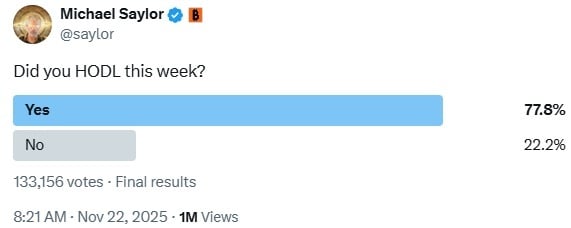

The massive expression of confidence from the Michael Saylor poll underscored Bitcoin’s strength, as most participants held firm during the decline, reinforcing bullish momentum supported by institutional demand, steady accumulation, and confidence in the asset’s long-term trajectory.

Bitcoin hodlers remain strong even as volatility spikes

Strategy Executive Chairman Michael Saylor shared on social media platform In this post, I highlighted behaviors that often form short-term emotions.

“Did you HODL this week?” started the poll and became popular as Bitcoin fell toward a major support zone earlier in the week. The decline spooked traders, and the price briefly fell to the low $80,000s, before rebounding to near $86,550. Despite the confusion, 77.8% of 133,156 respondents selected “yes.” This reaction suggests that many users held onto their positions during the recession rather than exiting, even though the daily chart showed sustained weakness.

As Bitcoin prices fall, Saylor remains bullish, calling his company Strategy (MSTR), which owns a large Bitcoin vault, “indestructible.” At the same time, MSTR faces the risk of being excluded from the MSCI index as its digital asset holdings exceed 50% of its total assets. The removal of such an index, as warned by JPMorgan, could force billions of dollars in passive outflows and pose major challenges to Strategies’ Bitcoin-centric strategies. Saylor insists that MSTR is not just a fund, but a managed business.

read more: Strategies face MSCI index overheating as Saylor furthers push for Bitcoin finance

Despite the recent selloff, analysts and fund managers are predicting a strong rebound in Bitcoin due to its long-term potential. Projections for 2025 are often in the ~$200,000 range, supported by increased institutional adoption through exchange-traded funds (ETFs). They view the current volatility as a “healthy correction”, a natural correction phase caused by macroeconomic uncertainty. Continued on-chain accumulation by large holders and possible easing of global monetary policy are expected to fuel the next big rally.

FAQ 🧭

- Why is Michael Saylor’s poll important to Bitcoin investors?

The overwhelming “HODL” response of 77.8% indicates strong investor confidence during a period of high volatility, reinforcing confidence in Bitcoin’s long-term strength. - How might MSCI index exclusion impact the strategy (MSTR) and investors?

The potential termination of MSCI could cause billions of dollars in passive outflows, putting short-term pressure on MSTR despite Saylor’s insistence that it remains a viable business. - What does current Bitcoin volatility say for long-term positioning?

Analysts view the recent price movements as a healthy consolidation phase, supporting continued accumulation by institutional investors and long-term holders. - Why is Bitcoin’s 2025 price prediction still bullish?

Rising institutional demand through ETFs, macro easing, and sustained on-chain accumulation supports predictions that Bitcoin could approach $200,000 in 2025.