- Polygon’s third quarter payouts reached $1.82 billion, demonstrating sustained growth across its financial network.

- With over $1.1 billion in tokenized assets, Polygon has established itself as the fintech backbone of Web3.

- Reflecting the rise in blockchain activity, Polymarket secured $234.7 million in TVL.

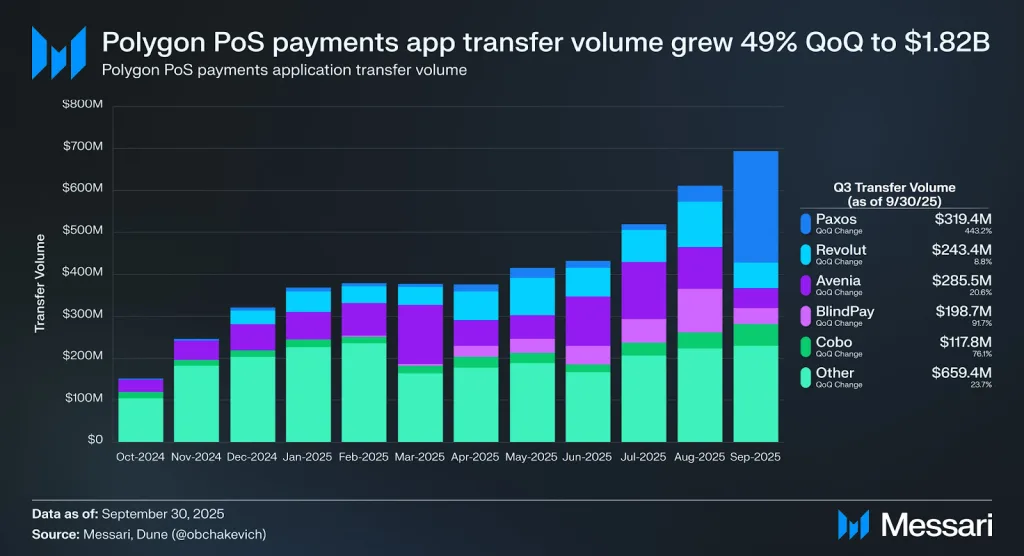

Polygon’s Q3 2025 performance reveals a decisive step towards real-world financial integration. According to Messari and Dune data shared on CryptoRand on X, the network’s PoS payment system recorded $1.82 billion in transfer volume, marking a 49% quarter-on-quarter jump.

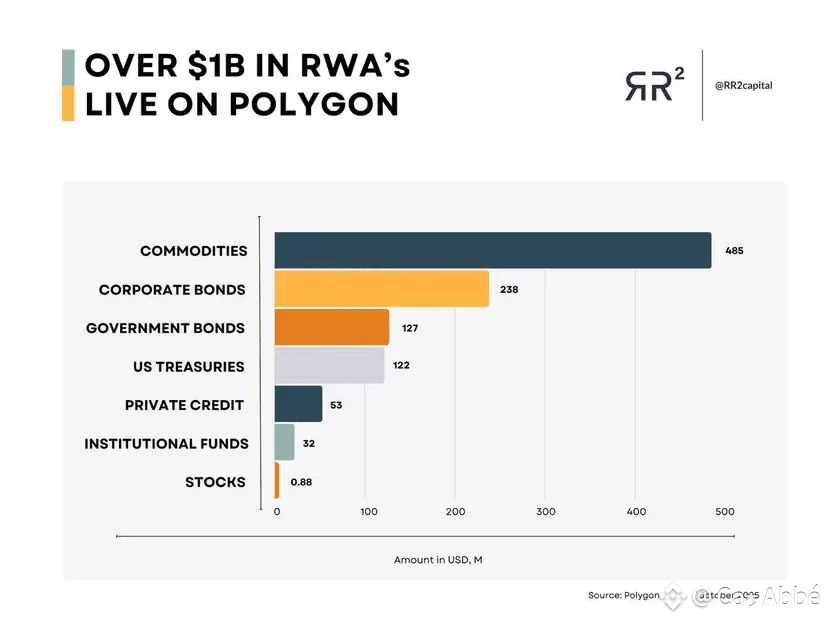

At the same time, Polygon’s tokenized real-world assets (RWA) exceeded $1.1 billion, marking Polygon’s best quarter ever. All these changes unmistakably indicate that a transition from scalability to actual fintech utility via global financial networks is occurring.

