According to data from VelidatorQueue.com, Ethereum’s Validator Exit Queue has recorded its highest level in over a year, with an ETH of about $2.3 billion worth of ETH 625,000 ETH of about $2.3 billion.

The rise at the mass exit from Ethereum staking began on July 16th when Ether began price rise in 2025 at $3,844. ETH has skyrocketed nearly $3,800 from its $1,500 low since April, closing out its profits for stakers.

The queue wait time will reach 10 days

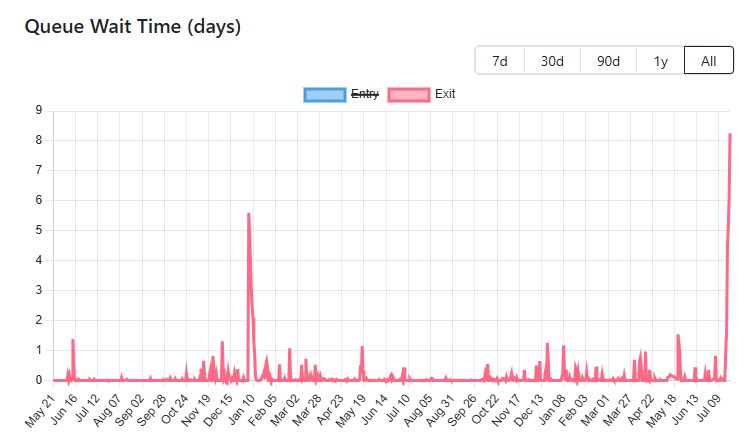

According to on-chain analysis, the waiting time before exiting Ethereum’s Validator Network has been extended to approximately 8-10 days, the longest since late 2023. As seen on BalidatorQueue.com, spikes containing the prominent drawer rush for January 2024 are previous high points.

Staking the waiting time for the exit queue. Source: validatorqueue.com

Validators are Ethereum nodes that lock ETH, operate specialized software to validate transactions, and propose new blocks. In return, they receive ETH rewards. Still, ending the role of the Valette includes a cue mechanism designed to maintain network stability.

The latest charts on the Analytics platform show that between July 16th and July 22nd, exit queue wait times jumped from under one day to over 8 years old. Over half a million ETHs, with more than $1.9 billion at current market prices, have been added to the exit queue within just six days.

“When prices rise, people bet, lock in profits and sell. Throughout many cycles, we’ve seen this pattern at the retail and institutional level,” explained Andy Kronk, co-founder of staking service provider Fission.

On the other hand, the entry queue has also risen. As of Wednesday, more than 359,500 ETHs worth around $1.3 billion at current prices are lined up to join the staking network following Balidatorqueue.com. The result was a six-day wait time for new validators to try to participate.

SEC Clarity adds staking demand for the scheme

The Securities and Exchange Commission’s May guidance said Ethereum is not security because “staking does not constitute a securities offering.” Market analysts believe this will drive the ether to a 62.9% price rise and make it more attractive to traditional financial institutions.

BlackRock has added an ETH staking language to its applications, among other things. At the same time, Joseph Rubin-backed Sharplink Gaming and Thomas Lee-Afiliated Bitmine Immersion launched the ETH financial program with incentives to generate shareholder yields.

Approximately 29.4% of Ethereum’s total distribution supply amounted to an all-time high of ETH 3,639 million, which was trapped in pool staking as of Tuesday. This amount exceeded the previous peak of 35 million on June 17th.

Data from the Dune Analytics Dashboard showed that as of Wednesday, about 237,000 ETH had been queued for the withdrawal at Lido, the largest liquid staking platform. That surge in withdrawals also contributes to rising network-wide exit times.

