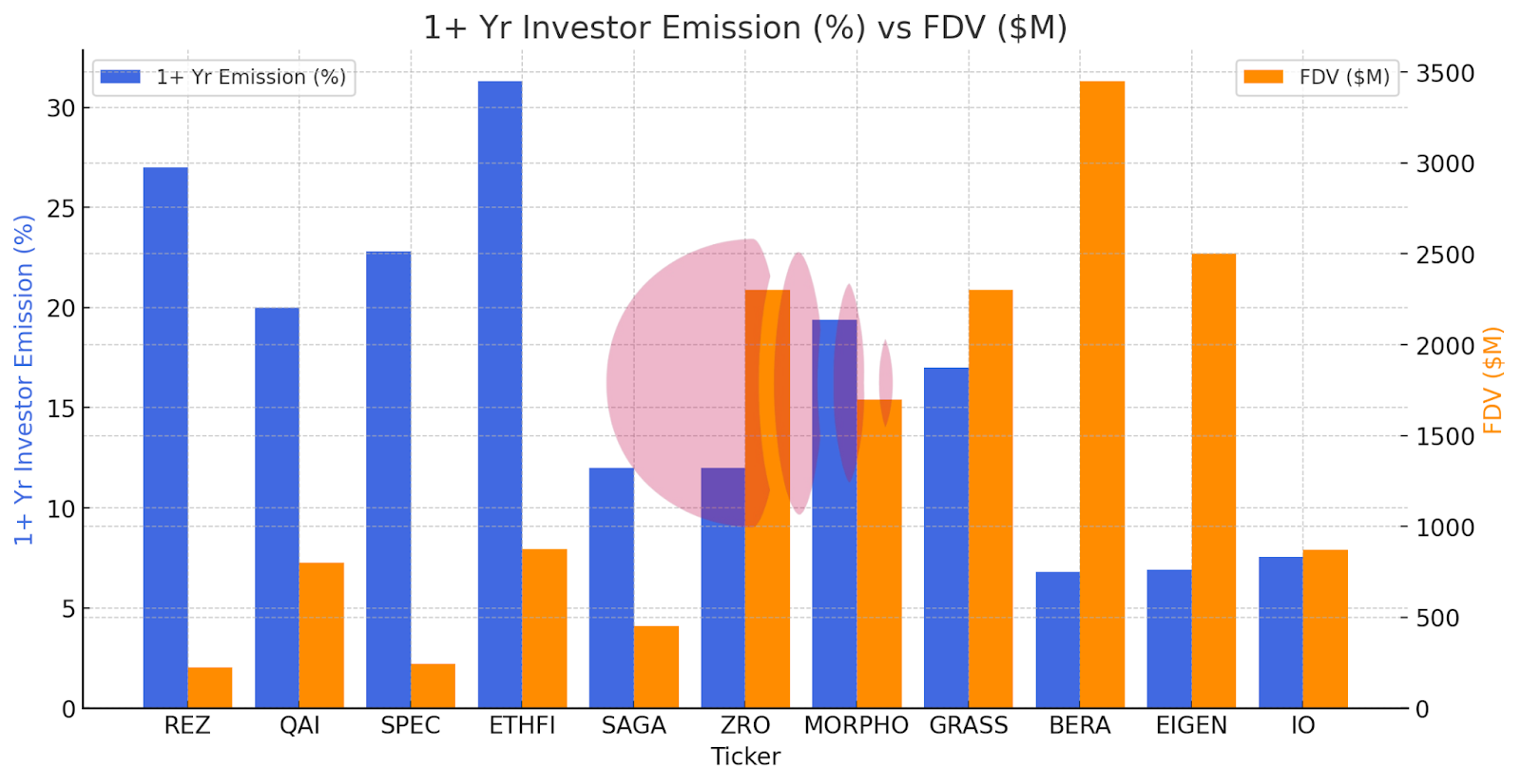

The crypto market is set to a major shift as major projects such as Etherfi (Ethfi), Layerzero (Zro) and Grass prepare for large token unlocking.

Data from Tokenomist shows that tokens held by more than $1 billion investors can be distributed across multiple projects, affecting price stability and market trends.

Ethfi and Zro tokens lead major releases

Etherfi and Layerzero are planning to release tokens worth $274 million and $276 million, respectively. This influx can have a major impact on token prices and sentiment across the market.

These unlocks occur relatively quickly, and can put great short-term pressure on each market.

Other notable releases, the Grass and Morpho (Morpho) Project, will release investor emissions of over $700 million. However, unlocking occurs on much longer timelines. This has been over a year now.

Extended schedules may mitigate the immediate market impact, but the enormous size of these emissions remains a key element to view.

Renzo (Rez) and Spectral (Spec) unlock more than 30% of the token supply. These substantial allocations could affect investor decisions and price fluctuations in the coming months.

Related: Next week’s Crypto Token is unlocked at $142 million.

Increased supply of rapid tokens

Projects like Quantixai (Qai) and Ethfi will completely unlock investors’ allocations within a year. This will rapidly increase circulation supply and potential sales pressure.

Meanwhile, Bera and Eigenlayer (Eigen) have unlocked schedules expanded to 2027-2028. This distributes sales pressure over a long period of time and reduces the immediate market impact.

Token monitoring unlocks important for investors

These unlock events are key indicators of potential market movements. Low FDV tokens like Rez and Spec can experience high levels of volatility as supply increases. However, high FDV projects such as Bera and Zro can see more controlled price action with a larger valuation compared to emissions.

Related: Crypto Token Unlock: $420 million worth of SUI, OP, Zeta Incoming

With major unlocks approaching, token holders should closely monitor these signs of sales pressure.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.