After a nearly vertical breakout from the $2,800 range earlier this month, today’s Ethereum prices have been consolidated near the $3,900 mark. This lies just below the important multi-year resistance zone, and the concept of smart money indicates that ETH is pushed into a historically profit-generating fast structure. The price action flashes as derivative metrics climb along bullish and ascending channels, traders are waiting to see their next move.

What happened at the price of Ethereum?

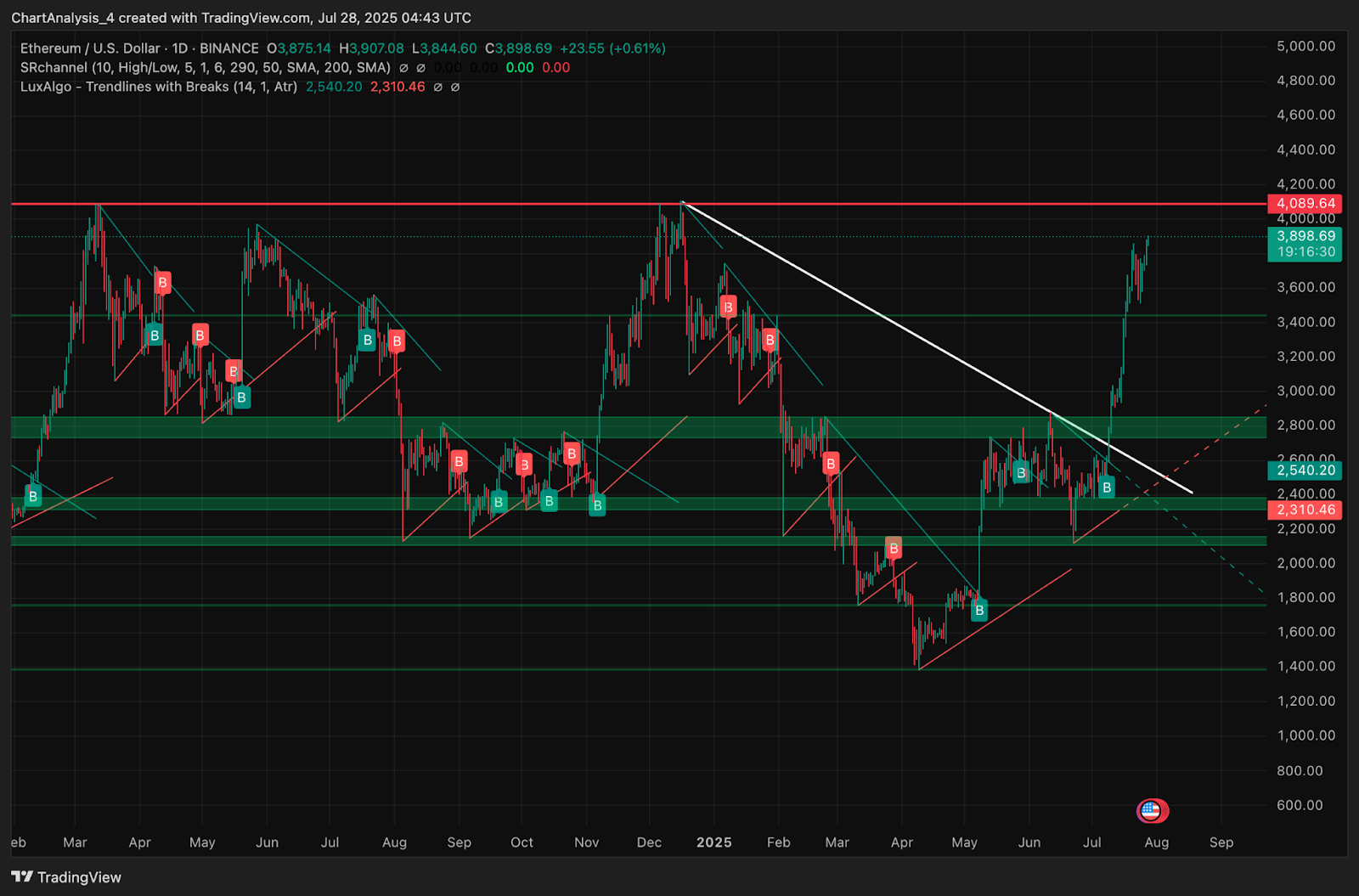

ETH Price Dynamics (Source: TradingView)

The daily chart shows Ethereum prices outweigh the downtrend resistance of several months in mid-July, targeting the 2024 swing high at nearly $4,089. ETH has cleared all major supply zones to this level and confirmed a flip of bullish market structure. A clean breakout from the compression structure between $2,400 and $2,800 caused this vertical rally.

ETH Price Dynamics (Source: TradingView)

In the weekly time frame, ETH is pushed against a red smart money liquidity zone between $3,890 and $4,200. The region served as a distribution area during its peak in April and May 2024, representing the ultimate resistance that could lead to $4,500 and $4,800. Mark a macro BO near over $4,089 and open fresh legs high.

Why are Ethereum prices rising today?

