Bitcoin traded at $115,975 on September 13, 2025, with a market capitalization of $2.31 trillion and a 24-hour trading volume of $43.07 billion. The mid-day price of cryptocurrency fluctuated between $114,838 and $116,705 as it continued to consolidate recent profits.

Bitcoin

Bitcoin has been stable near the top range as it has bolstered its profits from recent upward breakouts, showing signs of a cautious but robust maturing rally. Current trends across multiple time frames reveal bullish bias, while some oscillators suggest overexpansion and potential short-term fatigue.

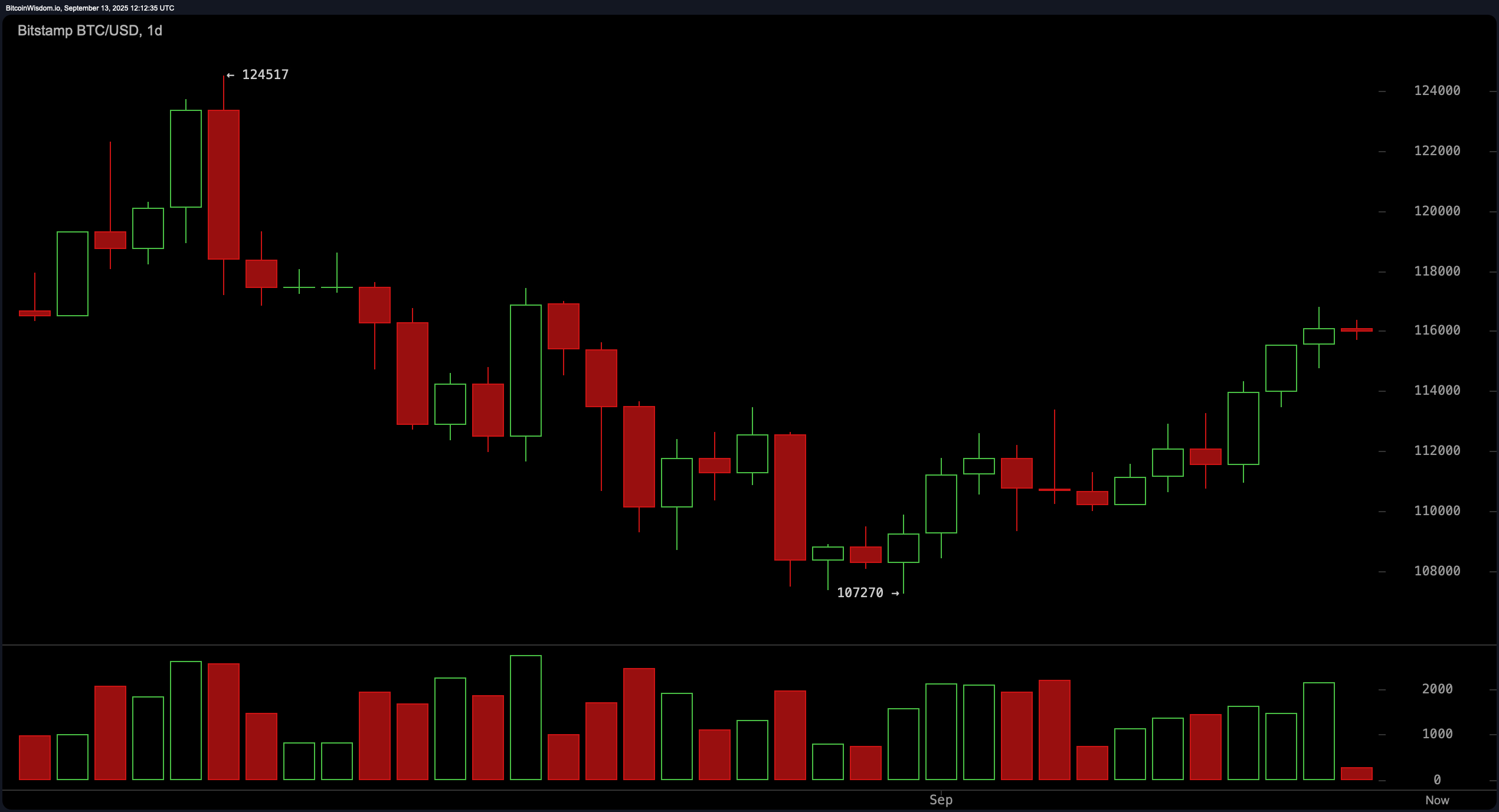

On the daily charts, Bitcoin is in the midst of a bullish reversal after a serious downtrend that bottomed out at around $107,270. Since its low, price action forms a clear sequence of higher and higher lows, and the amount gradually increases, and is a sign of a conviction. The asset is currently testing critical resistance near the $116,000 level and is testing its strong proximity above the area, which is needed to further confirm the area. The entry zone was more advantageous during inversion, but a trailing stop strategy close to $113,500 helps protect the interests of people already long. The price target ranges from $117,500 to $120,000 based on resistance clusters.

BTC/USD 1-Day Chart via BitStamp on September 12th, 2025.

The 4-hour Bitcoin chart offers a strong bullish continuation pattern that peaked at $110,624 from the breakout at $116,805. The rally remains intact, but recent candles show small bodies and show a pause with momentum. Buyers seem to be taking a break, with support formed between $114,500 and $115,000. A confirmed breakout of over $117,000 could accelerate profits towards over $118,000 if accompanied by volume with growth. A careful bull may consider an entry on retesting support.

BTC/USD 4-hour chart via BitStamp on September 12th, 2025.

