Rails, an institutional crypto derivatives provider, on Tuesday announced the launch of “Institutional-Grade Vaults” on the Stellar network. This will allow brokerages, fintechs, and other intermediaries to connect to crypto perpetual assets through a single backend. The company aims to begin options trading in the second quarter of 2026.

Satraj Bhambra, CEO of Rails, told Cointelegraph that the core idea is to separate matching from money. “The critical difference is detention and verifiability,” he says.

Rails runs a centralized matching engine, while client assets are stored in an audited smart contract vault on Stellar. Merkle proves that institutions can independently reconcile against their own records, so profit and loss (PnL), fees, and debt are committed on-chain every 30 seconds.

Related: Virtual currency derivatives exchange Paradex reports service outage and cancels open orders

Mitigating counterparty risk

The main design argument is that Vault reduces counterparty and operational risk by ring-fencing customer collateral from market-making capital and Rails’ own operating funds.

Vanbrugh framed this as a direct response to the previous currency collapse, when assets were held in omnibus accounts and customers had to rely on internal ledgers.

“If you go bankrupt, you become an unsecured creditor of the bankruptcy,” he said. “This is exactly what happened to FTX customers.”

He said the lesson here is clear: “separate execution and custody,” emphasizing that user funds remain in on-chain smart contracts rather than on Rails’ balance sheet.

Bambra said the company chose the Stellar network for its fast payment finality and 10 years of collaboration with banks, remittance providers, and tokenized asset platforms.

“When you ask financial institutions to trust smart contracts that hold tens of millions of capital, that legacy matters,” he said.

According to an announcement shared with Cointelegraph, the company has processed over $3.4 billion in trading volume to date. It is registered under the Cayman Islands Monetary Authority (CIMA), but Vanbrugh told Cointelegraph that Rails has “begun the registration process” with the U.S. Futures Association.

Related: Fenwick agrees to settle lawsuit over alleged involvement in FTX collapse

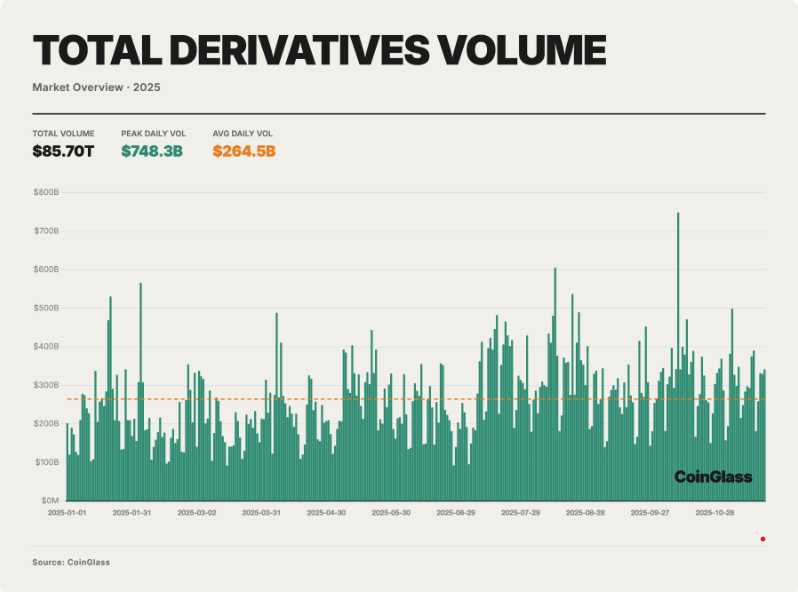

Annual trading volume of cryptocurrency derivatives reaches $85.7 trillion

Derivatives are rapidly becoming the primary venue for price discovery and risk transfer in cryptocurrencies. According to Coinglass’ 2025 Annual Report, derivatives trading volume was estimated at approximately $85.7 trillion last year, with an average daily trading volume of approximately $264.5 billion.

These numbers marked record trading volumes and deeper open interest as institutional traders used futures and options as their primary tools for price discovery and risk management.

Total trading volume of virtual currency derivatives in 2025. source: coin glass

The report warns that more complex and deeper leverage chains come with “increased systemic tail risks,” and the October 2025 deleveraging event revealed that weak liquidation engines, automatic deleveraging (ADL) mechanisms, and highly concentrated venues could still turn crowded positions into huge losses across markets.

magazine: Introducing on-chain crypto detectives who fight crime better than the police