Arenas of syphedSaifedean.com CEO and author of Bitcoin Standard provided a data-driven keynote. Bitcoin 2025 Conferenceinevitable US dollar decline and positioning warning Bitcoin As only a reasonable hedge. “Defaults, devaluations, or defaults due to default devaluations are inevitable,” declared Ammous, adding, “Tether cannot fix what ruined a century of Fiat democracy.”

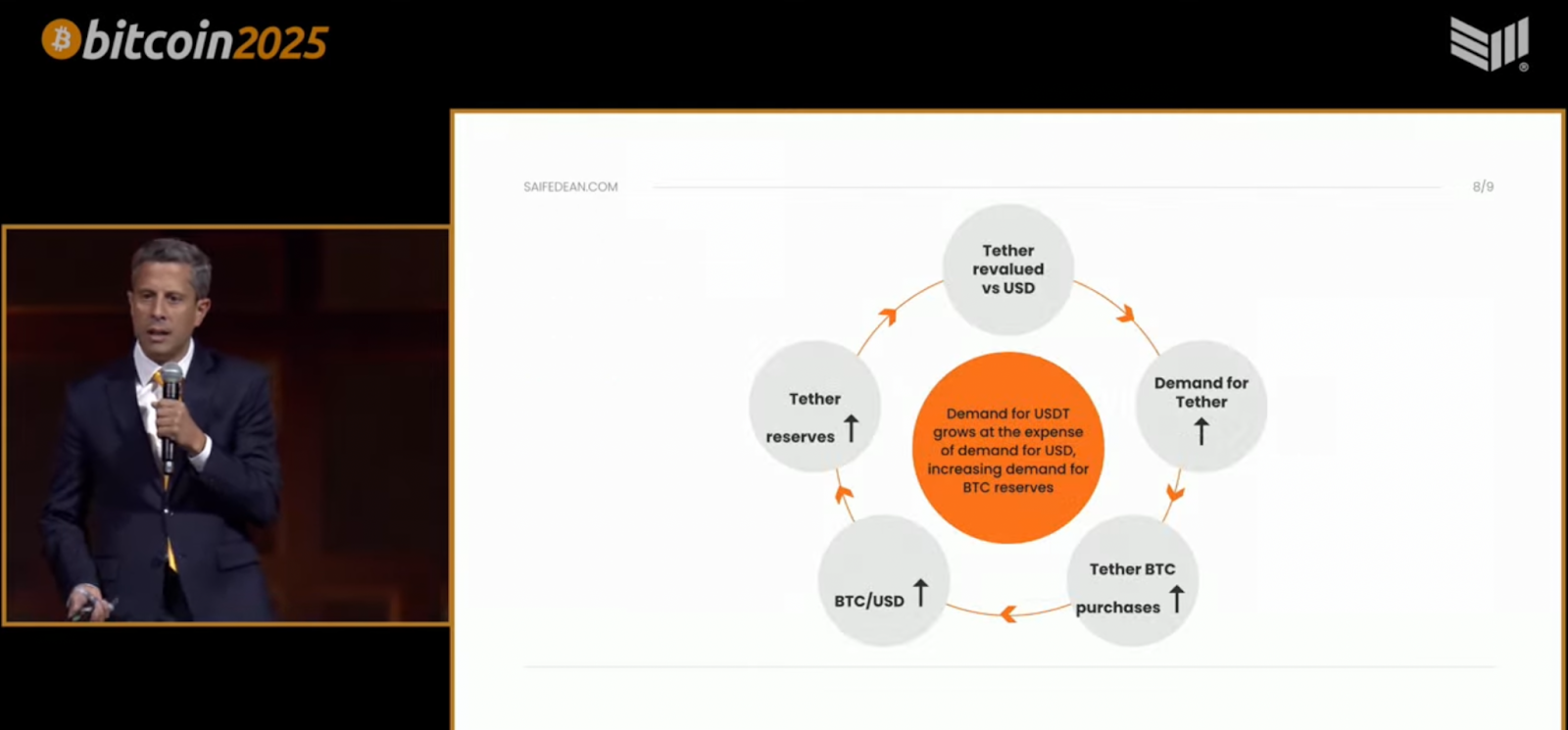

Using projections and flow charts, Ammous argued that Tether’s Bitcoin strategy could soon surpass US dollar reserves. “The tether then breaks the peg upwards,” he said, predicting a scenario where 1 USDT equals 1.02 USD, and that it could continue to revive as the dollar weakens. “As the dollar drops, the tethers become relatively stable.”

The lecture emphasized that it is described as a self-reinforcement loop. As demand for USDT rises, the need for BTC reserves that boosts the price of Bitcoin will be similarly reassessed. “This has a huge impact on the market,” he said. “Buying Bitcoin is the smartest thing anyone can do.”

In a final, drastic statement, Ammous predicted the end of the USD era. “In the end, the USD reserve will be zero next to the BTC reserve,” he said. “USDT will continue to be revalued upwards until it is redeemable in Bitcoin. USDT→BTCT.” He called Tether the “transition financial system,” and concluded that “even the most bullish scenario of USD is far more bullish for BTC.”

Ammous has the dollar trapped in a downward spiral while Bitcoin is rising with “numbers rising technology.” “To go up is to overtake what has fallen,” he said.

This post by Syphed Ammous: “Nothing to Stop This Train” – Tether, Bitcoin and Dollar Endgame first appeared in Bitcoin Magazine and was written by Jenna Montgomery.