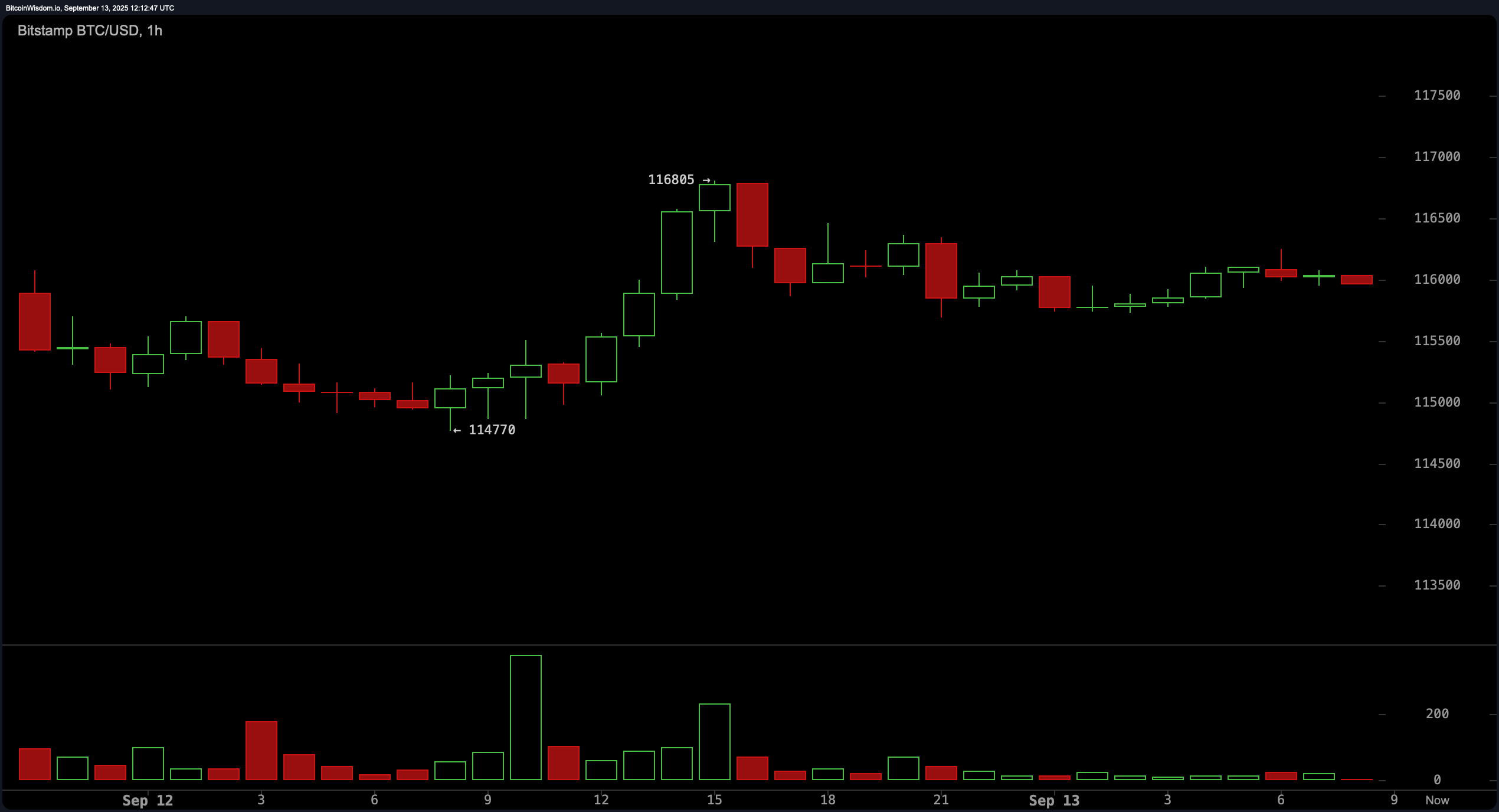

On the one-hour chart, Bitcoin is consolidated under $116,805 in height, forming what appears to be a bullish flag or range-bound setup. Momentum cools, but often precedes continuous movement rather than reversal. Short-term support is close to $114,770 and as long as the price is above $115,500, buyers are still in control. Scalpers may find opportunities with breakouts above $116,800 or bounces near the $115,000 level, but with the potential for a short-term pullback, the outage should close at under $114,770.

BTC/USD 1-hour chart via BitStamp on September 12th, 2025.

From a technical indicator perspective, movements point evenly on average, showing bullish momentum. All important levels of the exponential moving average (EMA) and simple moving average (SMA) (including indicators for periods 10, 20, 30, 50, 100, and 200) ensure that Bitcoin is trading beyond key trend markers. The exponential moving average (10) at $113,586 (10), and the simple moving average (10) at $112,799, provide short-term trend support, while the long-term simple moving average (200) at $102,349, highlighting a deep bullish base.

The oscillator presents complex images. The relative strength index (RSI) is located at 59, suggesting neutral momentum without excessive conditions. The stochastic oscillator rises at 95, indicating a potentially over-built signal. The Commodity Channel Index (CCI) 195, Momentum at 4,219, both issued sales signals, suggesting an upward drive. Meanwhile, the fantastic oscillator of 475 and the moving average convergence branch (MACD) level of 202 both show purchase signals, suggesting that the wider trend remains intact. This difference in indicators calls for careful optimism focusing on movements supported by the volume.

Bull Verdict:

The wider technological structure remains bullish as Bitcoin holds above the main support zone and all major moving averages line up at the top. If the buyer can push a $117,000 resistance with a strong volume, the road to $120,000 looks viable in the short term.

Bear Verdict:

Despite its bullish structure, it carefully suggests that it overstretches the vibrator and reduces daytime momentum. A breakdown below $114,770 could undermine short-term emotions and lead to deeper retracements towards previous integration levels near $113,500.