After hitting the new all-time high (ATH) of $124,474 on Binance on August 13, Bitcoin (BTC) fell to $113,000 with its next major support zone of about $110,000. Analysts warn that more shortcomings may still be ahead for the top cryptocurrencies.

Bitcoin falls even more? Long, busy trade gives hints

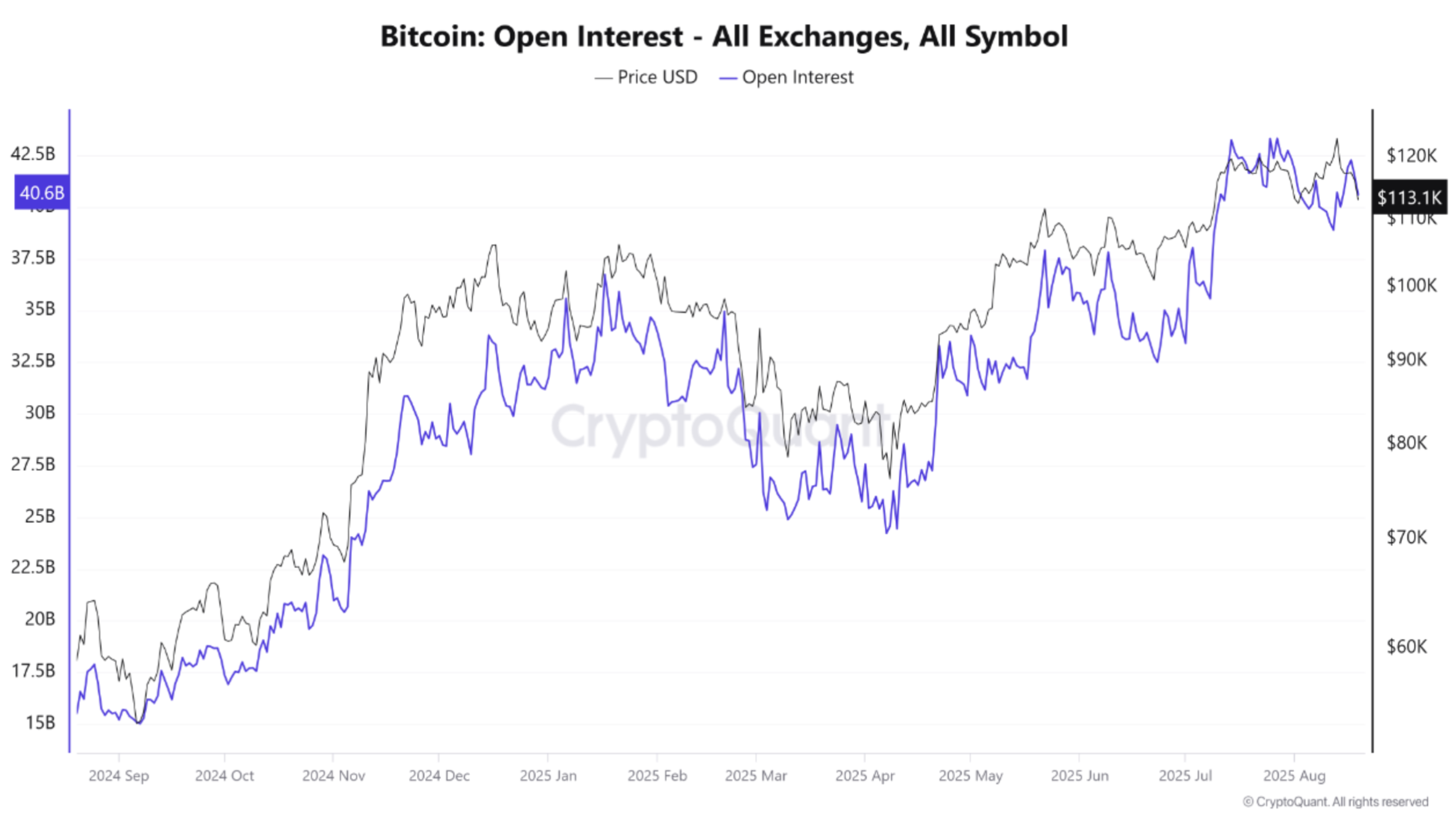

Open interest in Bitcoin across all exchanges has skyrocketed over $40 billion, moving closer to the ATH territory, according to a encrypted quick take post by contributor Xwin Research Japan. This rise shows that both whales and short-term traders are stacking up in leveraged positions.

The chart below highlights the recent surge in open interest in BTC, currently hovering at $40.6 billion. Open interest has increased by more than 150% compared to the level of $15 billion in August 2024.

