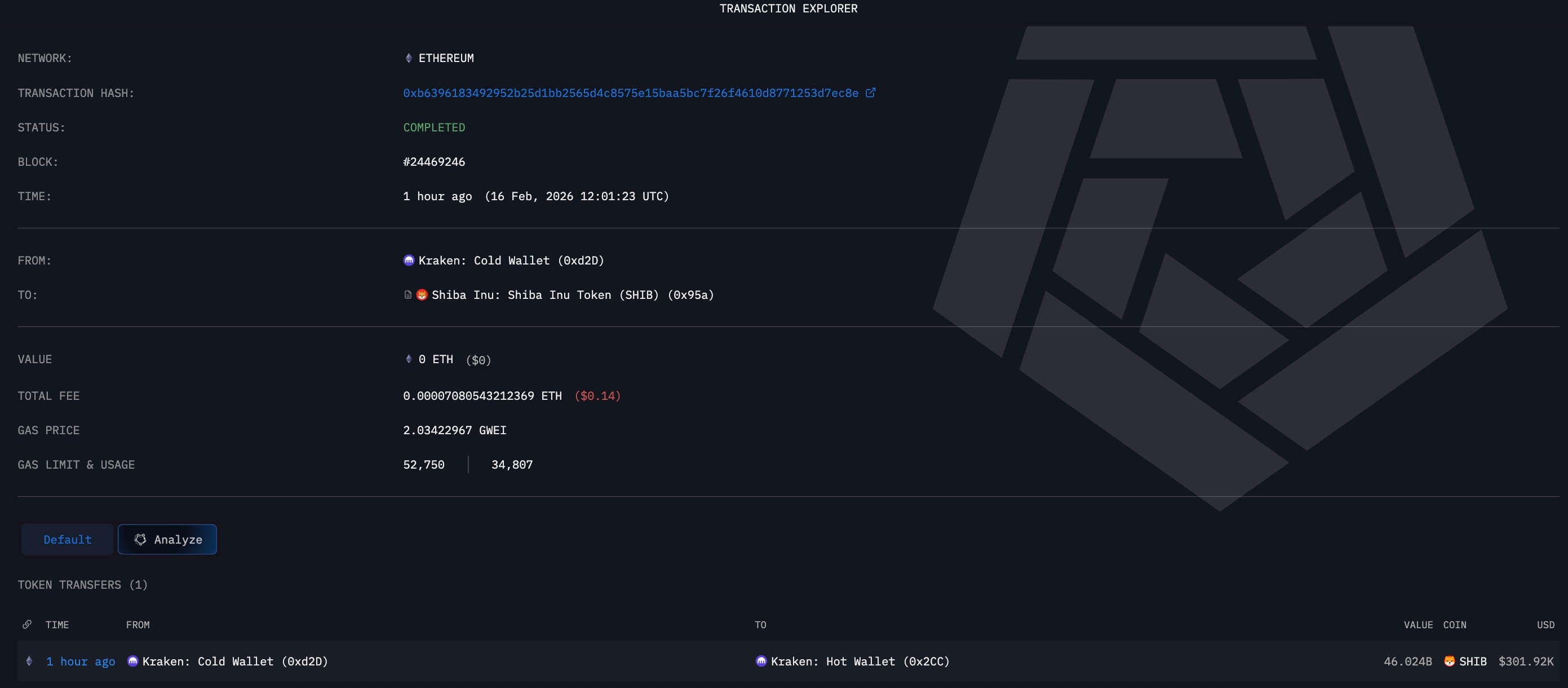

A prominent Shiba Inu ($SHIB) As visualized by Arkham, the transfer appears on-chain, showing 46,024,240,350 $SHIB It is moved internally between wallets managed by Kraken. The trade, worth approximately $301,900 at the time of execution, signals a shift in liquidity as exchanges reconcile holdings between cold storage and active hot wallets.

Kraken regulates heat and cold. $SHIB Pricing details

Blockchain data from Arkham confirms that the transfer took place on the Ethereum network. Despite the high volume, the efficiency of the network resulted in transaction fees of only 2.03 Gwei (equivalent to $0.14).

The sender’s address is verified as a Kraken Cold Wallet (0xd20) and the recipient’s address is verified as a Kraken Hot Wallet (0x2CC). Taken together, these addresses suggest routine operational moves rather than large-scale customer exits or external market sales. Exchanges typically keep most assets in offline cold storage for security and only relocate them to hot wallets in the event of increased trading demand, market-making needs, or future withdrawals.

The timing of this liquidity shift coincides with a gradual recovery in the global economy. $SHIBThe price of Bitcoin as it heads towards $70,000. On the Binance daily chart, Shiba Inu is currently nearing $0.00000669, with an increase of 2.29% on the day. $SHIB Enthusiasts are watching closely to see if Memecoin can regain the $0.0000068 level after the recent drawdown pushed the price towards the $0.0000052 zone.

Even though it’s 46 billion $SHIB is only a fraction of the 580 trillion circulating supply, and exchange-level liquidity adjustments are often a leading indicator of short-term volatility. By placing these tokens in hot wallets, Kraken can create deeper order book depth.

When this liquidity leads to an increase in spot volume, $SHIB It is likely to gain the momentum needed to reach the higher resistance levels of $0.00000900 and $0.00001102. So far, the move appears to be a vote of confidence in the president-elect. $SHIBCurrent trading stability. This suggests that the exchange is actively managing liquidity and compressing price movements during the long US holiday period.