On-chain analysis revealed that insiders have started selling YEPE, which was promoted by prominent trader James Wynn.

summary

- YEPE, a meme coin tied to James Wynn, drops 25% as insiders begin selling

- On-chain data shows insiders likely controlled over 60% of the tokens at launch

- So far, insiders have made $1.4 million in profit and still hold over 50% of the supply.

It looks like meme coin season is coming back, especially BNB. However, with it comes a proliferation of questionable projects. On Thursday, October 9th, Yellow Pepe, also known as YEPE, associated with James Wynn, saw a significant correction after apparent insider selling began.

BNB Base (BNB) meme coin has fallen 25%, from 0.4% to 0.3%, after rising over 400% in just a few days after its launch. Perhaps the main driver of the rally was the endorsement of James Wynn, a prominent trader known for his ultra-leveraged trading, which resulted in both huge profits and losses.

Yellow Pepe (YEPE) price movement since release | Source: Bubble Map

In the X post, Wynn shared the address of the token and claimed that “YEPE is flying” and that “the market is talking.” As expected, this prompted his followers to invest in this new meme coin.

You may also like: BNB Meme Coin Launchpad flips pump.fun with 24-hour profits

YEPE token has shown red flags since launch

Still, the token showed red flags from its launch. Blockchain analysis platform Bubble Map revealed that insiders owned 60% of YEPE on October 5, its launch date. Concentrations like this are usually a red flag and can put significant pressure on the price if insiders start selling.

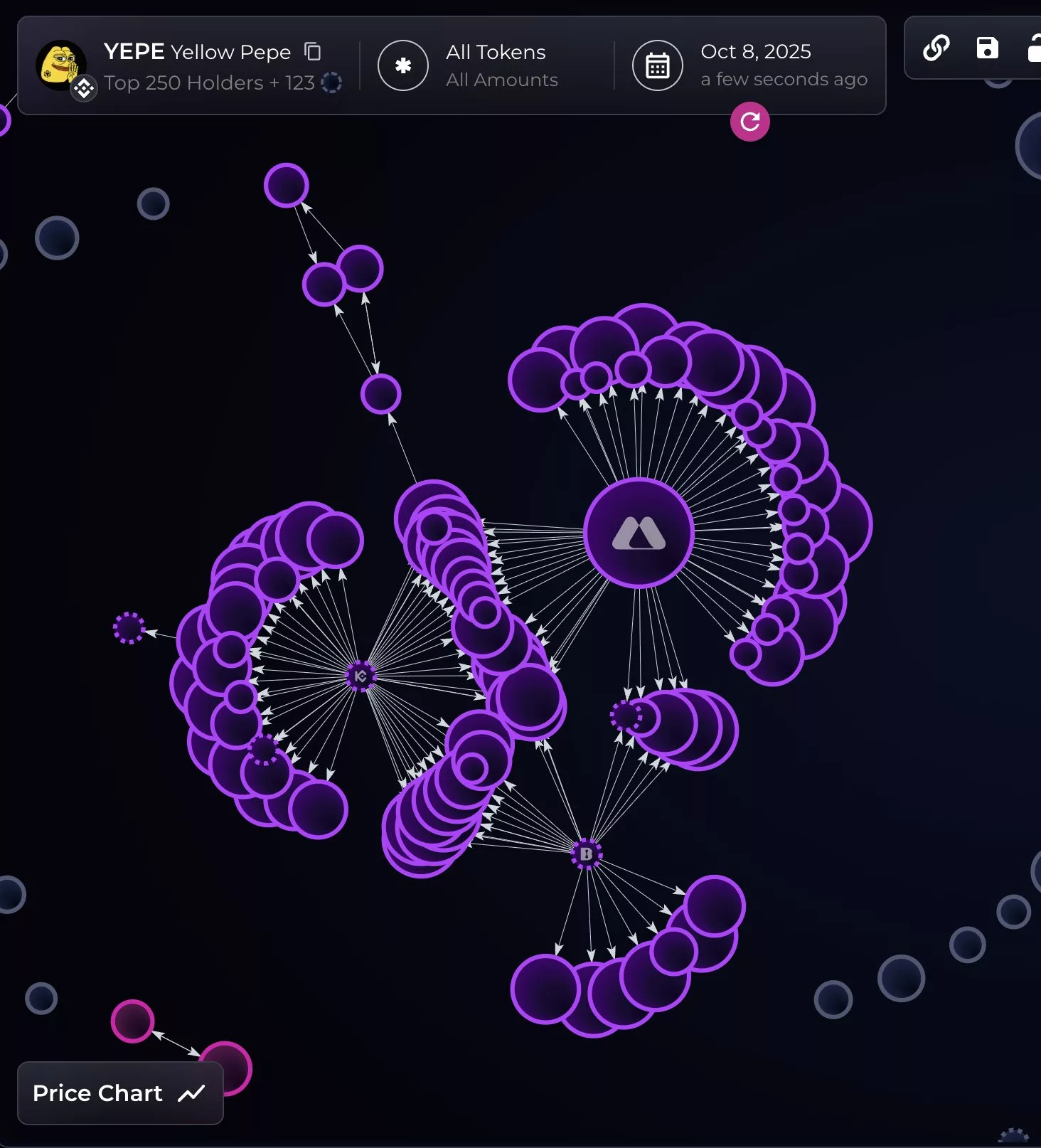

YEPE Wallet Nodes Showing Potential Insider Wallets | Source: Bubble Map

As expected, this is exactly what happened. On October 8, insiders began unloading their positions in YEPE, making a profit of $1.4 million by the next day. Moreover, despite this push, insiders still hold over 50% of the token’s supply, according to Bubble Map.

read more: From PEPE to Billions: Meet Cryptocurrency’s Boldest Whale, James Wynn