The NFT market is feeling the impact of a wider cryptocurrency drop, with sales volume falling 4.7% to $94.7 million.

This is a continuing downward trend of $102.8 million last week, according to Cryptoslam data. Drops extend beyond sales volume alone, with NFT buyers increasing by 77.9% to 128,244, and NFT sellers decreasing by 75.2% to 85,792. NFT transactions also fell by 6.3% to 1,441,009.

The downward momentum coincides with Bitcoin (BTC) dropping to a level of $83,000. At the same time, Ethereum (ETH) has lost 13.5% of its value in the last seven days, hovering at the $1,500 level.

The global crypto market capitalization is currently at $2.63 trillion.

You might like it too: Following the bullish bulge, the eye level of the Sonic Token

Despite the price drop, Ethereum remains dominant

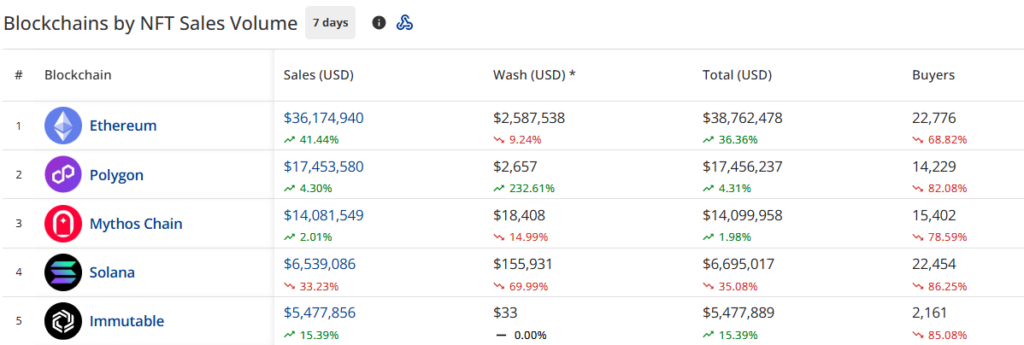

The Ethereum blockchain remains the dominant player with sales of $36.1 million, up 41.3% from last week. However, this boost in Ethereum sales was not sufficient to offset the decline among other chains.

Polygon (Pol) was second in the market, with sales volume of $17.4 million, showing a modest increase of 4.3%. The Mythos chain ranked third at $14.1 million, a mere 2% increase.

Solana (Sol) continues to struggle as sales fell sharply by 33.4% to $6.5 million. The Unchanging marks the top five with a sales of $5.5 million, up 15.4% from the previous week.

Source: Blockchain based on NFT sales volume (Cryptoslam)

You might like it too: High lipids show bullish reversal, with key targets visible at $18.50

Polygon is currently leading at $2.6 million, which has changed the washing trading pattern. This is a noticeable 232.6% increase. Ethereum’s washing transaction also fell 9.2% to $2.5 million.

Regarding the top NFT collection, Polygon Courtyard remains at its highest position with sales of $15.6 million and a 6.1% increase. Cryptopunks rose to second place with a surge of $9.1 million, a 168.3% increase.

DMARKET is currently third at $8.9 million, up 4.4%. Newcomer F(X)WSTETH’s Ethereum position was ranked fourth with sales of $5.8 million.

Guild of Guardian Heroes will complete the top five with sales of $3.7 million, up 29.4% from the previous week.

This week we saw high value sales at Cryptopunks #3100, which sells for 4,000 ETH ($6,042,922). Other notable high value sales include:

- Cryptopunks #1182 is for sale for 142 ETH ($209,310)

- Pixel Vault Founders DAO #4 sold for 97.08 res ($161,511)

- Autoglyph #462 sold for 98.5 Wes ($149,724)

- Cryptopunks #5361 is for sale at 69.69 ETH ($108,204)

opensea to sec: “We’re not a exchange”

This week, Opensea asked the U.S. Securities and Exchange Commission (SEC) to officially declare that NFTs are not “exchanges or brokers” under the U.S. Securities Act.

In a letter to SEC Commissioner Hester Perth, Opensea argued that NFTS usually only have one seller per token. As a result, platforms like theirs don’t function like traditional stock exchanges or brokers.

They emphasized that all NFT transactions occur on-chain via smart contracts. Opensea acts simply as a discovery tool, not just a middle-way, custodian, or advice giver.

To avoid future disruption, Opensea is asking the SEC to issue clear guidance such as breaking news and interpretation releases to ensure that the NFT market is not covered by exchange rules.

This push follows Opensy’s brush with Wells’ notification last year. However, the SEC stopped investigating in early 2025 after President Donald Trump told the agency to suspend code enforcement.

read more: Uniswap’s 2025 forecast tank raises $600,000 in three days by Cartelfi