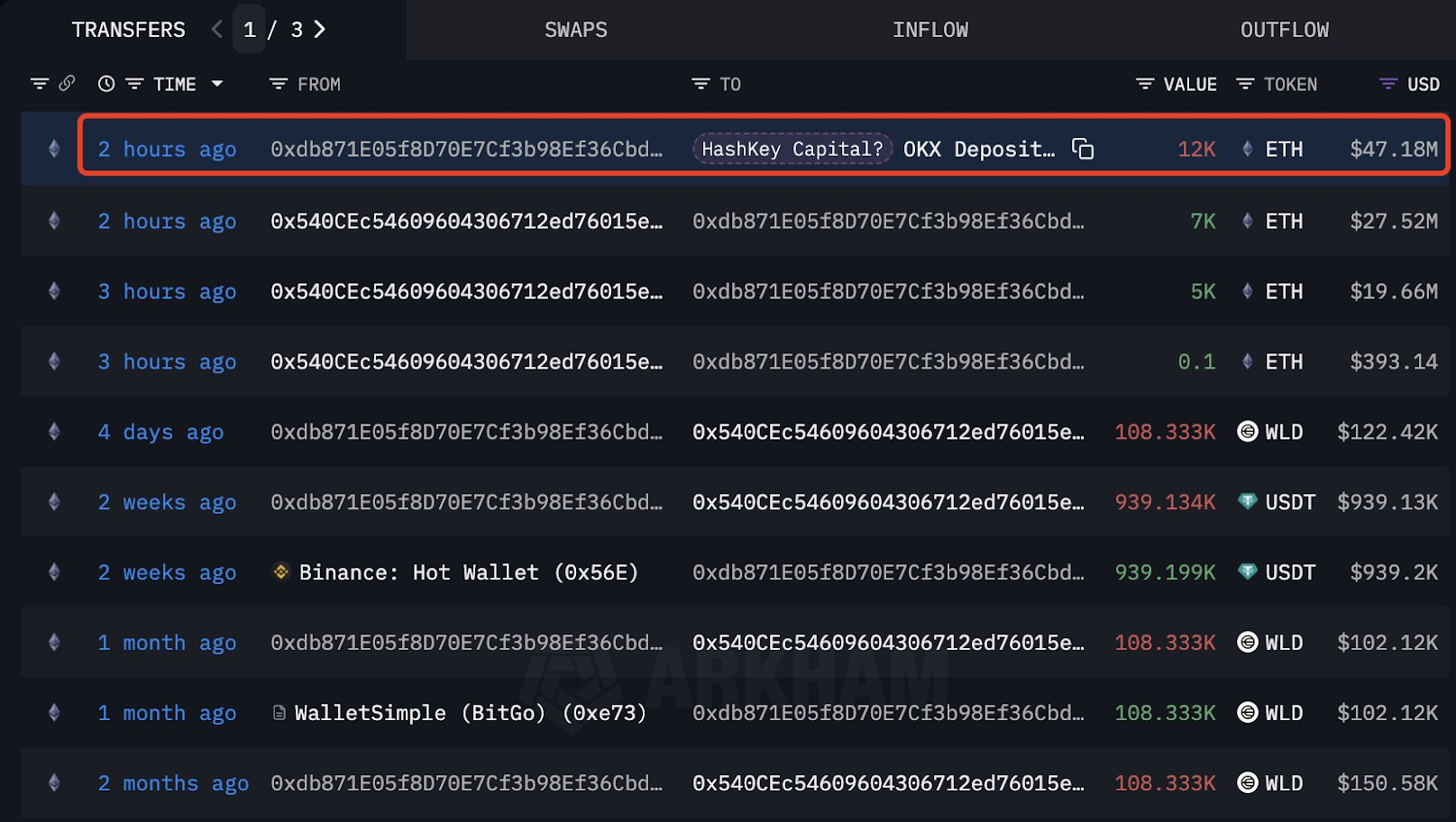

Ethereum slips from $3,900 as 12,000 ETH ($47 million) is moving to OKX by a wallet linked to a hash key, causing fear of selling.

Despite potential profit acquisitions, Ethereum remains technically strong above $3,800, with analysts looking to retest $4,000.

Ethereum has shown signs of cooling after a strong gathering, sliding slightly from nearly $3,900 from its recent high. The broader crypto market remains resilient, but the recent stranding movement has sparked concern among traders. A potential institution sale is underway.

$47 million ETH transfer to OKX

According to the on-chain tracking platform LookonChain, the wallet linked to leading crypto investment company Hashkey Capital moved 12,000 ETH (worth around $47.18 million) to OKX Exchange just two hours ago.

Such a massive transfer to centralized exchanges often indicates that senders are preparing for sale, leading to speculation that hashkeys could be profitable after the recent price surge in Ethereum.

Ethereum rally at the turning point?

The move comes days before the US Federal Reserve’s interest rate decision, a key macro event that could affect risk assets like Crypto. Analysts suggest that some agencies could increase or strengthen profits before potential market volatility.

Ethereum saw a solid breakout earlier this month, but whales’ activities often show short-term corrections, especially when the market is dominated ahead of macroeconomic catalysts.

Ethereum price analysis

Top crypto analyst Michael Van de Poppe also placed emphasis on Ethereum price action. He noted that ETH has recently erupted, but the move lacked strong momentum.

“I wouldn’t be surprised if I could see a short correction or a fluidity sweep before my next leg went up,” he said.

Van de Poppe believes recent volatility could bring opportunities for short-term traders, but it could shake up confidence among long-term holders.

- Read again:

- Top 3 altcoins to meet this week

- ,

Despite fear of selling, Ethereum remains technically strong.

- Current price: $3,887

- RSI: Neutral and 59.21

- MACD: A slight bearish crossover

- Support Zone: Fair Value Gap is around $3,865-$3,870

- Key Support: Holds important levels above $3,800

This suggests that while short-term fixes are possible, ETH remains on the uptrend unless $3,800 is decisively broken.

Is this just a dip or is it a big start?

The foundations of Ethereum continue to be strong, supported by institutional interests, future developments in Defi, and speculation around the Spot Eth ETF. If the macro state remains in its favor, many analysts still hope that ETH will retest more than $4,000 in the coming weeks.

However, short-term care is required as large players like Hashkey can offload their holdings. Now, all eyes can turn to the Fed’s rate decisions, either causing a wider market gathering or increasing profit.