Japan’s new government plans to roll out an economic stimulus package worth more than 17 trillion yen (about $110 billion) to counter rising prices and restore economic momentum. The move follows Japan’s economy contracting at an annual rate of 1.8% in the third quarter of 2025, halting growth for six consecutive quarters.

Analysts say the scale of the liquidity increase could put new pressure on the yen and direct capital to riskier assets such as Bitcoin (BTC).

Japan’s economic contraction accelerates policy response

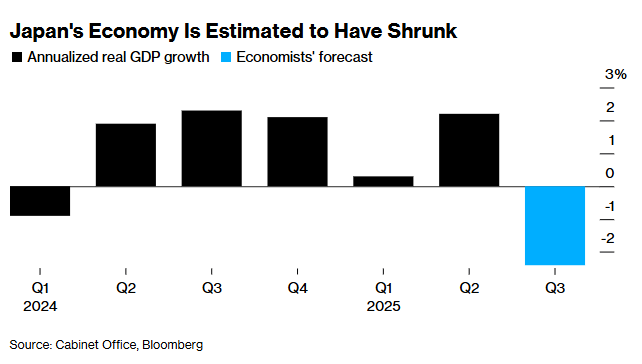

According to Bloomberg, the economic contraction was smaller than many economists expected. The actual decline of 1.8% turned out to be slightly slower, as the forecast showed a decline of 2.4%. Still, the negative growth marks an important change after 18 months of expansion.

“Japan’s economy was strong in the first half of this year, but today’s GDP showed that that momentum has temporarily stopped. Going forward, we expect the Japanese economy to return to a gradual recovery trend,” said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities.

Japan’s economy will contract in the third quarter of 2025. Source: Bloomberg

The contraction in GDP will further support Prime Minister Takaichi’s ambitious fiscal plan of a 17 trillion yen economic stimulus package.

“Japan is trying to help households absorb price increases without forcing the central bank to hit the brakes, while at the same time financing the industries that must support the next decade. Japan is the test case, the US is the audience. And the spillovers will tell us more about the next decade than the headline numbers,” the analysts wrote.

Still, the timing has led to an unusual divergence. While the government is preparing a large-scale economic stimulus package, the Bank of Japan is still bracing for a possible interest rate hike. The Bank of Japan kept its policy interest rate unchanged at 0.5% at its previous meeting in October.

Nevertheless, Governor Ueda suggested that conditions could warrant a rate hike as early as December. Such a combination could cause currency volatility and alter global capital flows.

What does that mean for Bitcoin?

Meanwhile, market analysts expect the large-scale liquidity injection to lead to a weaker yen. When governments increase the money supply, currencies often depreciate and investors seek alternative stores of value, especially those seen as hedges against inflation.

Bitcoin often benefits from these developments. Cryptocurrencies attract capital during times of currency devaluation and monetary stimulus. Analysts say liquidity often flows into risky assets before reaching the broader market.

“When Japan turns on the fiscal spigot, the yen weakens, capital moves overseas, and global liquidity increases. And every time that happens, Bitcoin is the first to react. If this policy passes, it will be one of the strongest macro tailwinds heading into 2026. The liquidity wave is quietly building again,” the analyst added.

The timing coincides with a broader easing in global financial conditions. One market watcher noted that in the U.S., the lifting of the government shutdown, the Treasury’s general account balance nearing $960 billion, and JPMorgan’s forecast that about $300 billion will flow out of the TGA in the coming weeks all point to an increase in dollar liquidity. At the same time, the Fed’s quantitative tightening cycle is slowing and is scheduled to end on December 1st.

China is fueling this by steadily injecting more than 1 trillion yen of capital into its economy every week. Taken together, these developments suggest that global liquidity is becoming more accommodative, as opposed to the tightening seen at the end of 2021.

The analyst argued that this environment raises the possibility that Bitcoin’s recent weakness is a bear trap, and that Bitcoin could move stronger as liquidity expands around the world.

“This does not mean an instant moon. It means BTC is likely to be in a bear trap before the next possible move begins,” the bull theory states.

🇯🇵 Japan considers more than $110 billion in stimulus package

🇺🇸President Trump demands $2,000 dividend check

🇺🇸 JP Morgan expects over $300 billion in liquidity injection from TGA in 4 weeks

🇨🇳 China is pumping trillions of dollars into the economy

🇨🇦Bank of Canada to restart QE program.

🇺🇸FRB will end QT next…

— Max Crypto (@MaxCrypto) November 16, 2025

It remains to be seen whether Japan’s economic contraction and stimulus measures will fuel Bitcoin’s expected rally. As global liquidity shifts, market participants will look to both traditional and crypto indicators to find the next big trend.

The post Japan Announces $110 Billion Economic Stimulus Plan — Will Bitcoin Benefit? The post appeared first on BeInCrypto.