The BTC (Bitcoin) market was very optimistic last week and the price increased by more than 10%. Among these positive developments, there was a remarkable investor activity, which pointed out the demand without demand to support continuous prices.

BTC Supply Shake-up: Increased long-term holders, new buyers are over $ 92K

Recently, the popular Crypto Pundit Axel Adler Jr. shared interesting on -chain insights in the Bitcoin market.

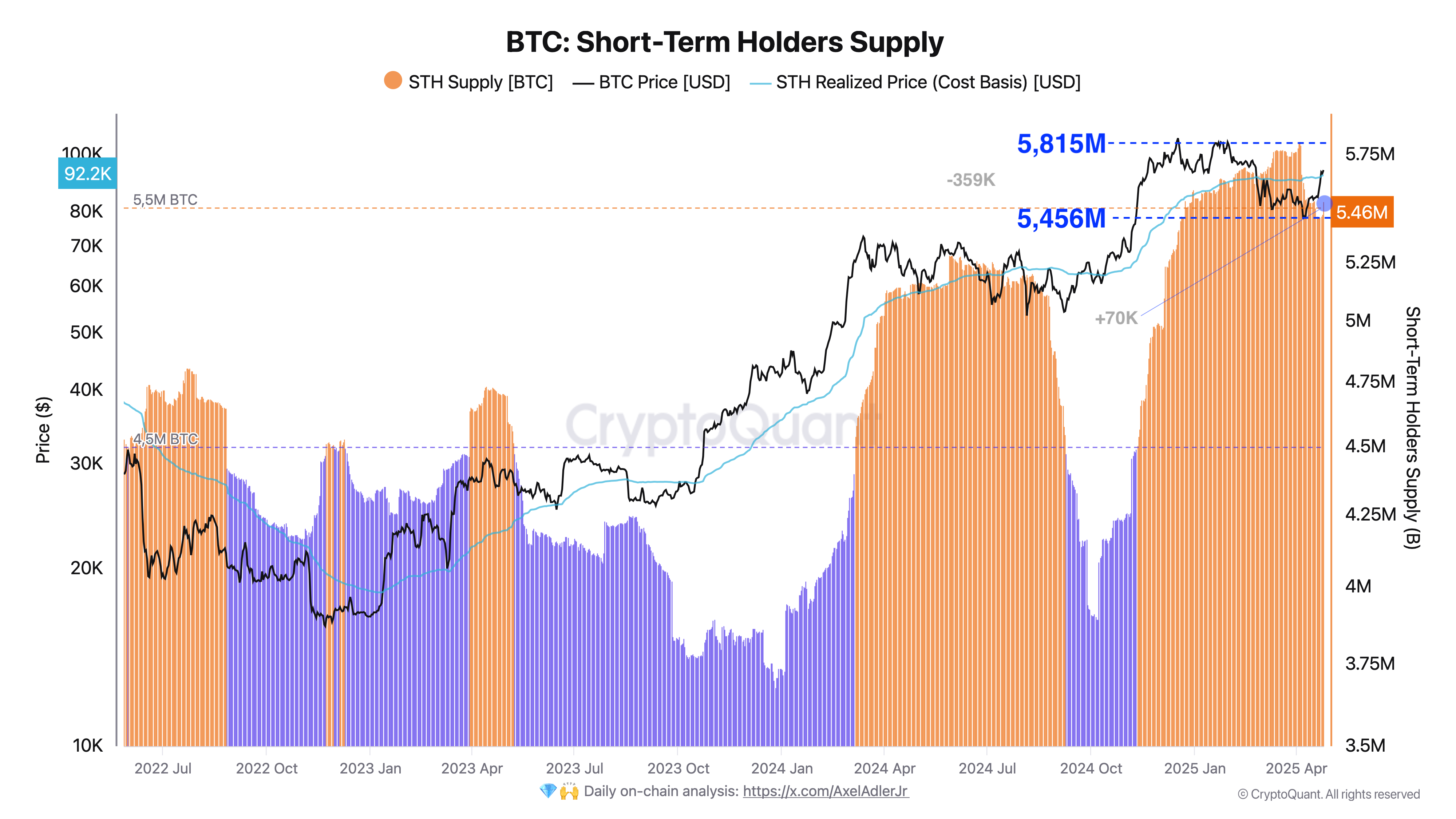

Adler has reported that the short-term market supply has decreased by 359,000 BTC, which is $ 380 billion, which is $ 380 billion over April 4-21, using Cryptoquant’s data. Interestingly, this decrease was not a pressure sales, but rather due to coin maturity, and the transition to a long -term holder category occurred.

This is a positive market signal that holders are convinced of Bitcoin’s long -term prospects. The holders are opposing sales to strengthen the basic market demand and provide a solid foundation for the future price rally.

In another interesting development, AXEL ADLER JR said that the supply of BTC short -term holders has increased by 70,000 BTC for the last two days following Bitcoin’s latest price rally.

The analyst has shown that this increase has gained the interests of long -term holders through redistribution. As the price rises. Importantly, short -term holders effectively absorb this new supply and show strong demand in the bitcoin market.

This demand is greatly reflected in the ability to maintain more than $ 92,200 of Bitcoin, which is the cost of short -term holders, which represents the average acquisition price of its retention. This shows strong market trust as new buyers actively enter the market and expand STH cohorts.

Overall, the combination of coin maturity, health redistribution, and bitcoin elasticity, which is much more than the cost standards of short -term holders, emphasizes structurally strong market demand. BTC has a continuous propulsion for a short period of time with the long -term holders who effectively absorb the supply and long -term holders who show new demands.

Bitcoin price outline

At the time of writing, Bitcoin is $ 94,408, reflecting a 0.78% reduction in the last day. However, daily asset trading volume decreased by 55.53%, showing weak market participation.

Nevertheless, the BTC is expected to maintain the price increase of $ 91,000, which has been supported by other strong development, including a total of $ 3.6 billion in revival, to $ 91,000 last week.

The next resistance is $ 96,000, you can move the past to a $ 100,000 path for an additional price increase. However, the rejection of the price is forced to make a range of $ 92,000, making it effectively creating a range of bounds.

Chart of TradingView, the main image of Economic Times

Editorial process focuses on providing thorough research, accurate and prejudice content. We support the strict sourcing standard and each page is diligent in the top technology experts and the seasoned editor’s team. This process ensures the integrity, relevance and value of the reader’s content.