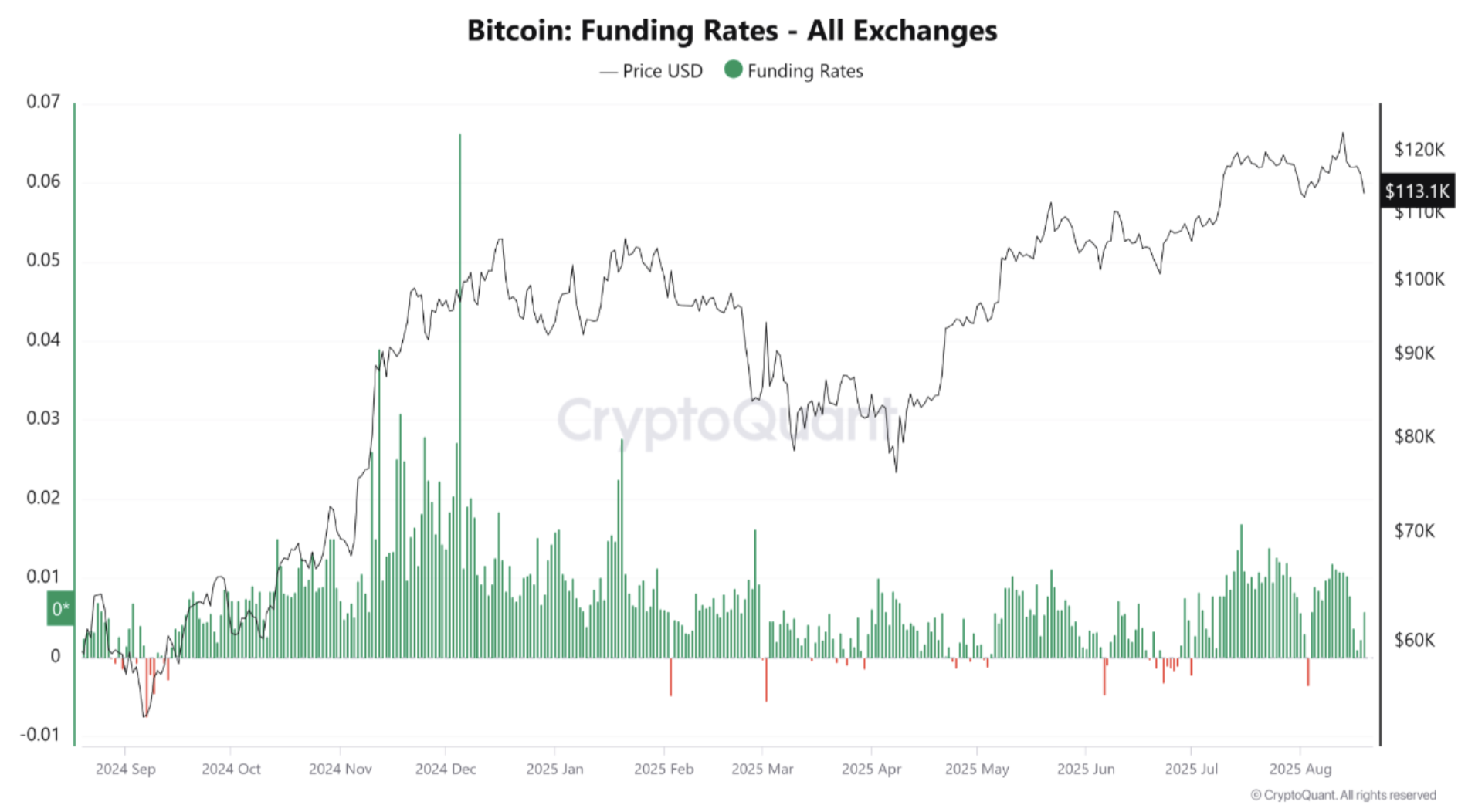

Crypto contributors added that despite this surge, the funding rate remains positive, indicating a strong, long bias. This reflects market optimism, but most participants bet on further BTC ratings, indicating busy trade.

As a result, there is an increased risk of forced settlements in long positions due to aggressive leverage. Xwin Research Japan explained in its analysis.

A sudden price drop can cause a cascade of forced sales, amplifying volatility. In other words, Bitcoin’s short-term movement is at the mercy of speculative trends.

