Bitcoin continues to show signs of price consolidation, its value hovering just below the $87,000 mark. As of today, BTC is trading at around $86,990, reflecting a 0.8% decline over the past 24 hours.

Despite the slightest dip, the wider picture shows that Bitcoin is stable over $85,000 in several consecutive sessions, indicating a pause with a strong upward or downward momentum observed in the past few weeks.

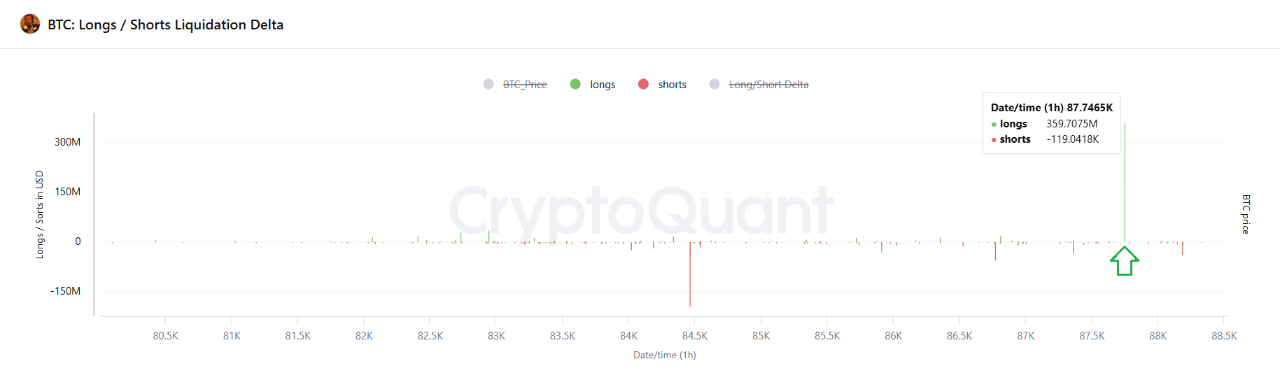

Long market liquidation signs

Volatility appears to be calm, but market dynamics continue to operate behind the scenes. Cryptoquant contributor Amr Taha recently provided insight into Bitcoin’s latest market structure and highlighted key developments. This is the liquidation of a long position of $359.7 million.

The event focuses on potential changes in sentiment and key technical levels that may act as support or resistance in the short term.

According to Taha, long liquidation occurs when traders who hold long leverage positions are forced to close trades after their prices fall below the margin threshold. As we have seen recently, when this happens on a large scale, it reflects a sudden shift in emotions, often forcing a short-term sale.

However, Taha points out that such events can set the stage for potential market rebounds as many over-converted positions have been cleared and new demand spaces will emerge.

Long-positioned $359.7 million liquidation event

“If BTC exceeds the short-term realised price, it suggests the strength of demand. Failures below these levels may indicate possible reversal or correction.” – by Amr Taha

Complete post

– cryptoquant.com (@cryptoquant_com) March 27, 2025

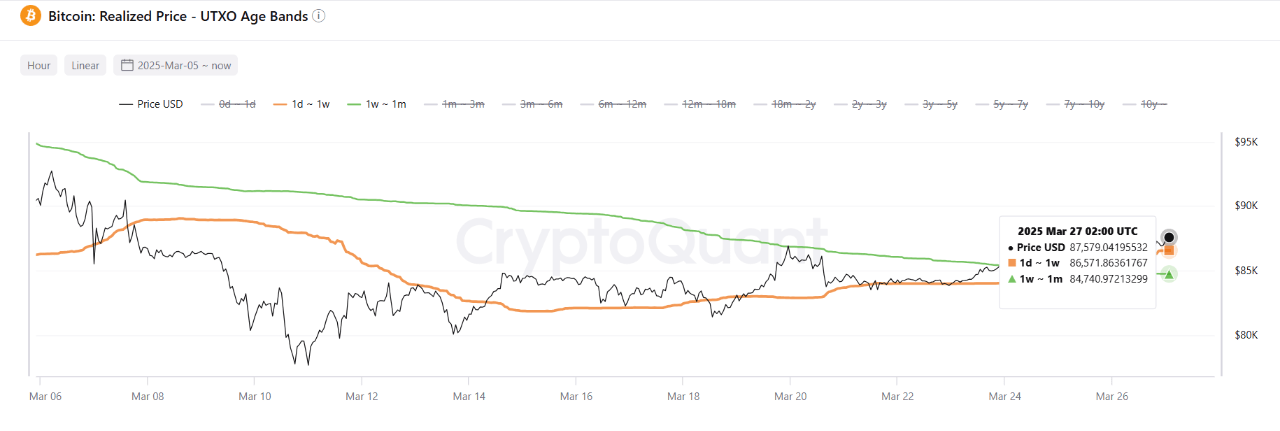

Bitcoin UTXO Metrics draw a variety of pictures

This observation is the realised price distribution of Bitcoin due to the UTXO age band. Taha shows that Bitcoin’s current market price exceeds the realised price of UTXOS for a day to week, indicating that recent buyers are holding unrealized profits.

Meanwhile, UTXOS, which ranges from one week to one month, has a realised price of nearly $84,740, which is the level that will serve as technical support if Bitcoin is immersed in the short term. This confluence of short-term holder profitability and support, nearly $84,000, could serve as a critical signal.

If Bitcoin remains positioned above these realized price ranges, it suggests continued strength from recent buyers. However, if prices begin to fall below these thresholds, they may point to an increase in sales pressure or a wider revision stage.

The liquidation of long positions and UTXO age indicators provides some insight into market sentiment, but the conclusion of the possibility that Tah’s prices will fall or continue to rise adds reason to be cautious.

Special images created with Dall-E, TraingView chart