PayPal’s US dollar Stablecoin (PYUSD) unlocks faster, cheaper payments for users and debuts on the stellar blockchain.

With the integration of PayPal, Venmo, and the entire stellar ecosystem, the move raises questions about what this means for Stellar’s native token XLM.

Stellar Taps PayPal USD, Earn Stablecoins on Payment Edge

Pyusd appeared on the star on Thursday, promoting low-wage transfers, a finality of about five seconds, and advertising the Fiat Lamp pinning.

The announcement also revealed a stellar asset contract compatible contract for payments.

Pyusd currently lives in Stellar.

– PayPal Developer (@paypaldev) September 18, 2025

The Stellar Development Foundation praised it as a way to change daily payments. The community’s response is equally enthusiastic.

“Stellar is fast, cheap and safe. This is one of the biggest partnerships we’ve been waiting for. It’s super, super exciting!” one user said.

On the other hand, integration can be more than a headline of a stellar network. It examines the long-term mission of positioning itself as a payment-focused blockchain.

The timing coincides with Stellar’s Protocol 23 upgrade “Whisk” and went into operation earlier this month.

Whisk introduced parallel smart contract execution and transaction throughput optimized for 5,000 TPS. This was one of the most important technical improvements in Stellar’s history.

By increasing capacity while reducing latency and costs, the whisk sets the stage where PYUSD scales efficiently across Stellar’s network of wallets, anchors, and payment partners.

Additionally, developers benefit from a unified event format, making it easy to build applications that combine traditional star manipulation with smart contracts.

Ondo Finance adds yield to Stablecoins

Still, Stellar’s Stablecoin development in September exceeded the release of PYUSD. Ondo Finance recently introduced USDY. USDY is a yield stable coin supported by the US Treasury Department and bank deposits.

Usdy, Ondo’s flagship Aldecoin, currently lives at @Stellarorg.

Stellar’s vast global network connects Finance Onchain with real solutions. Currently, with USDY, it has been extended to real assets.

Together, we unlock access to the yields of the global economy. pic.twitter.com/b0exhqtavb

– Ondo Finance (@ondofinance) September 17, 2025

Unlike USDC and PYUSD, USDY automatically generates daily yields while maintaining fluidity.

“Stablecoins unlocks global access to the US dollar. With USDY, you take the next step by turning on the chain in a combination of stability, liquidity and yield,” said Ian de Bode, Chief Strategy Officer at Ondo Finance.

According to Denelle Dixon, CEO of Stellar Development Foundation, pairing Stellar’s reach and yield-holding assets is possible in chains.

USDY is already integrated into star-based apps such as Lobst, Aquarius, Meru, Soroswap, and Decaf Wallet.

XLM price outlook

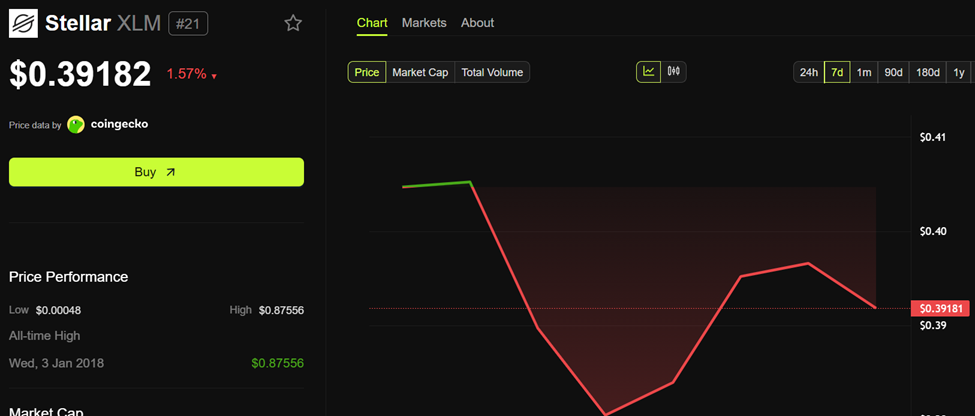

Despite the buzz, XLM slipped almost 1.3% on launch day, falling almost 2% over the past 24 hours. At the time of this writing, the token was traded for $0.39.

Performance at Stellar (XLM) prices. Source: Beincrypto

It points to investors’ attention given that short-term price movements often depend on liquidity and overall risk sentiment.

Partnerships and technical upgrades could provide a foundation for long-term bullishness.

Still, Stellar currently hosts US fintech giant Stablecoin and Stablecoin, which will bear the first yield backed by the Treasury Department. In combination with the whisk upgrade, the ecosystem rarely looked strong.

PayPal PayPal USD will be officially released on Stellar. What does this mean for XLM prices? It first appeared in Beincrypto.