Growth in payments strengthens network strength

The payments ecosystem within Polygon’s PoS network achieved significant momentum in Q3 2025. Paxos led the growth with $319.4 million, a significant increase of 443.2% sequentially. Avenia posted a 20.6% increase to $285.5 million, while Revolut posted an 8.8% increase to $243.4 million.

sauce: ×

BlindPay almost doubled its total to $198.7 million (up 91.7%) and Cobo posted $117.8 million (up 76.1%). In total, other payment applications added $659.4 million, an increase of 23.7% from the second quarter.

Monthly data clearly captures this expansion. Transfer fees averaged $300 million in January and February, but jumped to $700 million by September. This continued expansion demonstrates the continued growth of our user base and the consistent integration of our fintech partners into Polygon’s scalable infrastructure. Such a move is a sign of a robust payment system capable of processing both institutional and retail transactions with high efficiency.

Tokenized assets lead the RWA frontier

However, Polygon was only used in the payments area. This remained the leading platform for tokenizing real-world assets. According to RR² Research, the total amount of on-chain RWA has exceeded the $1 billion threshold, as stated in a Binance news release. Commodities accounted for $485 million in this market segment, followed by corporate bonds at $238 million. Treasury bonds and U.S. Treasuries account for $127 million and $122 million, respectively.

sauce: RR2 Capital

With $53 million coming from private credit and an additional $32 million coming from institutional investors, there is significant commitment from major financial institutions. Although this stake is quite small at only $880,000, it represents early adoption of equity tokenization. The sum of these numbers represents growing confidence in Polygon’s asset-backed ecosystem. The wealth of assets shows that the crypto world is moving from DeFi to real-world finance.

Related: Vitalik Buterin praises Polygon’s ZK rollup and scalability

Polymarket expansion drives ecosystem growth

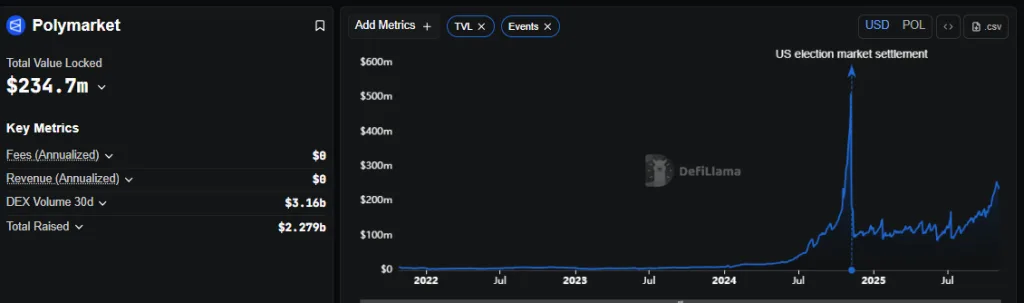

At the same time, DeFiLlama data shows that Polymarket, the top betting platform on Polygon, has a Total Value Locked (TVL) of $234.7 million. In addition to this, the platform recorded a DEX trading volume of $3.16 billion last month. This is an important indicator of trading activity taking place on the platform.

After the US election market settlement, Polymarket’s activity surged to $600 million, confirming the company’s leadership in the field of market prediction based on blockchain technology.

sauce: Defilama

Even though Polymarket reports zero annual fees and revenue, its statistics show that its user base will continue to grow steadily from 2024 to 2025. The increase in users coincides with a general rise in market activity, suggesting a link between on-chain financial activity and real-world event speculation.

Overall, with these huge developments, Polygon holds the largest share (88%) of the total value locked in prediction markets. Therefore, Ethereum’s position as a leader in the Layer 2 ecosystem is further strengthened.

Using the same technology, Polygon integrates real-world assets and digital payments under one scalable layer. One challenging question then arises. Can cooperation between RWA and payment networks create a self-reinforcing cycle of long-term utility beyond market speculation?

Disclaimer: The information provided by CryptoTale is for educational and informational purposes only and is not to be considered financial advice. Always do your own research and consult a professional before making any investment decisions. CryptoTale is not responsible for any financial loss arising from the use of the Content.