important notes

- Validators will vote to upgrade to Nearcore v2.9.0, and 80% approval of network stakeholders is required to activate this proposal.

- This halving is aimed at mitigating token dilution and further encouraging DeFi participation within the NEAR ecosystem.

- NEAR is trading in bearish territory at $2.34, and lower inflation could ease medium-term selling pressure similar to the Bitcoin halving.

The Near Protocol network will vote to reduce NEAR starting October 21st. near $2.32 24 hour volatility: 2.3% Market capitalization: $290 million Vol. 24 hours: $210.15 million Token emissions will increase from 5% to 2.5% per year of supply, effectively halving inflation for the first time. This is similar to what happened with Bitcoin. BTC $112073 24 hour volatility: 1.6% Market capitalization: $2.24 trillion Vol. 24 hours: $8.843 billion Every 4 years.

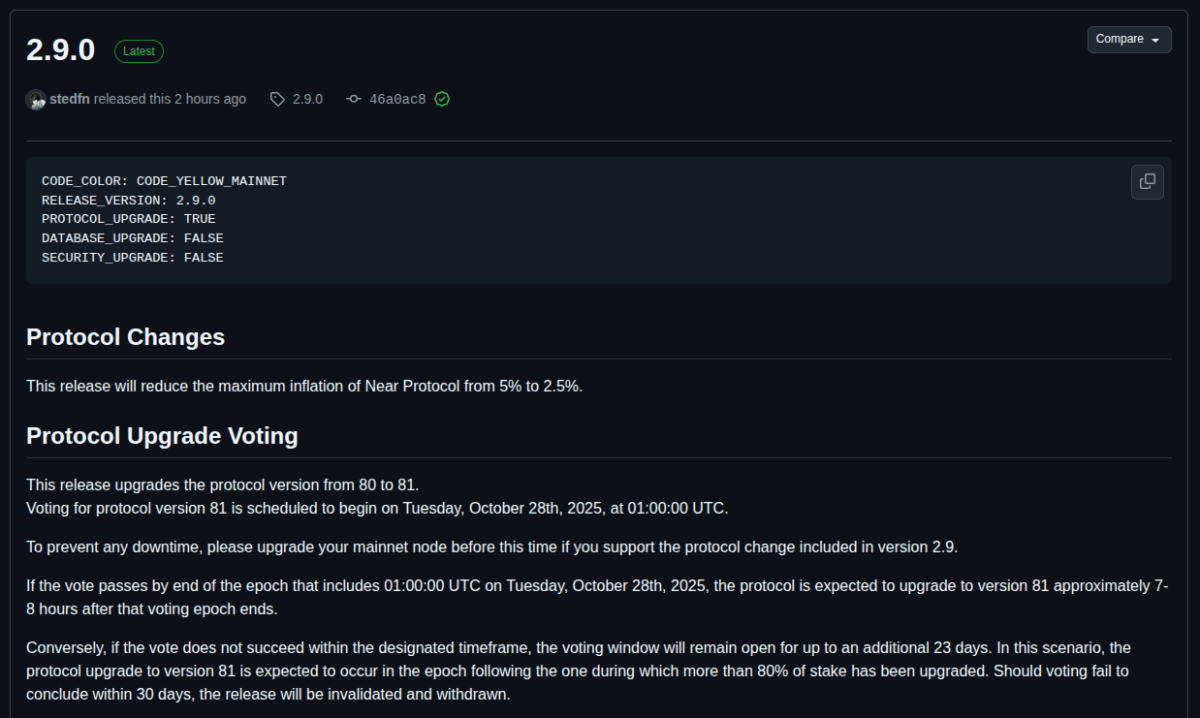

Voting takes place at the node layer, and verifiers choose to upgrade the near-core software to release 2.9.0. This release was published on October 21st in the near-core repository on GitHub, along with an explanation of how it happened.

In summary, this release only includes a halving of emissions (from 5% to 2.5%) and activation parameters, is fully backwards compatible, and will not harm validators who choose not to upgrade. If you want to upgrade, vote “YES”; if you do not want to upgrade, vote “NO”. This proposal requires 80% approval. Otherwise, 80% of the network’s active stake is delegated to NEAR block producers running Nearcore v2.9.0.

Activation is planned for October 28th at 1:00 AM (UTC) and will upgrade the protocol version from 80 to 81 at the end of this epoch. If the threshold is not reached by then, the voting period will be extended for an additional 23 days, giving you a total of 30 days to upgrade.

By the end of the 30 days, if the vote is resolved as “NO” and less than 80% of validators have upgraded, NEAR inflation will remain at the current 5% tail emission. If the required percentage is reached any time after October 28, the halving will take effect two epochs after the requirement is met, reducing the inflation rate to a tail emission of 2.5%.

