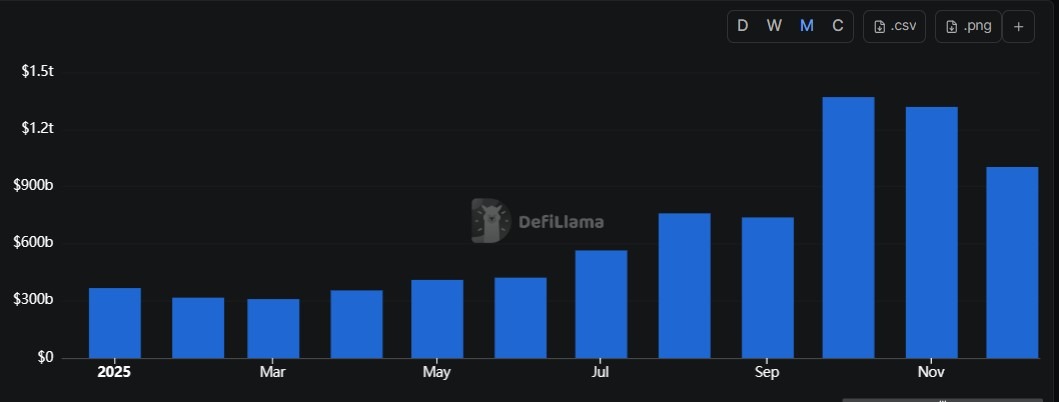

Perpetual decentralized exchanges are coming to the end of 2025, with cumulative trading volume reaching approximately $12.09 trillion, up from approximately $4.1 trillion at the beginning of the year.

DefiLlama data shows that about $7.9 trillion of this lifetime total was generated in 2025 alone. This means that 65% of all Perp DEX trading volume occurred in one calendar year. This concentration highlights how rapidly on-chain derivatives expanded in 2025.

Perpetual trading volume reached $1 trillion in December alone, continuing the momentum from October, when monthly trading volume reached $1 trillion for the first time.

This increase reflects a sharp acceleration in the use of on-chain derivatives over the past 12 months as perpetual DEXs absorbed an increasing share of leveraged cryptocurrency trading activity.

Perpetuals DEX Volume in 2025. Source: DefiLlama

Perp DEX activity accelerates in second half of 2025

The nearly $8 trillion amount generated throughout 2025 was mainly concentrated in the second half of the year.

According to data from DefiLlama, sales in the first half of 2025 were around $2.1 trillion, while sales in the second half were around $5.74 trillion, which is 73% of the record for the entire year.

Trading activity remained relatively stable through the first half of 2025, suggesting a consistent baseline for on-chain derivatives usage rather than a breakout phase.

This pattern changed mid-year, with volumes accelerating in the third quarter and reaching an inflection point in the fourth quarter, when monthly volumes began to consistently exceed $1 trillion. The trading volume in the fourth quarter alone exceeded the total trading volume in the first half of 2025.

As liquidity deepens and execution improves, perpetual DEXs increasingly serve as primary venues for leveraged trading, rather than as a supplementary alternative to centralized exchanges.

Related: Aster says tokenomics remain unchanged amid community confusion after CMC update

Challenge Hyper Liquid’s dominance as rival DEX gains momentum

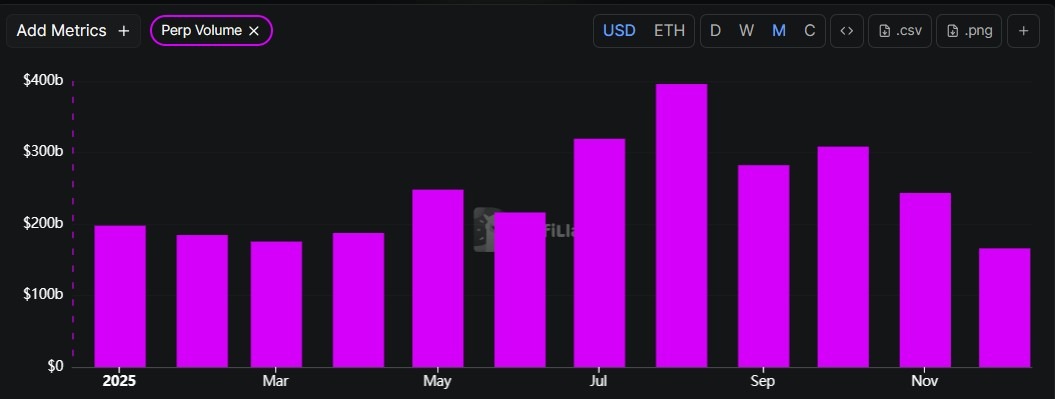

HyperLiquid dominated the PERPS DEX space for much of the year, especially in the first six months, with monthly trading volumes consistently ranging from $175 billion to $248 billion.

During this period, competing platforms such as Aster and Lighter remained relatively small, with Aster’s sales in the single digits of $100 million, but Lighter only began to scale after the first quarter.

Hyperliquid Permanent Trading Volume in 2025. Source: DefiLlama

The competitive landscape began to change mid-year as competing platforms accelerated faster than Hyperliquid. Both Mr. Astor and Mr. Reiter have seen a sharp increase in activity since June.

Writer monthly trading volume has moved from less than $50 billion to consistently over $100 billion by Q3, demonstrating growth in trader adoption and liquidity depth.

The most notable challenge to Hyperliquid’s dominance came in the fourth quarter. Astor posted explosive growth in October and November, with monthly trading volume soaring to $259 billion in both months.

By the end of the year, data suggested a shift from a single leader market to a more competitive multi-venue ecosystem.

magazine: South Koreans ‘pump’ alternatives after Upbit hack, China BTC mining surges: Asia Express