- The whales accumulated 1.974 million ARB worth $1.14 million, causing a price rise of 16.9% in 24 hours.

- The strong volume and bullish technology confirmed the trader’s trust after major resistance was broken.

Arbitrum (ARB) token prices are rising sharply 16.90% In the last 24 hours. On-chain data shows large movements by a single whale, quietly accumulating a huge amount of ARBs.

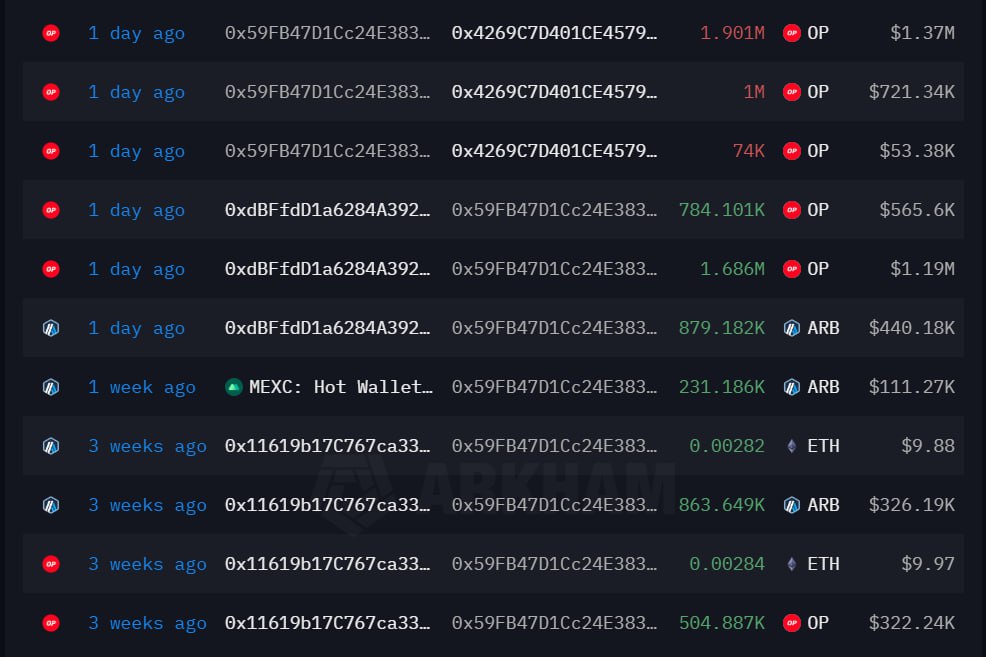

The total whale purchase amounted to 1.14 million ARB, worth about $1.14 million, according to on-chain analyst Rose. Interestingly, this purchase occurred after the whales exchanged ETH to fund their accumulation of ARB tokens.

Source: Rose on x

Such a big move was certainly not noticed by market participants. When entities pump such a large amount of funds in such a short period of time, there is certainly a motive behind it. Many view it as a signal of trust in the short- and long-term potential of the arbitrum ecosystem.

Furthermore, technical support further strengthened optimism. ARB has broken through major resistance, bringing trading volumes to $1.444 billion in one day, surged by 227%. Technical indicators like the MACD histogram also returned to positive territory for the first time since July, but the 14-day RSI hovered around the age of 63.

So whale accumulation, technical support, and a large amount of massive combinations seem to fuel this surge.

Source: TradingView

Adoption momentum builds as Arbitrum attracts key players

Meanwhile, development within the ecosystem continues to flow. In mid-July, CNF reported that PayPal had quietly added support for Arbitrum to its Stablecoin product, Pyusd. This information was first revealed through an update to PayPal’s Terms of Use page.

Although not widely announced, this move paves the way for faster and cheaper transactions through this Layer 2 network.

In the same month, Nodeops officially launched the permitless computing protocol on Arbitrum. This protocol had previously undergone testnet testing phase, with promising results. Nodeops is currently expanding its services with staking, cross-chain integration and AI-based orchestration to support the Depin ecosystem.

If you’re wondering if this all affects prices, it’s not necessarily short-term, but the long-term impact can be important, especially in attracting new users and developers.

That’s so interesting, Arbitrum is also an option for large projects currently being considered for migration. For example, Sky Mavis, developer of the game Axie Infinity, has accepted the proposal to migrate the Ronin network to Arbitrum Orbit as Layer 2.

If implemented, the Ronin network, with 1.7 million active users every day, is integrated directly into the Arbitrum ecosystem. Yes, this transition is not risk-free, but imagine the transaction volume that follows.

Wyoming’s stubcoin move suggests what’s coming next

Beyond users and developers, the network is beginning to gain traction in traditional finance, a more serious field. On August 19-20, Wyoming launched Frontier Stable Token (FRNT), the first state-issued stable coin in the United States.

This token was launched simultaneously on seven networks, including Arbitrum. It’s even more appealing with support from celebrities like Visa and Kraken. Additionally, the Stablecoin has a 2% overload system, supported by the agency’s asset reserves.

This integration further strengthens Arbitrum’s role as a part of the regulator’s financial infrastructure. To say it is the new backbone of large cross-chain transactions is not an exaggeration.

Meanwhile, Circle has joined Fray by launching Gateway Protocol, a cross-chain liquidity solution that supports USDC integrated across multiple networks, including Arbitrum. They aim to reduce capital fragmentation and make it easier for institutions to manage their funds efficiently.

Additionally, Arbitrum remains a strong leader in the Ethereum Scaling sector as of early August, with over $2.53 billion in TVL and over 900 active Dapps.