More than $1 billion has been liquidated from today’s crypto leverage market, following cost data from producers that are hotter than expected.

Bitcoin prices could potentially rebound to a new ATH after filling the CME gap at around 117.5k.

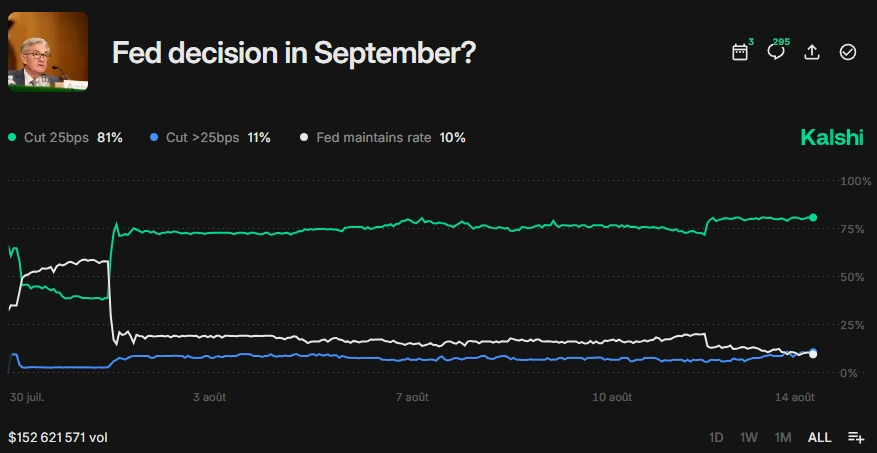

Kalshi traders bet on a Fed rate cut in September despite hotter PPI data than expected.

President Donald Trump distrusts the fear of inflation caused by the producer price index (PPI) that is hotter than expected on Thursday. Trump told reporters Thursday that inflation is declining to “the perfect number,” so hopes for a September Fed rate cut will be rejuvenated.

“Inventory is rising sharply at 401(k),” President Trump pointed out.

Crypto market responds to inflationary pressure

In particular, PPI data on Thursday suggests a possible increase in the Consumer Price Index (CPI) next month. The result was a surge in fear that the Fed had held its benchmark rate at 4.5%, causing a massive liquidation of long traders.

More than $1 billion has been liquidated from the Crypto Leveraged market, according to Coinglass’ aggregate market data. Long traders were majority on Thursday with Rekt, which amounted to over $827 million.

Nevertheless, as shown in Kalshi’s data, the probability of a 25 bps rate reduction in September rose to 81%. Most importantly, despite the fear of inflation, Kalshi’s data shows that traders are more likely to have a 11% 50 bps rate reduction compared to the first time they were reduced by 10%.

What’s next for Cryptocurrency Bull Market?

Cryptocurrency Bull Market recently signaled the entrance to its euphoric phase, particularly after rebounds in prices for Ethereum (ETH) and Bitcoin (BTC). The bullish sentiment of macros is strengthened by increasing demand from institutional investors implementing cryptocurrency strategies.

Additionally, President Trump recently signed an executive order to allow the 401(k) with over $8 trillion assets under his control to diversify into the cryptocurrency market.