Real World Assets (RWAS) tokenization is accelerating fundamental change in global finance as US finance, stocks, commodities and private credits based on blockchain are poised for exponential growth this year, according to a report from market maker Kilock and Centrifuge of Tokenization Platform.

KeyRock and Centrifugal Analysis: Tokenized RWA can capture 10% of the Stablecoin market by the end of the year

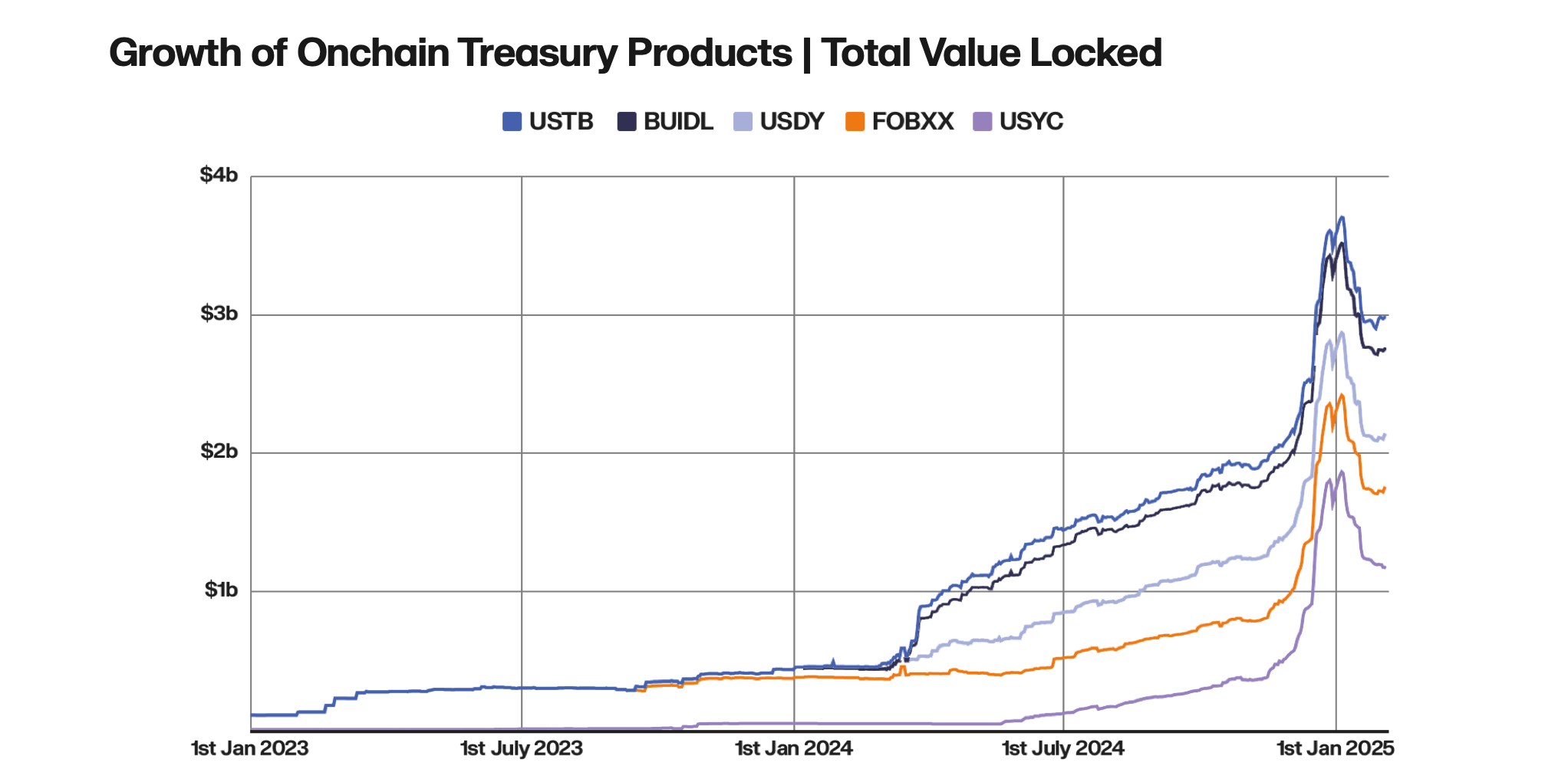

According to two companies, the tokenized US Treasury Department has increased by 415% year-on-year, driving stablecoin owners and institutional adoption seeking yields. Keylocks and centrifuges project that if tokenized products account for 10% of the $210 billion stubcoin market, the sector could reach $28 billion. “The tokenized Treasury expects to evolve from niche innovation to the core infrastructure component of global digital finance,” the report said.

The analysis explains that tokenized stocks are behind at $15 million TVL, but are facing a pivotal 2025 as regulatory clarity grows. The backed finances and the ONDO global marketplace allow unauthorized access to tokenized S&P 500 Exchange-Traded Funds (ETFs) and corporate shares.

“The democratization of sophisticated financial tools through non-Kyc promises that unauthorized protocols will unlock signs of potential for undeveloped markets from previously unserved regions and groups.”

The report highlights that products like Gold are fighting the liquidity gap despite $1.2 billion in tokenized supply, but synthetic platforms like Ostium Labs aim to capture speculative demand. Personal credit is leading at a $12.2 billion TVL as Centrifuge’s in-facility pool reduces securitization costs by 97%.

The regulatory hurdles persist, especially for stocks, but KeyRock and centrifuges note that bipartisan US law and European frameworks like MICA have eased the path. The report predicts that total tokenized RWAS could reach $50 billion in the bull case in 2025, driven by institutional intake and significant distributed financial (DEFI) integration.

“The movement envisages restructuring global finance by democratizing access, promoting increased efficiency and increasing transparency across asset classes,” explains the tokenized RWA analysis. “Instead of a slow payment pipeline, the market operates on blockchain rails with near-hour payments and verifiable ownership records, reducing counterparty risks and back-office friction.”

The tokenized Treasury, KeyRock and Centrifuge Position 2025, which modernizes colonies and modernizes private credit democratization access, is as an inflection point for the blockchain’s $30 billion to $500 billion breakthrough.