“The current 5% interest rate, originally designed to encourage early-stage participation, now results in unnecessary dilution. At the same time, it reduces the incentive for holders to engage in DeFi and other productive activities within the NEAR ecosystem. (…) This more sustainable inflation model is intended to encourage on-chain participation in the NEAR ecosystem,” the proposal’s rationale states.

Near Protocol’s Near Core v2.9.0 Release Tag | Source: GitHub

NEAR price analysis

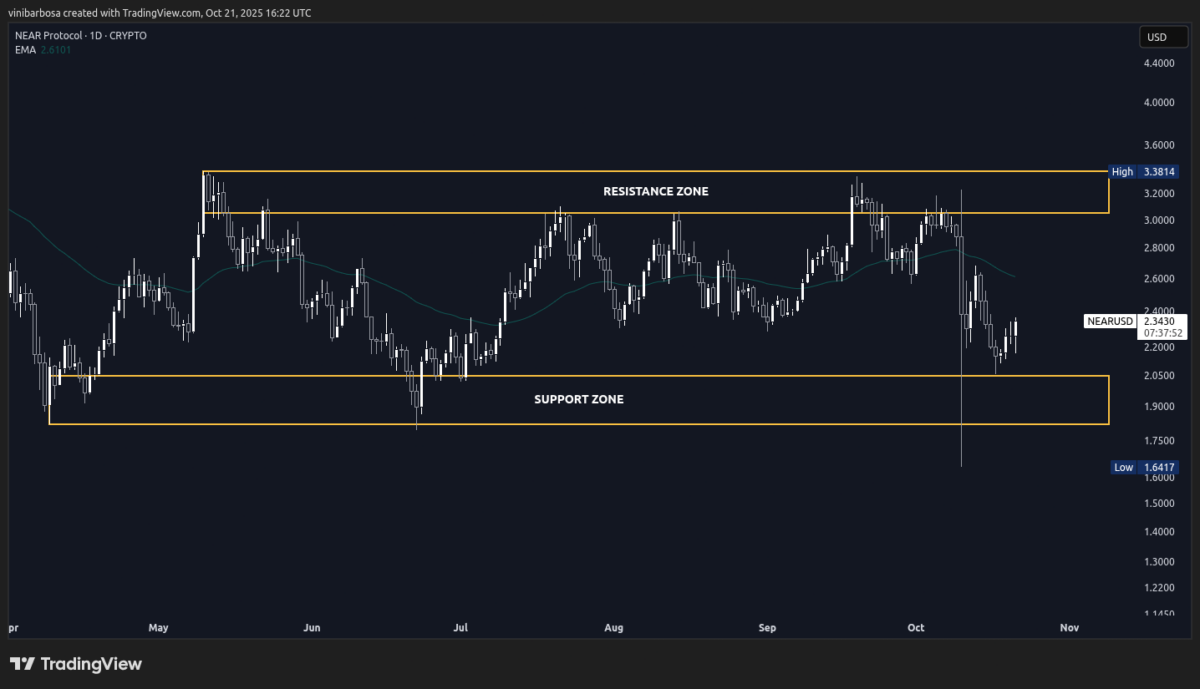

At the time of writing, Near Protocol’s native token, NEAR, is trading at $2.34, which is within a price range stretching back to early 2025 between two key pressure zones. The support zone ranges from $1.80 to $2.05 and there is significant buying pressure. On the other hand, the resistance zone is in the $3.05 to $3.40 range, which is under heavy selling pressure.

Additionally, NEAR is currently trading below the 50-day exponential moving average (1D50EMA), a popular trend indicator, suggesting that the token is currently in bearish territory and needs to break out of this indicator first before moving into the one-year resistance zone.

NEAR Daily (1D) Price Chart as of October 21, 2025 | Source: TradingView

Interestingly, halving NEAR supply inflation could ease selling pressure in the medium term and weaken the currently active resistance zone. This same effect is seen in Bitcoin every four years, favoring the bulls after the halving. Bitcoin’s most recent halving occurred on April 20, 2024, and BTC hit a new all-time high seven months later in November 2024.

Near Protocol is making waves in the cryptocurrency industry in 2025 thanks to its NEAR Intents protocol, which connects over 20 different blockchains into decentralized intent-based transactions, making it a popular choice for privacy enthusiasts to acquire and use Zcash. ZEC $278.2 24 hour volatility: 5.0% Market capitalization: $456 million Vol. 24 hours: $876.56 million .

Disclaimer: Coinspeaker is committed to providing fair and transparent reporting. This article is intended to provide accurate and timely information but should not be taken as financial or investment advice. Market conditions can change rapidly, so we recommend that you verify the information yourself and consult a professional before making any decisions based on this content.