The NFT market appears to be in a worse position as the crypto market prepares for turbulence amid the tariff war.

Trading volumes are declining and the market is closed.

The once-dead world of uneven tokens could swell to more than $264 billion by the once boldly predicted 2032, but it seems to be limping now. Weekly trading volumes have fallen like Domino’s for a few weeks, scaring capital and bringing the market back to levels that have not been seen since its explosive 2020 debut.

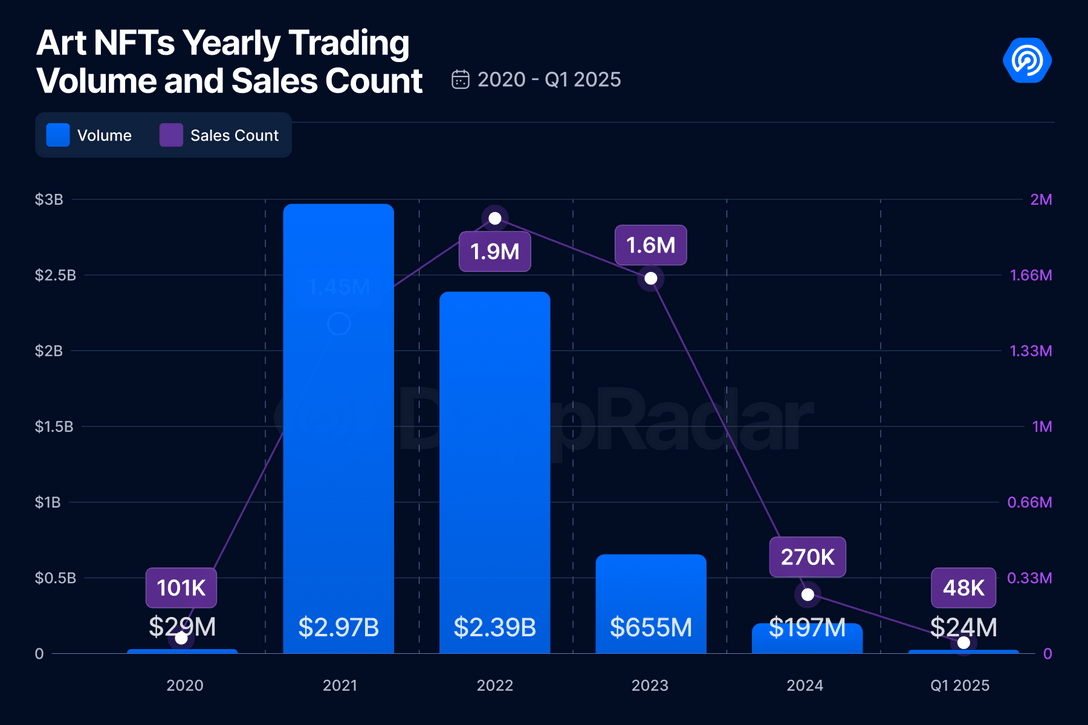

ART NFTS annual trading volume and sales volume | Source: Dappradar

Blockchain analytics firm Dappradar shows that trading volumes have run high in 2021, reaching nearly $3 billion.

Fast forward to the first quarter of 2025. That figure focuses on just $23.8 million from 93%, as “active traders have disappeared.”

“This rapid growth coincides with the global change driven by the Covid-19 pandemic, which accelerated the adoption of digital platforms and encouraged artists to explore innovative ways to engage with audiences. But three years later, ART NFT hype has dropped significantly.”

Sarah Gaszcheras

Data backs her up. In 2024, trading volumes fell nearly 20% from the previous year, but total sales fell 18%. As Gherghelas put it in his 2025 study, it was “one of the worst years since 2020”.

Still speculative assets

In an interview with Crypto.News, OntsetPR legal officer Alice Frei implies that the regulations are still confused as “the government is still undecided on how to classify NFTs.”

In the US, they are often treated like securities. This means that platforms must walk legally tightropes. In the UK, it is seen as a collectible under intellectual property law.

“These are examples of major countries with clear cryptocurrency regulations. In many other countries, the situation is even more uncertain. This lack of clarity in regulations creates an environment where fraud is ripe and undermine investor trust.

Alice Fryer

Frey also highlighted a deeper problem. Beyond the world of cryptocurrency and gaming, NFT emphasizes that they are “trying to prove that they provide real value.”

“In theory, it could revolutionize some industries. Think of concert tickets that prevent scalping, digital IDs for online verification, or property deeds stored on the blockchain. But in reality, most NFTs are still primarily speculative assets.”

Alice Fryer

Speaking of games where NFTs are most likely to be used in mainstream use, Frei points out that their adoption is also struggling, and Ubisoft’s project Quartz recalls that attempts to integrate NFTs into AAA games “confront resistance from players and force them to shut down.”

Frey says gamers are “he hesitated about digital assets that feel more like currency than a real addition to the experience.”

You might like it too: What is NFT? A complete guide to impossible tokens

Rotating door

If the data is still dark, March brought even worse news. A series of market closures added fuel to the fire. Among them, South Korean high-tech giant LG has closed its LG Art Lab, which was launched just three years ago, at the height of NFT enthusiasts. The company doesn’t share detailed reasons and simply says, “It’s the right time to change our focus and explore new opportunities.”

Just a week later, former Opsy rival X2Y2, which once boasted a lifetime volume of $5.6 billion, is also struggling to stay competitive in the space, citing “a 90% contraction of NFT trading volume since peaks in 2021.”

Then came the Bybit. The crypto exchange, still caught up in the $1.46 billion theft associated with a North Korean-related hacker, quietly shut down the platform.

Emily Bao, head of Web3 at Bybit, said the decision will allow the company to “enhance the overall user experience while focusing on the next generation of blockchain-powered solutions.”

Amidst the wave of closures, Frey says the NFT market “feels like a rotating door.”

“For example, get a boring Ape Yacht Club. Once you reach the peak of your NFT status, your prices have dropped dramatically. At its peak, bored apes are on sale for $400,000, but now they’re barely earning $50,000.

Alice Fryer

The final hope

Coinbase seems to be pulling back too. Although it has not officially shut down the NFT platform, all signs suggest that it will change focus. During the early 2023 revenue call, President and COO Emily Choi showed that the company is seeing “medium-term and long-term opportunities” with NFTS. But its real focus appears to lie behind its Layer 2 blockchain network, the base.

Coinbase declined to comment on its position as NFT activity continues to decline despite multiple requests from crypto.news.

Ontpr’s legal officer believes that the current trajectory of the market makes it unlikely that a small platform will survive the storm. “Small platforms continue to close, with only a few dominant players like Opensea and Blur remaining,” she said.

She explained that the shift is driven by two main forces. First, there are more stringent regulations on the horizon, which will likely end “NFTS’ Wild West Day.” Second, the gaming division may offer a lifeline to the NFTS, but it’s still narrow. As Frei states, the game could be “Last Hope” for NFTS, but developers should avoid “a favorable mechanic that could drive players apart.”

“The hype is over. If NFTs survive, they need to prove they offer more than expensive photos on the blockchain,” concluded Frey.

read more: NFT sales slip 5.3% to $100.9 million, Bitcoin NFT sales fell 30%