Five spot XRP exchange traded funds (ETFs) have been listed by the Depository Trust & Clearing Corporation (DTCC): CoinShares, Franklin Templeton, 21Shares, Canary Capital, and Bitwise.

These funds are set to debut this month, with Canary CEO Stephen McClurg teasing at Ripple’s Swell conference that they could be ready for launch as early as next week, reminding investors of the successful launches of the Litecoin (LTC) and Hedera (HBAR) ETFs.

Nate Geraci, co-founder of the ETF Association, echoed similar sentiments, saying on Monday that the lifting of the U.S. government shutdown has “opened the floodgates” to new listings, predicting that the first 33-year spot XRP ETF could be launched by Friday.

“Government shutdown ends = floodgates open for spot crypto ETFs…Meanwhile, we could see the first ’33 Act spot XRP ETF launches this week.” Gerashi wrote to X.

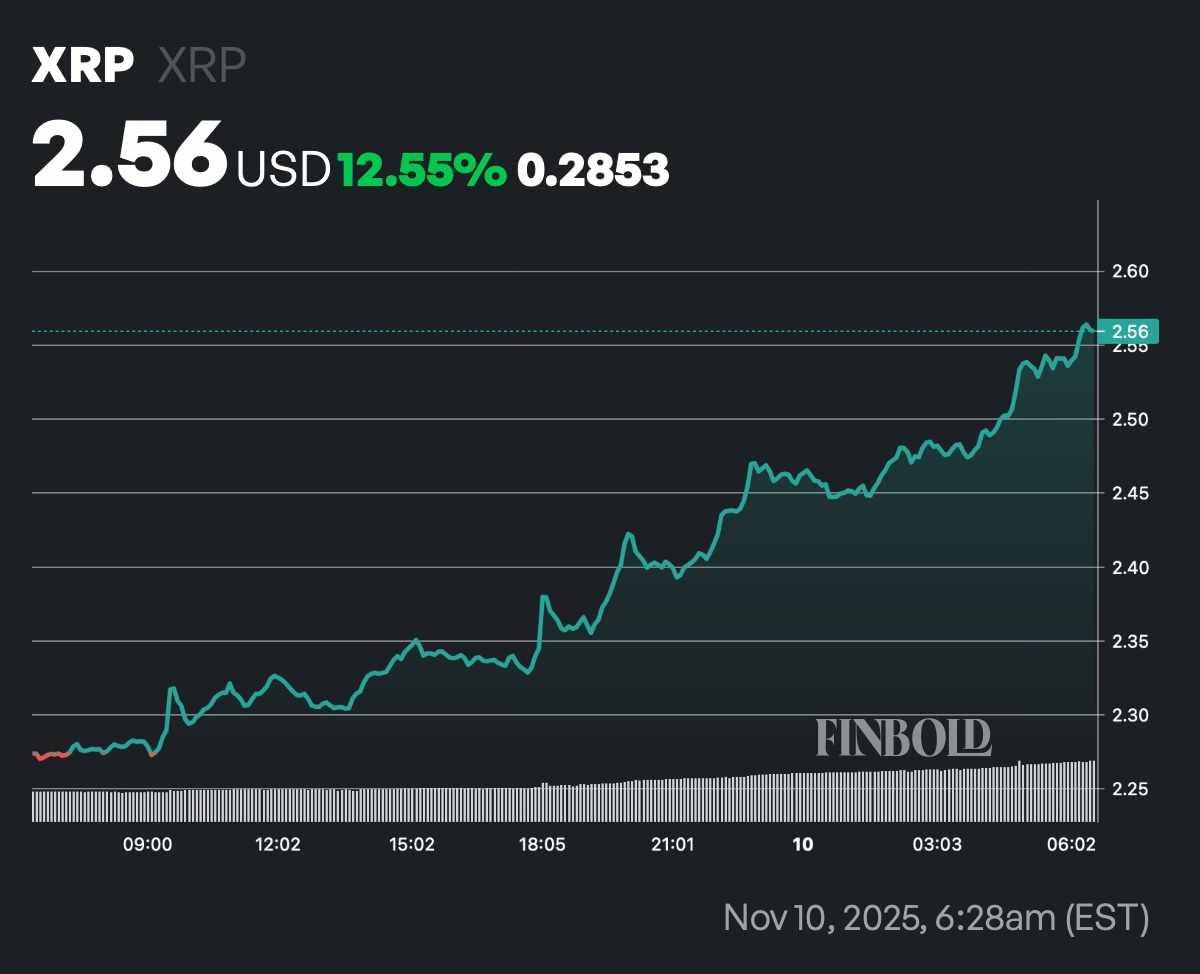

New efforts on XRP ETFs appear to be the main catalyst for this move. Although DTCC listing does not guarantee SEC approval, it typically means that the ETF is ready to operate upon structural approval.

The macro environment also became favorable for risk assets. Specifically, the U.S. Senate approved legislation ending the government shutdown, maintaining regulatory continuity for pending ETF reviews.

At the same time, debate over the proposed “tariff dividend” has boosted investor sentiment, even though the Treasury has made it clear that it could be a tax cut rather than a direct stimulus package.

Featured image via Shutterstock