Some employees of Morph, Bitget’s new blockchain, initially viewed the L2 network as a potential future rival for Coinbase’s base.

However, sources familiar with the project tell Blockworks that Morph is being hampered by internal dysfunction. Sources claim that since the $20 million seed was promoted last March, team conflict, flashy spending and mysterious “shadow CEOs” have led to layoffs, delays and loss of direction.

BlockWorks spoke with 12 current and former employees who were allowed anonymous to share candid details about what went wrong in one of Bitget’s most common bets.

The beginning of the morph

Exchange is the biggest app in crypto. One way these digital assets Titans can capitalize on their popularity is to launch their own blockchain.

Binance first launched the BNB chain in 2020. Coinbase released Ethereum Layer 2 in 2023, called Bass.

These chains can be advantageous. Base generated a total profit of $76 million in 2024 for each Blockworks survey.

In this context, an L2 named Morph became a hot ticket after being incubated by Bitget, the 10th largest exchange per spot volume. But instead of following a more classic startup model where two co-founders came together with a single idea, Morph saw two co-founders who didn’t know each other paired together.

According to her LinkedIn, the team behind Morph has acquired leaders of Azem Khan, who lived in the US, and formerly Singapore-based Cecilia Husue. Hsueh was previously Chief Marketing Officer and briefly CEO of Crypto Exchange Phemex. She was tapped as CEO of Morph, and Khan became Chief Operating Officer.

At first things seemed brighter. As Crypto’s fundraiser began to recover, Morph raised $20 million in seed funding from US-based venture Dragonfly. Other investors include Pantera, MexC Group, Bitget’s venture arm foresight ventures, and Spartan Group.

Bitget and Foresight did not return multiple requests for comments about MORPH. Dragonfly and Pantera declined to comment when they reached.

Morph’s main net was released in late October last year. According to Morph’s Block Explorer, L2 had around 16,000 transactions on Monday, May 12th. Following the Blockworks Research Dashboard, to give these figures a perspective, the base averages millions of transactions each day.

The launch was only half of the battle. Another big goal was to launch the token, the former employee said, but this hasn’t happened yet.

Last month, Morph teased people who minted the so-called Platinum NFTS “set their ecosystem location with a $500 million FDV rating and unlock 50% token locks with TGE.”

According to familiar people, the seed round valued the morph at a $125 million value in March 2024.

However, since the pay raise, Bitget Layer 2 has experienced turbulent years.

“Ghost Founder”

A rift emerged in his leadership as Morph tried to staff and bring the working blockchain to the market.

The familiar people explained the tension between Hsueh and Khan.

Khan declined to comment when BlockWorks reached.

According to company data, Bitget, which is not available in the US, has experienced strong growth over the past few years in Africa, South Asia and Southeast Asia. Morph originally intended to reach users in the Global South that were not serviced by other exchange blockchains.

Strategically, according to some sources, Khan and Hsueh were not always in alignment. Khan spoke about emerging markets in a press appearance, but the former employee said these initiatives were slow to come to fruition internally. Teams who spent months planning activations in these markets were told they would not receive the budget, sources said.

Stranger Still felt that the employees who spoke to Blockworks didn’t seem to have the power to decide on things at all times either Khan or CEO Hsueh.

One employee described Khan as more of a “ghost founder” than an actual co-founder, pointing out that he had never seen anything like that throughout his crypto career.

Many decision-making powers appeared to be on the lookout for Forest Bai, co-founder and partner of foresightful ventures (Bitget’s venture arm and MORPH investor), and the bloc’s chairman. Several people have confirmed that Bai is something like “Shadow CEO.” Sources said they are monitoring spending and company strategies and more.

Khan announced he would leave Morph in March, calling it “the best path for me” in a post on X. He has since appeared as a co-founder of a different blockchain named Miden.

According to several well-known people, the lack of alignment and independent decision-making power contributed to Khan’s departure.

Hsueh remains as CEO. Her powers are said to have declined further in recent months, but the three of them allegedly told BlockWorks.

Who is really in charge?

Almost everyone said that he explained Hsueh as having a limited understanding of the technical internals and externals of blockchain. While it is not a prerequisite for the executive to be from a cryptographic origin, sources argue that Hsueh has not been in contact with blockchain users and is not interested in learning about technology, and feel that Morph lacks a clear strategic direction.

Instead, Hsueh is obsessed with her growing online presence, sources said. Three former employees said they were asked to be involved in her post. Others added that Hsueh will prioritize announcements about Morph on her personal account on her official account.

At one point, Hsueh posted a photo of his feet on X.

The former employee described her as “Teflon”, but it is unclear how much power Hsueh still holds.

