The data suggests that a significant portion of Bitcoin could be in the hands of a limited number of large wallets, which could lead to increased concentrations.

As Bitcoin (BTC) adoption increases, ownership continues to focus on larger wallets, with retail investors shrinking their share, according to new Santiment data.

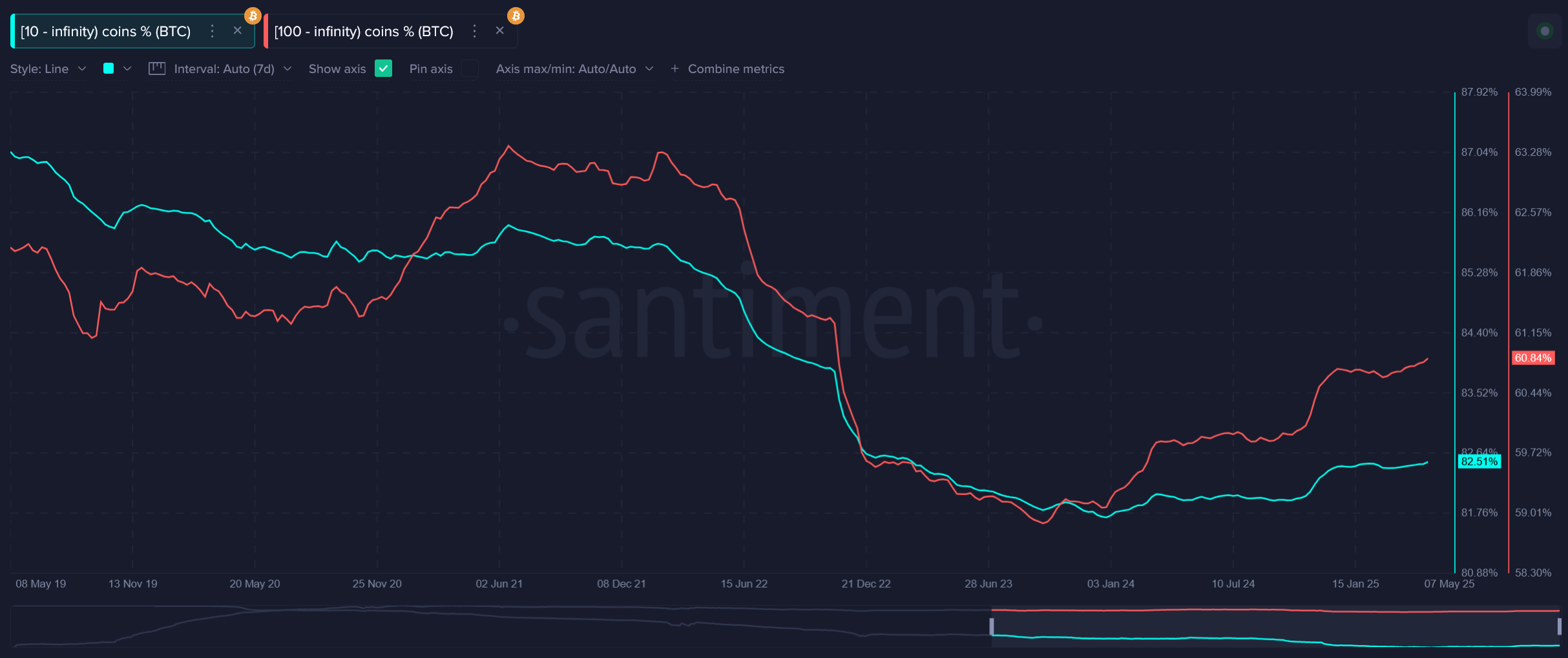

As of May 13th, wallets holding at least 10 btc (equivalent to about $1 million or more) control more than 82% of mined Bitcoin supply. As Santiment analysts suggest, only about 17.5% of Bitcoin is held by wallets that “hold less than $1 million in BTC.”

Wallets over 100 BTC (currently worth more than $10 million) hold more than 60% of their total supply. Santiment can be broadly classified as “comprising primarily of small institutional investors,” while wallets over 100 BTC are primarily held by “in-facility and liquidity providers (with the exception of very large retail wallets of course.”

Cohort of wallets holding 10 BTC vs 100 BTC | Source: Santiment

Approximately 3.47 million BTC remains in wallets of less than 10 bTC, worth an estimated $358 billion. Whether this small group will continue to retain or sell may depend on future market sentiment, analysts argue.

“Historically, major price retraces tend to incite retail panic sellers, followed by large wallets that absorb loose coins that will not hold comfortably in the long run.”

single

You might like it too: A decline in supply of long-term Bitcoin holders shows market signs: GlassNode

Crypto mining has become difficult for individuals to access due to its high costs and low rewards. In addition, many crypto miners “enjoy enthusiastic institutional investors and often make profits immediately after the successful mining session is completed,” the analyst added.

Santiment estimates that between 3 and 4 million Bitcoin “may be gone forever” because they lost their private key or unaccessible wallet, but around 14 million coins have yet to be mined until 2140.

read more: Novograts’ Galaxy Digital may find a better return with AI than crypto