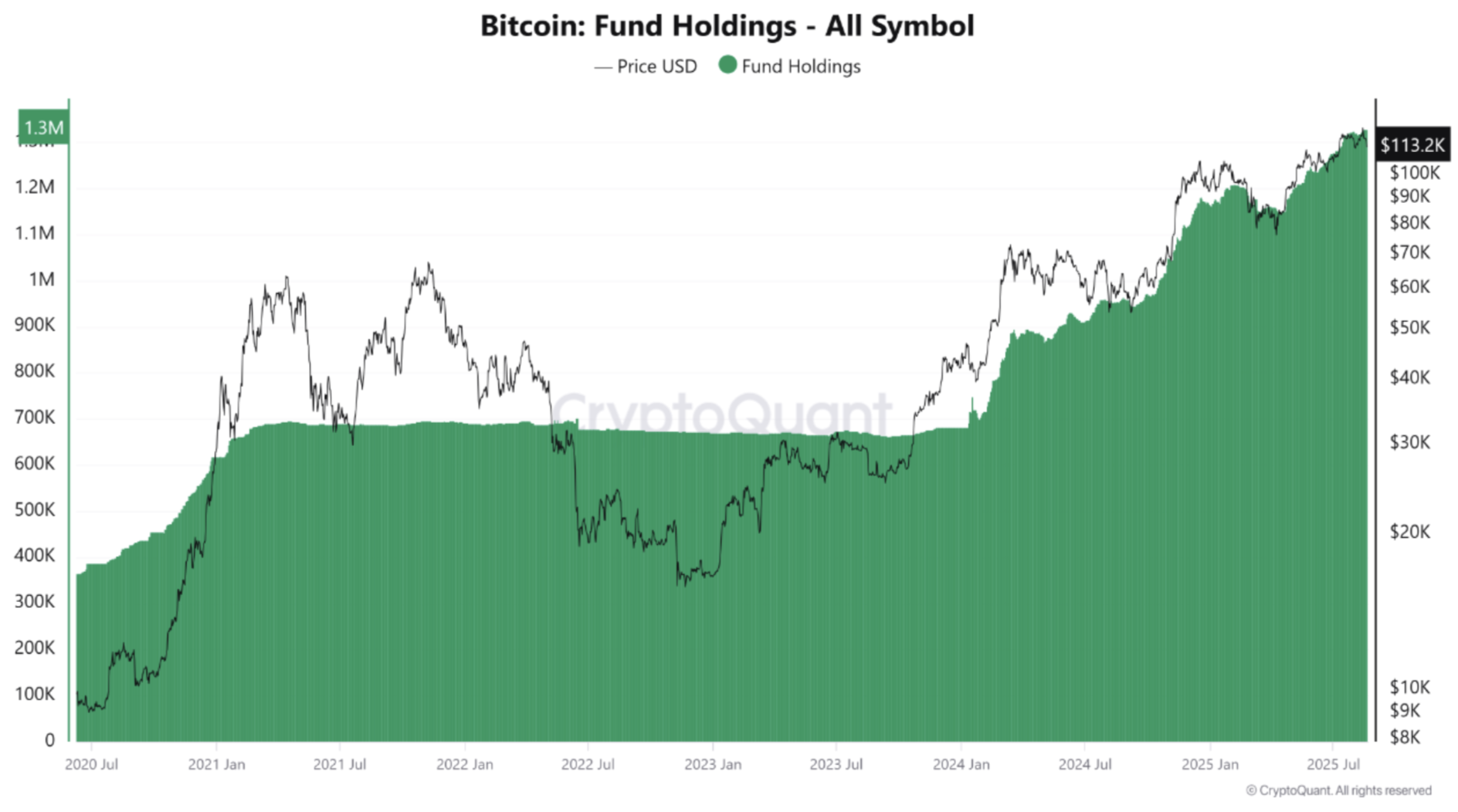

Institutions’ holdings of BTC funds will rise

Despite speculative bubbles from excessive leverage in the market, the BTC fund continues to surge in Bitcoin Exchange Trade Fund (ETF) and institutional investors holdings, with the latest data showing above 1.3 million.

Spot ETFs that absorb BTC and the Ministry of Corporate Treasury will provide digital assets with structural bids that will steadily reduce the available supply. According to data From SOSOValue, the US-based Bitcoin ETF currently holds a net worth of $146 billion. This accounts for 6.47% of BTC’s market capitalization.

That being said, this week alone has seen more than $645 million of spills from the Spot Bitcoin ETF after two consecutive weeks of influx of nearly $800 million. Among the ETFs, BlackRock’s IBIT is leading a net worth of $84.788 billion as of August 19th.

Still, not all signals are bearish. For example, while BTC falls below $115,000, the spot trading volume It has risen sharply After $6 billion, I hope for the Bulls to have a potential rebound.

Similarly, recent technology analyst AO Proposed That BTC could reflect a gold trajectory with an ambitious target of $600,000 by early 2026. At press time, BTC will trade at $113,845, a 1.5% decrease over the past 24 hours.

Featured images from Unsplash, Cryptoquant and TradingView.com charts