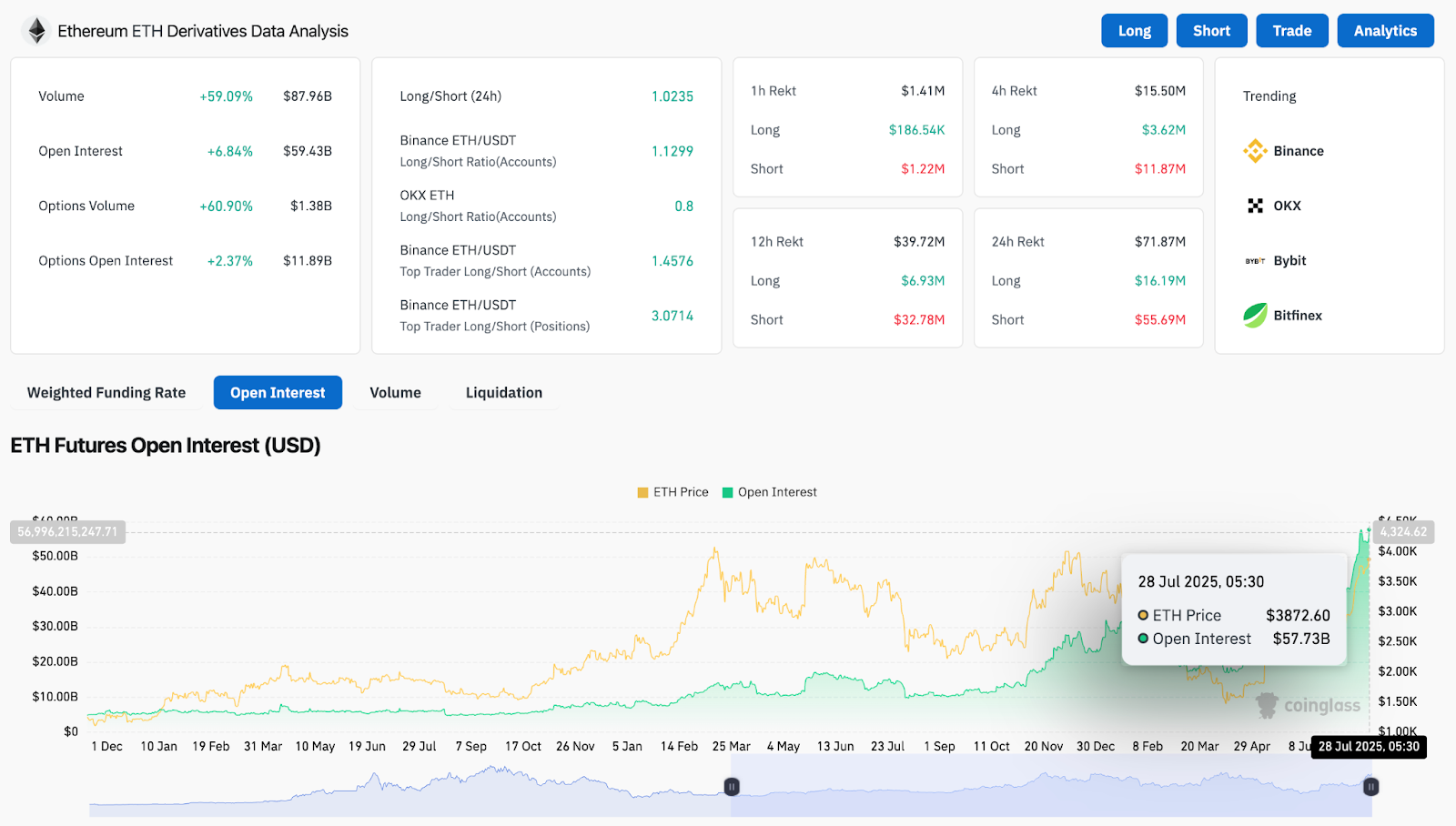

ETH derivative analysis (source: Coinglass)

The price of Ethereum today is why it is tied to a combination of technical breakout strength and heavy derivatives flows. Coinglass data shows ETH trading volumes have skyrocketed by 59.1% over the past 24 hours, with open interest reaching 6.84% to $5.943 billion. The top traders at Binance showed significant institutional positioning, reaching the longest ratio of 3.07.

ETH Price Dynamics (Source: TradingView)

The four-hour chart reflects the momentum of the powerful trends that candles are climbing along the upper bollinger band, close to $3,920. Prices are firmly above EMA 20, 50, 100, and 200 clusters, and now serve as a multi-layered support base from $3,475 to $3,781.

ETH Price Dynamics (Source: TradingView)

The Supertrend turned bullish on July 9th and is currently sitting at $3,701. The directional motion index showed +DI at 25.3, leading above DI at 11.5 while ADX was rising. This confirmed growth trends.

Channel Structure and RSI Signal Healthy Trend Expansion

ETH Price Dynamics (Source: TradingView)

On the 30-minute chart, ETH respected the price-guided upward channel from July 24th. The price was on the median price. VWAP support went from about $3,883 and RSI cooling went from 66 to 62, avoiding excess territory. This gradual gradient indicates a continuation of a controlled, low-volatile trend rather than euphoric fatigue.

The Bollinger band was expanded again on the four-hour chart, with Price pushing the upper band at $3,920. If this band breaks, volatility expansion can drive ETH to $4,050. However, traders must keep their long-term red zones from $4,000 to $4,200 carefully, which previously triggered a series of sales.

ETH Price Forecast: Short-term Outlook (24 hours)

Ethereum prices remained structurally bullish, but the momentum could be temporarily slower as they tested liquidity caps from $3,920 to $4,089. A clean breakout of over $4,089 would have signaled continuance towards $4,300 and $4,500. These levels do not currently indicate an immediate supply zone.

If the ETH failed to exceed $4,000 on volume, a healthy pullback to $3,754 (boltinger band bottom) and $3,680 (EMA50) could have been. These levels coincided with previous breakout zones and provided the possibility of bull re-entering.

As long as ETH was held beyond the $3,680-$3,754 support band, the uptrend remained. Volume and VWAP had to be closely monitored to assess whether accumulation was still playing around or whether it made a profit near the $4,000 mark.

Ethereum price forecast table: July 28, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.