Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

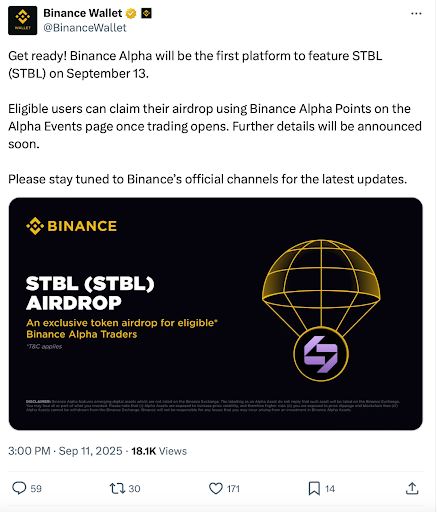

Binance Alpha announces it will list STBL, the governance token of the STBL protocol, and is the first to see the RWA-backed Stablecoin ecosystem of its projects to early access traders.

summary

- Starting this week, Binance Alpha will list STBL, the governance token for the STBL protocol.

- STBL manages a USST-centric Stablecoin system. This is backed by real assets like the US Treasury Department.

- The project, led by Tether co-founder Reeve Collins, aims to align user participation with Stablecoin development and yield generation.

Dubai, United Arab Emirates, United Arab Emirates – Binance Alpha, Binance’s early access platform, announced this week that it will list STBL, the governance token of the STBL protocol.

The launch comes after STBL completed a previous seed round led by Wave Digital Assets, a digital asset manager under management of over $1 billion.

Binance Alpha is the first to see token building infrastructure and real-world applications by touching the project before traders reach the main exchange. The addition of STBL highlights the platform’s focus on projects that combine traditional financial models with decentralized frameworks.

The role of STBL in ecosystems

STBL acts as a governance token for a wider Stablecoin system centered around USST. This is a Stablecoin designed to back up real-world assets such as the US Treasury. The token allows for the community to upgrade protocols, adjust parameters, and participate in Treasury allocation. This model is designed to coordinate user and protocol incentives while introducing accountable mechanisms as new features unfold.

Founder’s perspective

Tether’s STBL founder and co-founder Reeve Collins described the token as the governance layer of the project’s ecosystem.

background

Reeve Collins is the co-founder of Tether, the world’s first and largest Stablecoin, and leads the STBL project. STBL is the governance token of the STBL protocol, allowing users to earn revenue and mint USST Stablecoin. Stablecoin is RWA-Collateralized. This means that owners will receive profits from the underlying assets and integrate Defi Instruments into their investment strategies to increase yields and unlock liquidity.

read more: Escape from the Extracted Economy: Ownership and RWAS Win | Opinion

Disclosure: This content is provided by a third party. Neither Crypto.News nor the author of this article ends with the products listed on this page. Users should conduct their own research before taking any action related to the company.