Metaplanet, a publicly listed Japanese company, is attracting global financial market attention with its bold Bitcoin (BTC) acquisition strategy.

Since its first purchase in April 2024, Metaplanet has consistently increased its Bitcoin Holdings, but stock prices have skyrocketed dramatically, with more than 15 times within a year.

Metaplanet’s Bitcoin accumulation journey

More recently, Metaplanet announced the purchase of 555 Bitcoin, increasing its total holding to 5,555 BTC, with cumulative acquisition costs of approximately $481.5 million. Not only that, the company has issued $25 million interest-free bonds to continue its Bitcoin accumulation efforts.

Metaplanet has also appointed Eric Trump to the Strategic Advisory Committee to enhance Bitcoin-centric growth and innovation.

“The unrealized profit in Metaplanet’s Bitcoin position is 6 billion yen. For recognition: it’s four times the capitalization before switching to the Bitcoin standard!” Users of X highlight the major economic impact of this strategy.

In 2025 alone, Metaplanet has made several large purchases. On April 14, 2025, the company invested $26.3 million in 319 BTC, showing confidence despite the yields of the Japanese Ministry of Finance. Metaplanet acquired 497 BTC on March 3 for $43.9 million on March 3, and 156 BTC on March 12 for $13.5 million.

The company also acquired several Bitcoin acquisitions in February.

Metaplanet has become one of the largest publicly listed Bitcoin holders in Asia. Holdings are much smaller than micro-strategic holdings, but Metaplanet is called the “Asian micro-strategic strategy” and could lead a wave of institutional Bitcoin investment in the region.

“Anyone with a Tokyo Stock Exchange account will be able to be exposed to Bitcoin without regulatory risk,” said Jason Fan, founder of Solaventure, in an April 2024 collaboration announcement with Metaplanet.

The move demonstrates Metaplanet’s belief in crypto, prompting whether such a strategy can set new precedents for traditional financial companies.

Impact of Bitcoin Purchasing Strategy on Metaplanet’s Stock Prices

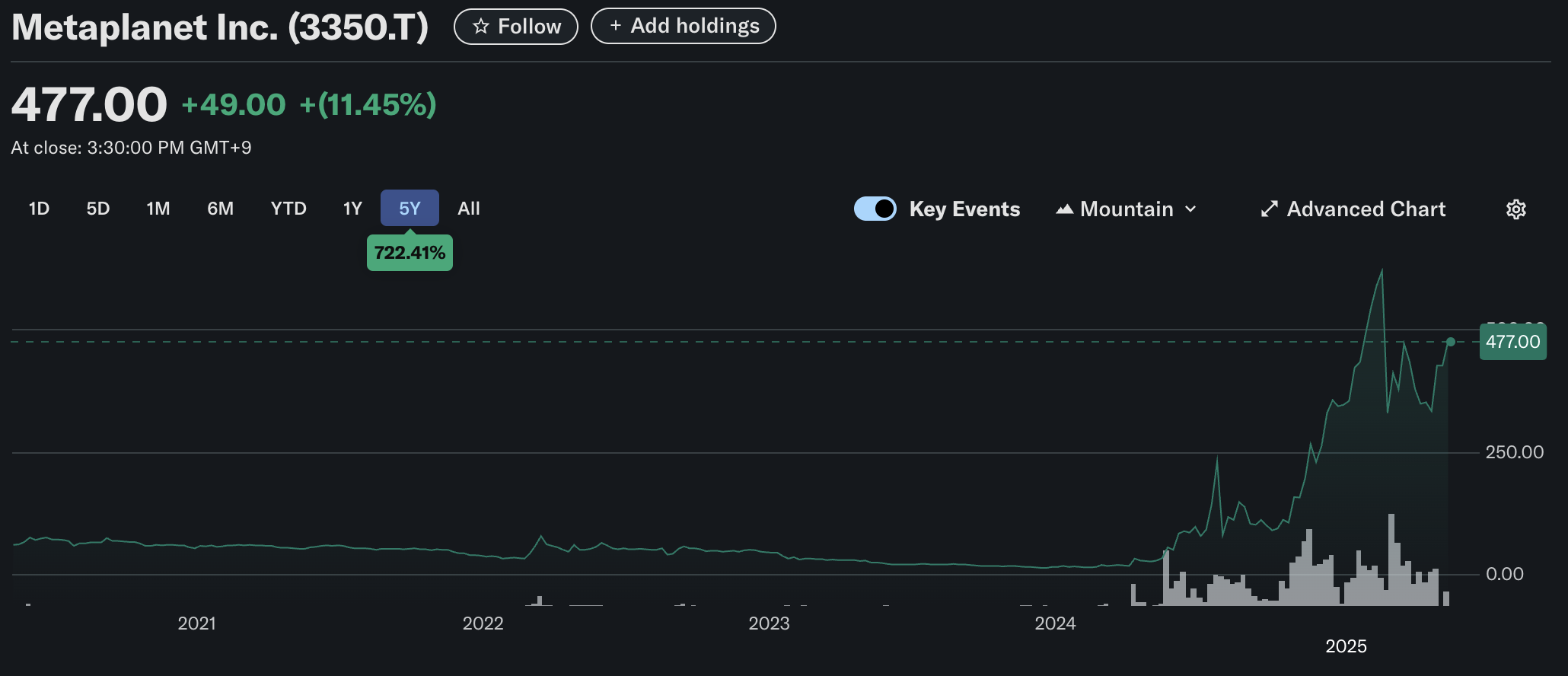

Metaplanet’s Bitcoin acquisition strategy has had a major impact on stock prices. According to Yahoo Finance, following the announcement of the purchase of 555 BTC on May 7, 2025, Metaplanet’s share price jumped 11.45% to 477 JPY (approximately $3.33).

Metaplanet stock price performance. Source: Yahoo Finance

Even more surprising, since the company began purchasing Bitcoin in April 2024, the stock price has skyrocketed from around 34 JPY to its current level more than 15 times, making Metaplanet one of Japan’s best performing stocks during this period.

The announcement of each Bitcoin purchase has usually caused a significant stock price rise. For example, on March 12, 2025, the share price rose 7.93% after the acquisition of 162 BTC and 19% after the purchase of 497 BTC on March 5, 2025.

Metaplanet’s Bitcoin acquisition strategy will have a major impact on the company and the broader financial markets. First, the aggressive accumulation of Bitcoin reflects Metaplanet’s strong confidence in the long-term potential of cryptocurrencies, especially amid global inflation and depreciation of the Japanese yen.

Second, a 15x increase in stock prices indicates that consolidating cryptocurrencies can bring significant value to traditional financial companies. This sets precedents and encourages other companies in Japan and Asia to consider similar strategies.

Metaplanet has set an ambitious goal of holding 10,000 BTC by the end of 2025 and 21,000 BTC by the end of 2026. By achieving these goals, we can solidify our leadership in the accumulation of Bitcoin in Asia and establish a model that other companies should follow.