Bitcoin Price Action It rebounded strongly from $112,000 support and now it’s trading above $116,000, so it’s once again in the spotlight. This could happen next.

Support and resistance levels

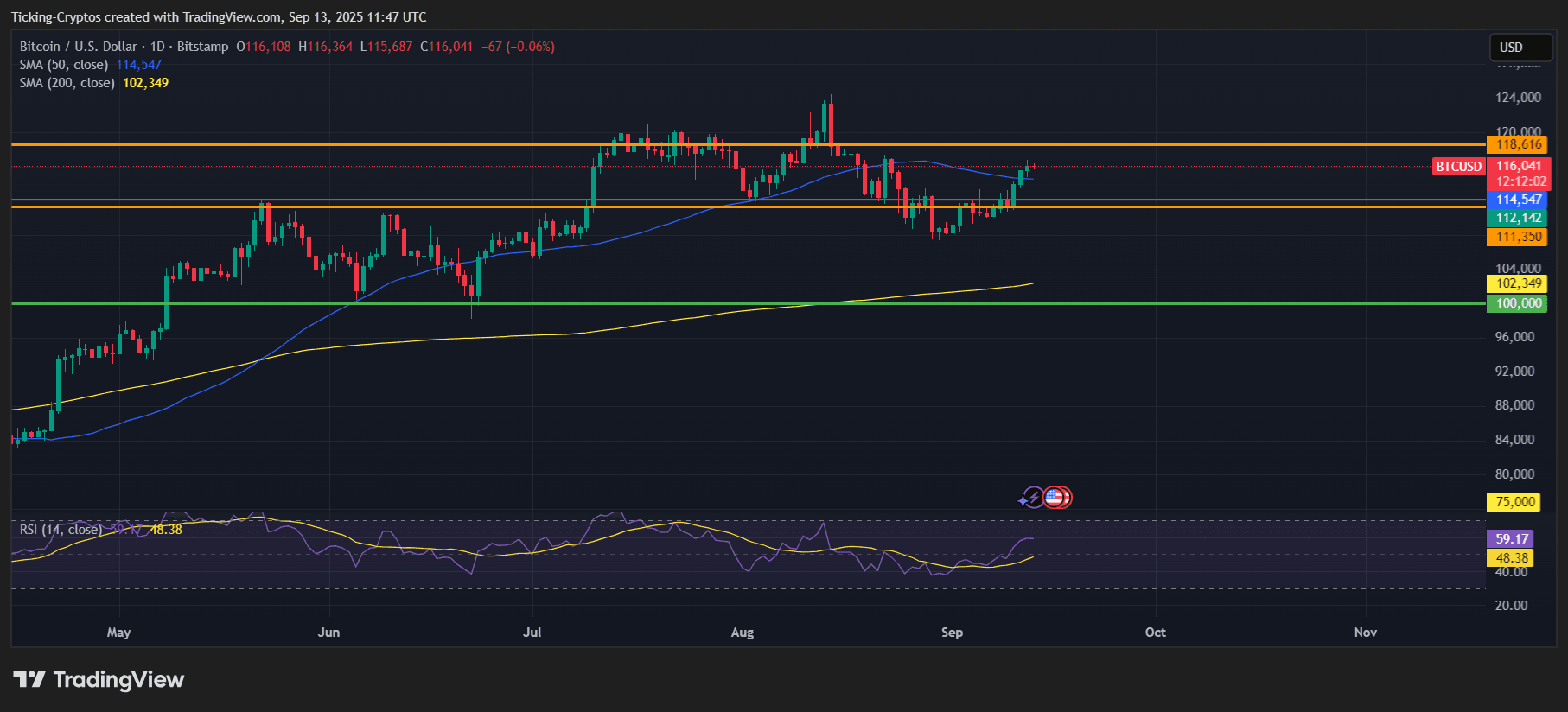

The chart highlights the main support zones between $111,350 and $112,142. The region serves as a strong cushion for BTC, with buyers actively intervening. Below this, the 200-day SMA is $102,349, and the psychological $100,000 level forms a key medium-term safety net.

BTC/USD 1 Day Chart – TradingView

The advantage is that immediate resistance is $118,616. This level has previously rejected Bitcoin multiple times, making it a decisive battlefield. The confirmed breakouts on top of that could burn bullish momentum towards a higher price target.

Short-term Bitcoin Prediction

In the short term, RSI is currently rising by around 59, just below the over-purchased zone. This still shows healthy purchasing pressure without flashing extreme levels. If BTC is able to break $118,000 above the 50-day SMA, the next goal will be around $120,000 to $122,000.

However, a rejection at $118K could lead to a minor pullback, and could retest $114,000 before another attempt rises.

Mid-term Bitcoin outlook

Looking at the broader trend, the $102,349 200-day SMA is sloping upward, reflecting strong medium-term support. If BTC breaks and consolidates beyond $118,616, the medium-term gathering for $125,000 is realistic. Beyond that, the Bulls were able to see $130,000 as their next major psychological milestone.

However, if momentum slows, Bitcoin could potentially return to the $111K-112,000 range. Deeper corrections to $100,000 will occur only when global market sentiment is weakened significantly.

Bitcoin Price Prediction: Here’s what to do

Bitcoin has shown resilience after bounced back from its recent lows and regaining its 50-day SMA. Traders should closely monitor $118K of resistance. A breakout here could get BTC on track towards $125,000 in the medium term, but a denial could lead to another consolidation phase of around $114,000.