As of this writing, gold is trading at $5,079.30 per ounce and silver is trading at $113.24. This level now makes today’s prediction market bets look more like forward-looking scoreboards than just curiosities.

Gold and silver prediction markets favor strength, not moonshots

Polymarket metals contracts provide a valuable window into crowd expectations, translating macro stories into clear probabilities rather than headlines. The four active contracts track whether gold and silver futures reach or exceed a certain price level by a set deadline and are strictly dependent on the official settlement price.

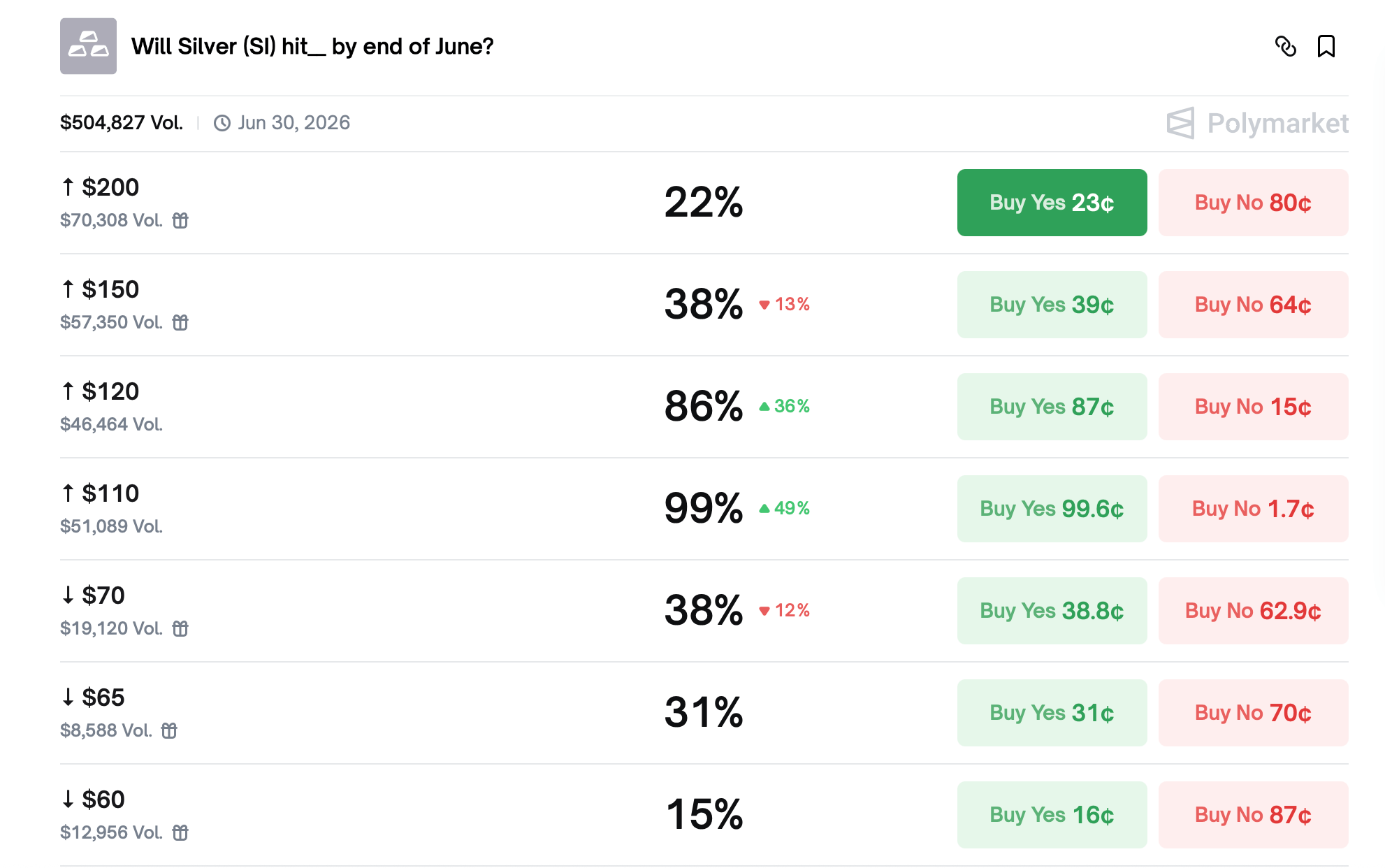

The two contracts are silver-focused, and both are tied to CME silver futures. The first contract looks toward a final trading day in June 2026 and is structured as a ladder from $35 to an astonishing $200. Traders see a near certainty (about 99.6%) that silver will reach $110, but confidence quickly wanes above that mark, dropping to about 86% at $120, 39% at $150, and 20% at $200.

Source: Polymarket, January 26, 2026.

This distribution tells us a lot. The market consensus is not debating whether silver will stay high. How far the rally could realistically go is being debated. While the crowd seems reassured by continued strength, there is a clear line to be drawn between plausible upside and speculative excess.

Polymarket’s second silver contract narrows the period to the end of January 2026. Here, the probabilities are further compressed. A low price threshold provides strong “yes” pricing, but lofty targets quickly fade, often falling below 1%. Bottom line: Traders expect silver to remain strong, but fireworks aren’t being paid for in the short term.

The same is true for gold contracts, only at a higher price level. One contract asks whether CME gold futures will reach a certain threshold by the end of January 2026. Odds are clustered around a single mid-price level that is priced almost as a certainty, while most of the higher targets have probabilities near zero, reflecting skepticism about a sudden breakout within weeks.

The gold market traded about $1.35 million in interest in January, indicating active participation without the frenzy seen in meme-driven contracts. In other words, this is a market driven by macro beliefs, not mood.

The longer-term gold contract extends to June 2026 and paints a broader picture. Traders overwhelmingly expect the price of gold to reach $5,000, pricing in that outcome as almost certain. The odds drop sharply above $5,500. While the $6,000 level is treated by traders as a coin toss zone, expectations quickly collapse above $6,500.

Also read: BlackRock pushes deeper into Bitcoin, files for ETF built for both exposure and income

Taken together, these four contracts paint a coherent picture. Polymarket participants are generally bullish on precious metals, but disciplined about tail risks. Strength is expected. Parabolic movements are not followed.

It is also worth noting that all four contracts rely solely on the official settlement price from CME. This design removes intraday noise and allows traders to anchor their expectations on verifiable outcomes rather than momentary spikes.

With gold already above $5,000 and silver well above $110, these markets suggest that the crowd believes the challenge may already be over. The remaining debate is not about direction but scale.

In other words, prediction markets exhibit confidence without euphoria, bullishness with restraint and pricing accordingly.

FAQ

- What are Polymarket traders predicting silver price levels by June 2026?Silver is almost certain to reach $110 in the market, with a much lower chance of it breaking above $120.

- Are traders expecting a short-term breakout in silver by January 2026?No, the odds suggest silver continues to rise, but within a relatively narrow range.

- How confident is the trader in $5,000 gold?The price of the June 2026 gold contract is $5,000, a near-certain outcome.

- Is an extreme gold target like $6,500 widely expected?No, the odds drop rapidly above $6,000, indicating skepticism about significant upside.