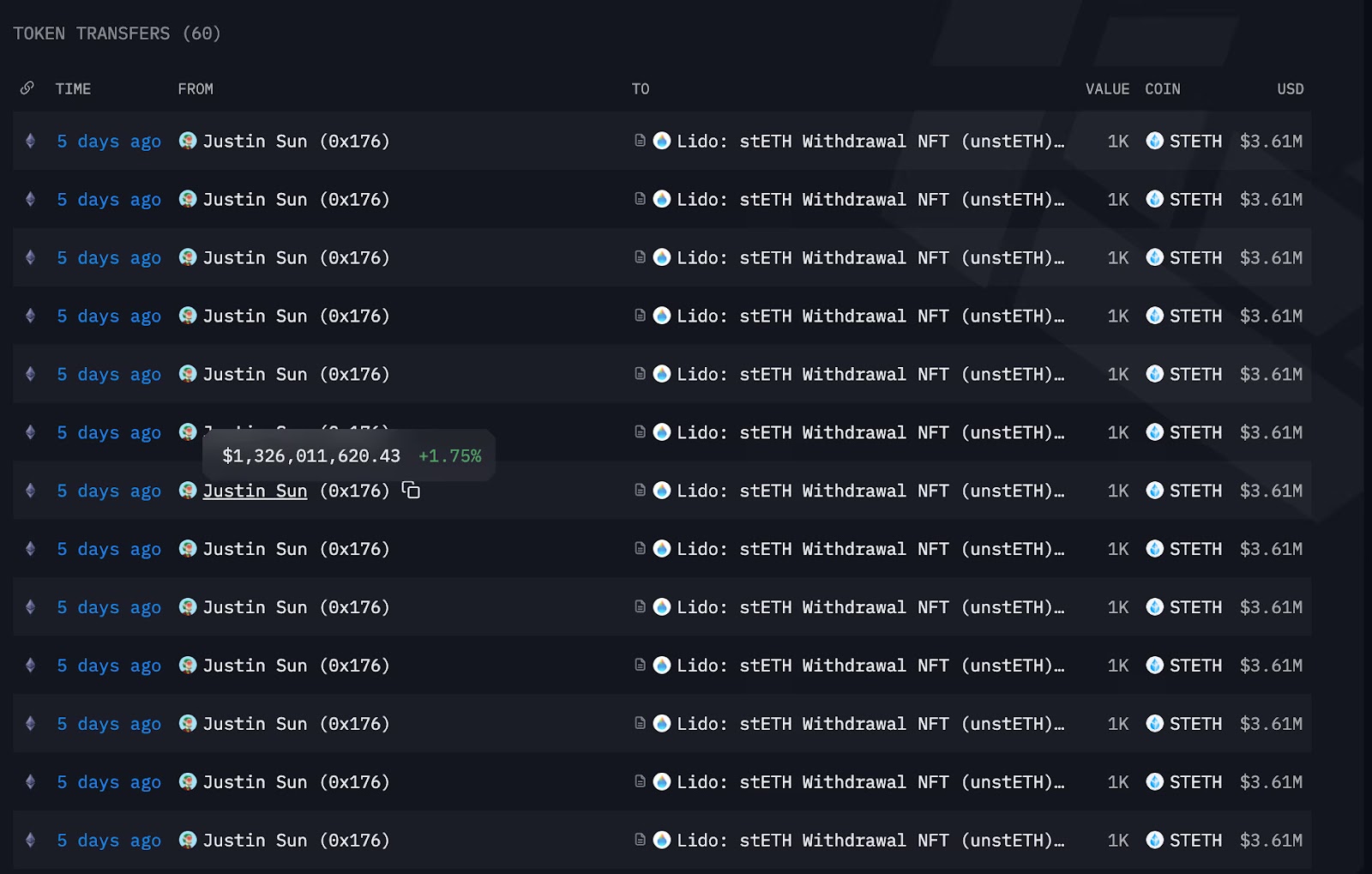

X’s Network Observers said Tron Dao founder Justin Sun on Friday withdrew 60,000 ETH from Lido and withdraws private amounts from Aave. This created a “domino effect” that forces others to settle their loop strategies when profitability decreases, and forces them to recursive borrowing to amplify yields, according to Tom Wan, data director at Entropy Advisors.

Justinsan’s address activity. Source: Arkham Intelligence

“The lender is now a queue of ETH Unstake now, so it is potentially locked up for 18 days. Ultimately, we may see Steth’s liquidation from an outbreak of interest.