Bitcoin mining stocks experienced a widespread decline on Wednesday, with most major public companies in the red sector of the sector.

Bitcoin mining stocks look red all over

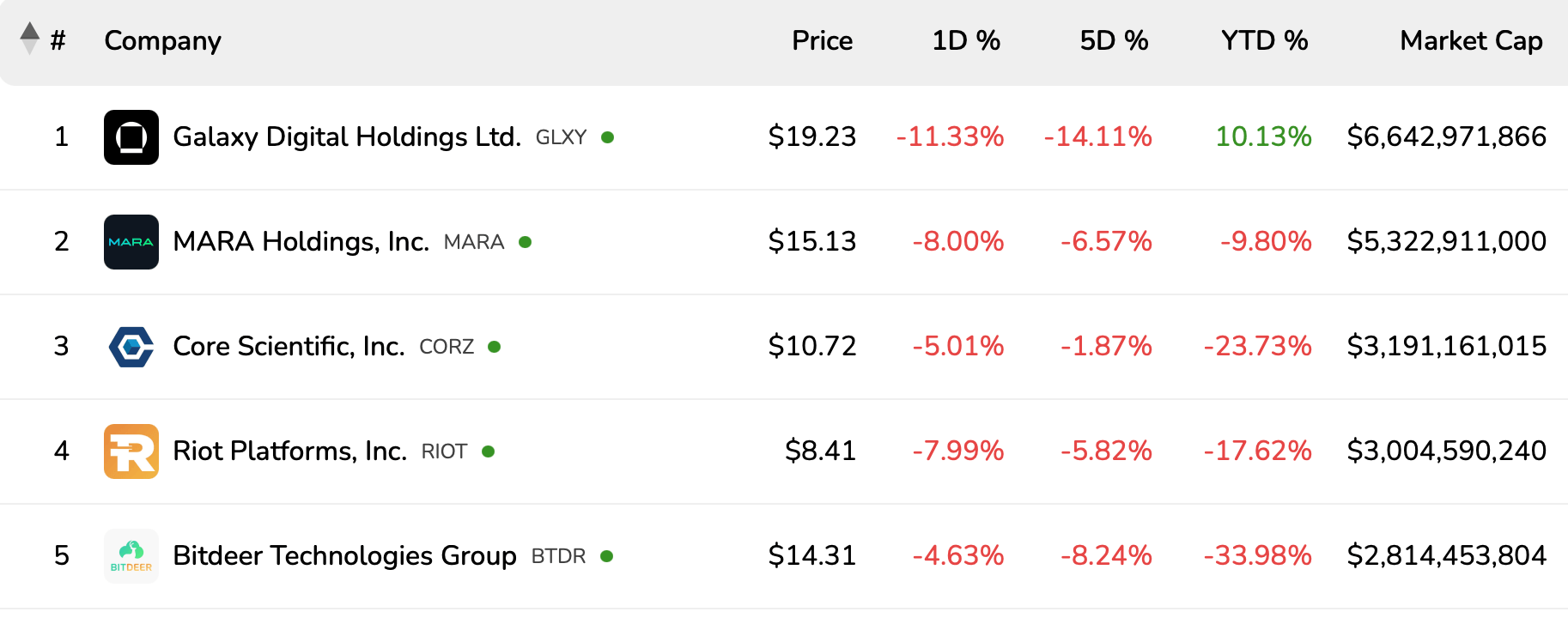

Galaxy Digital Holdings has a market capitalization of $6.644 billion, with stocks down 11.33% in the next five sessions and 14.11%. Bitcoin Minor Mala Holdings continued at a $5.32 billion valuation, but so far it has dropped by 8% on Wednesday, down around 10% per year.

According to Bitcoin Min Cist Stock, the top five publicly available Bitcoin mining companies by market capitalization at 11:30am Eastern time.

Of the top 12 public miners, Core Scientific, Riot Platform and Bitdia Technology all recorded significant daily losses of over 4%, showing a deeper decline in figures from the start of the year. Bitdeer is currently down nearly 34% per year, while Riot has slipped 17.62% and Core Scientific is down 23.73%.

Few companies have recorded profits in the last five sessions. Northern Data AG is outstanding, up 9% today and 12.52% last week. Despite these short-term profits, it remains the largest year lagard on the list, down 35.81% against the US dollar.

CleanSpark was stable with a year-end gain of 0.02% despite losing 6.57% in today’s trading session. Iren Limited recorded a tiny five-day profit of 1.45%, but performance that year remains negative.

The smallest companies by Market Capital, Terawulf and Cipher Mining have been in intense negative so far, trading below $4 per share, falling more than 28% and 34% respectively.

Uneven performance across Bitcoin mining inventory suggests a market tackling cost pressure. Short-term gatherings from selected companies suggest speculative purchases, while losses elsewhere reflect persistent losses, broader doubts about profitability and growth.

Due to the persistent volatility, investors may be measuring operational efficiency and capital strength more heavily than their simple exposure to market behavior in the Bitcoin mining sector.