On-chain data suggests that institutional investors have been actively purchasing Bitcoin and Ethereum during the recent market decline.

This surge in institutional investor activity signals a stabilization and possible reversal of recent bearish trends.

Bitcoin demand soars to record in 48 hours

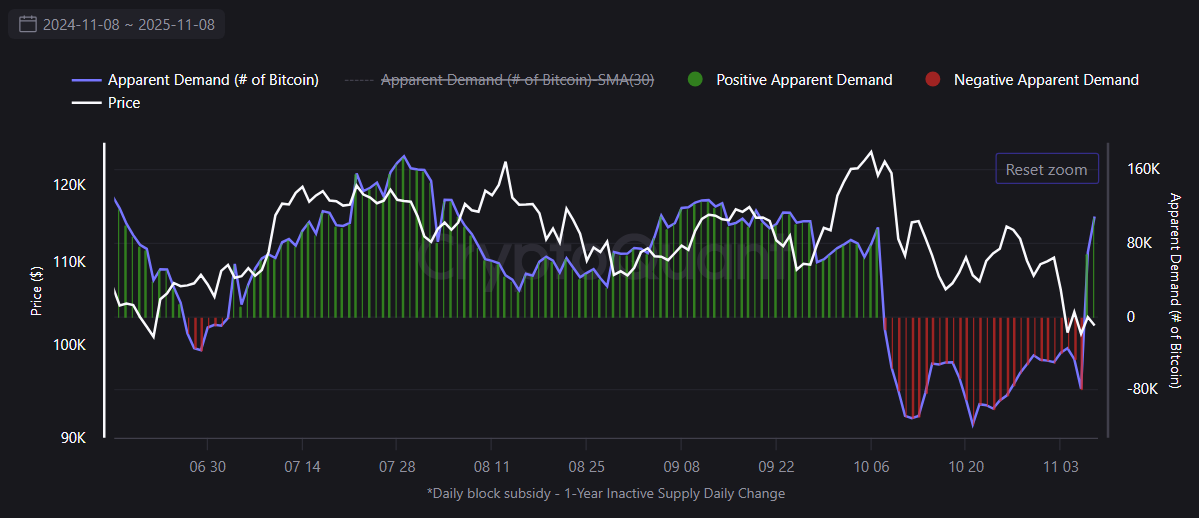

According to CryptoQuant’s “Bitcoin: Apparent Demand (30-day Total)” indicator, net purchase demand for Bitcoin jumped dramatically from -79,085,000 BTC on November 6 to +108,5819,000 BTC two days later. This sharp increase is the sharpest movement recorded in this indicator all year.

The “apparent demand” metric compares Bitcoin production (supply) and the behavior of long-term holders (LTH). This comparison measures the true strength of net long demand.

Bitcoin: Apparent Demand (30-day total). Source: CryptoQuant

Track cumulative net demand over the past 30 days using spot BTC on-chain movement. This methodology helps analysts distinguish between speculative price-driven flows and genuine structural accumulation. This is because deep-pocketed investors use it to identify activity.

Historically, a negative to positive reversal is known as a “demand pivot.” This event signals the entry of new institutional capital and often portends a significant rebound in prices and the establishment of a solid base of support.

The greater the change in the value of the indicator, the more likely large-scale whale demand is involved. What is noteworthy is that this index worsened on October 8th, just before the October 10th crash, and remained negative until it turned positive on November 7th.

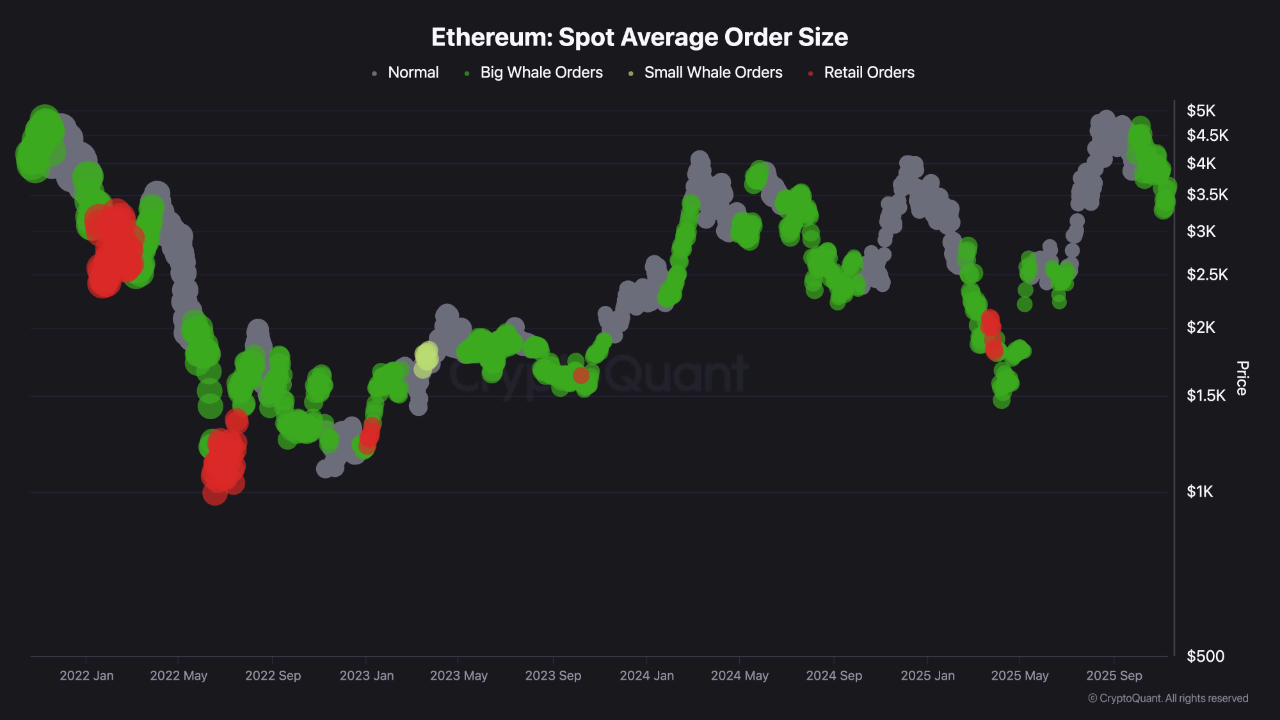

Whale activity spikes due to low Ethereum prices

Evidence of institutional purchases was also captured in Ethereum’s on-chain data. CryptoQuant analyst Shayan Markets revealed in a report on Monday that a temporary spike in whale-driven activity was detected while ETH was falling to the $3.2 million level.

Ethereum: Spot average order size. Source: CryptoQuant

Our analysis shows that whale order activity (green) was previously concentrated at a near-term low in April. A similar pattern was observed in the recent decline from $4.5K to $3.2K.

ShayanMarkets evaluated this change as follows: “This shift means that while retail traders remain cautious, large market participants are re-entering exposure at discounted prices.”

The analyst also hinted at a bullish path forward. He said if this move persists and the $3,000-3,4,000 area holds as structural support, Ethereum could enter a low-volatility accumulation zone and prepare for an eventual bullish possibility towards the upper end of the $4,5,000-4,8,000 range.

The article Whales Buy the Dip: Institutional Demand Surges for BTC, ETH appeared first on BeInCrypto.