Exhausted US-based Bitcoin BTC$93.110,27 Bulls may think it’s crazy to think that the reason BTC looks like it’s doing pretty well when you wake up every morning is because the price is only going to drop during US trading.

In fact, they aren’t imagining it.

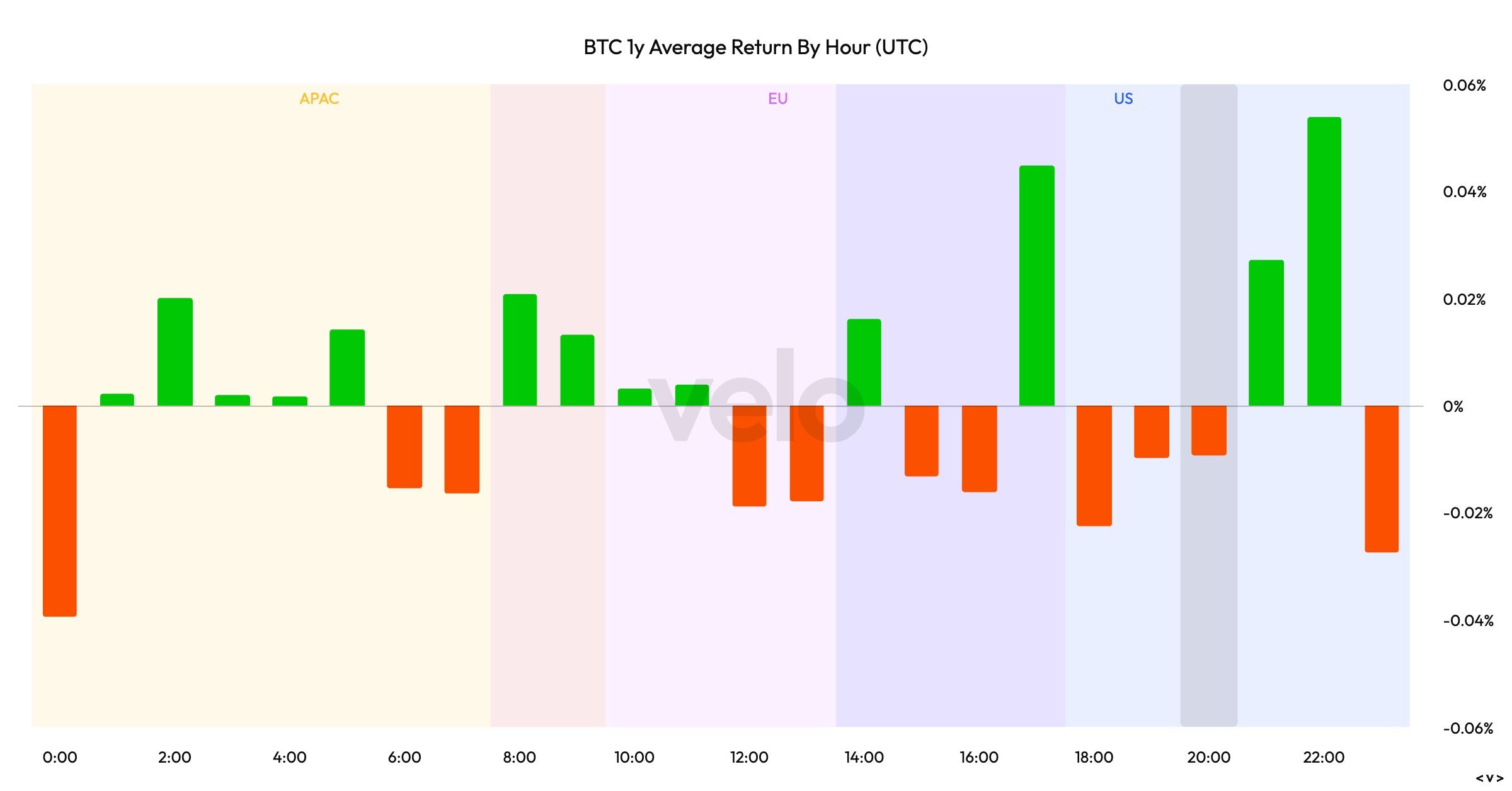

Data from crypto analysis platform Velo.xyz shows that over the past year, Bitcoin has been more likely to make profits when traditional U.S. markets are closed and lose money when they are open.

Bitcoin performance by hour over the past year (Velo.xyz)

Bloomberg’s Eric Balciunas said the data on improved U.S. after-hours performance is similar in 2024, suggesting that spot ETF and derivative positioning may be playing a role.

In an attempt to take advantage of this, small asset management firm Nicholas Financial Corporation has applied to the U.S. Securities and Exchange Commission (SEC) to issue Bitcoin. BTC$93.110,27 An ETF that completely opts out of the U.S. trading day and only holds assets during the night hours.

The fund, called the Nicholas Bitcoin and Treasurys After Dark ETF (NGTH), buys Bitcoin at 4 p.m. ET when U.S. markets close, and sells it by 9:30 a.m. ET before markets reopen the next day. During the day, the fund would rotate into short-term U.S. Treasuries to preserve capital and generate yield.

The company also filed documentation for its second product, the Nicholas Bitcoin Tail ETF (BHGD).

If approved, the ETF would add a new twist to the growing ecosystem of Bitcoin investment products by treating time of day as a key element of the strategy.