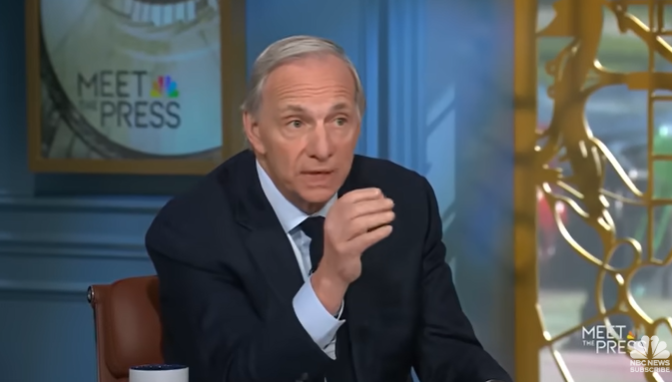

“We’re at a critical point right now, we’re very close to a recession, and we’re worried about something worse than a recession if this isn’t managed well.”

He speaks to Ray Dalio, founder of the Bridgewater Investment Management company. In an interview with CNBC, he expressed concern Political tensions derived from the “customs war” President Donald Trump has begun.

As reported by Cryptonotics, the US president had announced mutual tariffs on several countries.

However, Trump has ordered a 90-day tariff break on several countries, except China, to raise interest rates, which is now at 125%. In response, Chinese authorities raised tariffs.

“We are transitioning from multilateralism, a world order that is primarily from the United States, to a one-sided world order with great conflict,” Dario said.

In this regard, the billionaire needs to be made clear that he just published a letter explaining it. These transformations are driven by five interconnected forces: Unsustainable global debt levels, internal political polarization, the end of the US-led geopolitical order, extreme climate events, technological advances.

With regard to the level of global debt, Dario believes there is a structural imbalance between economies such as the US, which rely on credit to support consumption.

For him, the world is moving into a stage of jisrovariation and mistrust under a system that “needs to be converted in a destructive way”, which could have a profound impact on the capital market.

For this reason, he asked the US Congress to reduce the federal deficit of 3% of GDP. Because “otherwise there will be these other issues, while there will be debt supply and demand issues, which will worsen as a normal recession.”

In other words, what is at risk Dollar hegemony as a global reserve currencywhich could cause a collapse of the bond market and add to internal and external disputes. This blow will affect the monetary system with more force than the exit of the 1971 Gold Standard or the financial crisis of 2008.

Dario warns that all these factors could come together in a complete storm if emergency measures are not taken. Unsustainable global debt, uncontrolled fiscal deficit, mistrust of the dollar as a reserve currency, and fragmented geopolitical order can lead to a decline in demand for American treasured debt, forcing interest rates to rise and earn credit. This will stop consumption and investment and directly affect economic activity.

And while the economic recession already means a long-term decline in growth, the rise in unemployment and lower output are even more extreme in the scenario Dario explains. The possibility of a global financial collapse with systemic reliability and deeper consequences than previous crises.

In the midst of an uncertain economic landscape and rising global tensions, questions arise as to which alternatives can protect investors from deeper financial collapses.

More traditional investors are leaning towards assets that are less exposed to market fluctuations, such as treasure bonds, but others are watching Bitcoin (BTC) is an alternative to traditional financial systems.

Before continuing, it is important to note that in its 16 years of existence, the currency created by Nakamoto At never surpassed the recession officially declared in the United States. That growth occurred in the context of economic expansion and flexible monetary policy, conditions that support their appreciation.

The fact that Bitcoin has never faced a declared recession raises an important question.

Before this scenario, BTC may behave differently than traditional assets.

In times of economic uncertainty, such as those associated with recessions, confidence in gold tends to be erosed due to policies implemented by central banks, such as the amount of gold in large amounts and interest rates.

These measures, seen in past crises such as the Great Recession of 2008 and the Pandemic of 2020, create distrust between investors and citizens, opening up space for alternatives such as BTC.

Unlike Fíat money, which can be issued inorganic and unlimitedly to meet government needs, digital assets have limited emissions at 21 million units, and that emissions are reduced every four years by halving. This is a factor that has a positive impact on medium and long-term prices.

Furthermore, it cannot be operated by banks or governments. Therefore, it is a more resistant alternative to economic decisions that affect traditional assets.

For this reason, many investors They consider BTC to be “digital gold” because of its similarity to precious metals. However, it is important to note that, as it is considered a majority of risk assets, its prices usually fall into a disadvantaged economic context.

Even BlackRock, the world’s largest asset manager, considers BTC to be “a unique and diverse asset.” The company shows that its characteristics are still adopted early compared to the risk that traditional assets cannot be mitigated, especially during periods of high geopolitical and economic uncertainty, but that characteristics can turn into coverage.

(TagStoTRASSLATE)US (T)Investors (T)Latest Investors