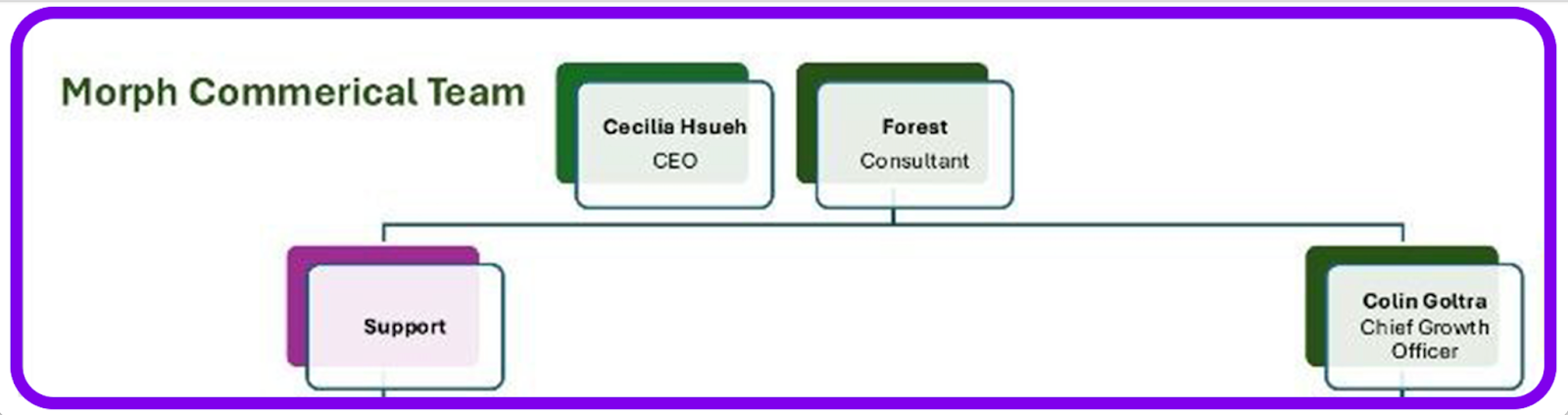

Although she is listed as CEO of the company’s document, Bai, the co-founder of a visionary venture, appears next to her on the internal organizational chart shared with BlockWorks.

Edited screenshot of Morph’s organizational chart showing the roles of Bai and Hsueh

Neither Hsueh nor Bai returned emails or messages requesting comment.

Bai has gained more control over the past few months – officially added to the company’s Slack following three sources familiar to the three sources, but said it upset both Khan and Hsueh before Khan’s departure. Officially, BAI is listed as a consultant for internal slack messages seen by BlockWorks.

Another internal Slack message shared with Blockworks called for Bai’s presence in the ecosystem and marketing team meeting.

No trades or no trades?

In 2024, the Morph was a massive Spender, four said. Certainly, the company had just confirmed a $20 million salary increase.

However, the spending included events from the K-Pop Band Triples. There, Morph is said to cover the group’s travel and accommodation. Lu.ma, a popular website used by projects planning post-meeting events, teased Triples’ “special performance” in April last year. The event was hosted by Gitz, Bitget, Morph and visionary venture QuantStamp.

Several sources discussed Morph, who spends hundreds of thousands of dollars on events at crypto conferences. At Token2049 in Singapore, Morph held an all-day event at the ArtScience Museum in Singapore, sources say. Lu.ma’s invitations show that the event included Vitalik Buterin, Stani Kulechov of Avara and Mo Shaikh of Aptos.

Large event spending did not match return on investment or return, another source noted. And while the event seemed to get money, Hsueh seemed reluctant to greenlight actual business transactions, familiar people told BlockWorks.

According to familiar sources, the bright side of the company’s spending was that Morph first compensated employees competitively.

Outside of the event, there was discussion about the physical offices in New York City. This reached its peak in the 77th floor space at One World Trade Center, three sources told Blockworks.

The office is shared with foresight and block, but it is unclear who is leasing it.

On the developer side, Morph once paid a team of developers over $200,000 to build a fork for UNISWAP V2, according to multiple sources. Because Uniswap’s code is open source, one former employer felt that the DEX project, which became known as Bulbaswap, was overpaid. According to Defillama, Bulbaswap currently holds around $93 million in total locked value, centering around the 200th largest DEX in its metric.

“Dark Arts”

Morph’s burn rate may have been offset by planned Series A funding, but the new funding round has not yet been realized.

“We’re looking for the next round,” Hsueh said in an interview with Web3TV in September, “Operating the chain is very expensive,” and the company was aiming to grow its personnel.

However, familiar people pointed out that there was tension around Series A before Khan’s departure. Two familiar bees said Morph pushed to raise another round.

Blockworks was unable to determine the current status of Series A.

Even without a pay raise, familiar sources have told Blockworks that Morph hasn’t paid yet and is still supported by Bitget.

Morph did not return multiple requests for comments.

Morph, meanwhile, struggled to maintain his talent. One employer said he faces “crazy amounts” of sales, from departures to layoffs. Some employees are also receiving pay cuts, others noted.

Several employees said they would not receive token contracts. According to one source, Morph tried to force employees who received the contract last May to sign new employees.