Strong demand for crypto-based ETFs has led to new products including recently submitted basic transaction ETFs in BTC and ETH. Defiance, one of the current ETF issuers, filed the US SEC for two additional ETFs that tap on the basic transaction.

The ETF market offers more complex products as carry trade strategies are packaged for crypto investors. Defiance Investments, Diverse Publishers ETFSfiled for two new products built around the basic transactions linked to BTC and ETH.

The two new ETFs aim to automate strategies to profit from the price gap between the crypto spot market and futures. Unauthorized cryptography allows investors to buy spot assets, sell regular contracts, and profit from the difference depending on the spread. Crypto is a smaller market, so the gap between spots and futures can be important.

Defiance has already proposed tickers for NBIT and Deth, ETF and ETH products. The newly launched entity simplifies investment by wrapping the underlying transaction into a single purchase. For investors, this approach is easier than buying a spot ETF like IBIT and reducing BTC with a CME. Defiance products may offer the same returns.

‘It brings a relatively sophisticated strategy to “one click” for individual investors.‘Steve Sosnick, Chief Strategist of Interactive Brokers, said, Quote According to Bloomberg. ‘ETF spaces are so saturated that people need to think about ways to be more creative. This is a subtle trade and makes it very interesting to me.‘

As crypto adoptions expanded, basic trade was drawn into more funds, desks from crypto, and native investors. Defiance ETFs reduce management and transaction costs and also directly approach retail.

Defiance’s ETFs depend on bull markets

Defiance’s ETF strategy is usually successful in bloom markets where futures premiums are in high directions. In 2025, carry trade was beneficial for most traders.

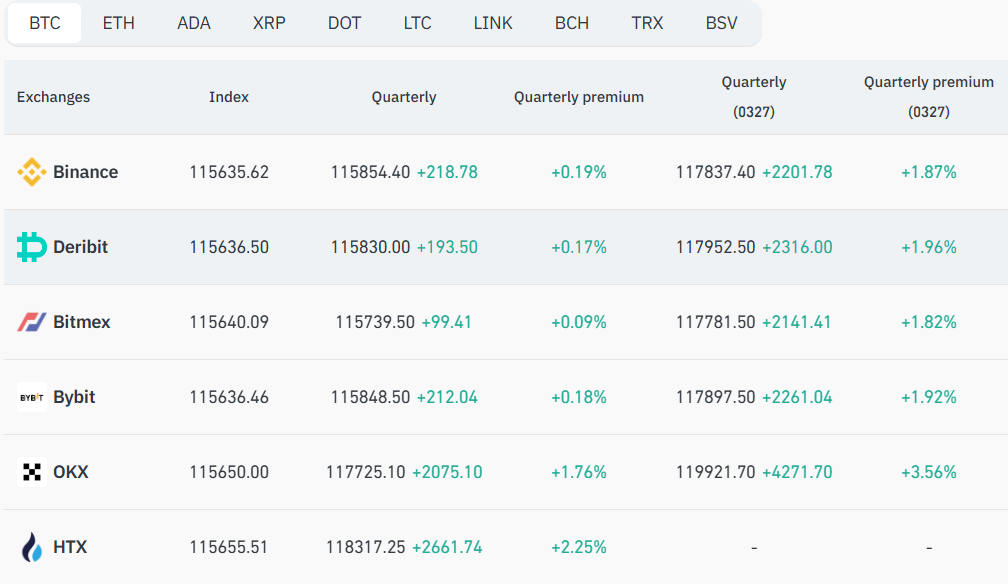

The opportunity to tap on futures premiums depends on the market as some exchanges offer higher risk and more advantageous futures premiums. In the vibrancy of the peak market, insurance premiums in the futures market have risen to 20%.

BTC premium for futures against spot markets is consistently high for BTC | Source: Coinglass

ETH Premium is more unpredictable, but also offers potential revenue. Ethereum’s market often breaks down Defiance’s strategy and acquires more futures prices than the spot market. However, on a long-term scale, both assets remain bullish.

The basic trading and overall bullish trends are also what Esena’s strategy worked as a project from a cryptocurrency origin.

Can CMEs achieve robust crypto revenue?

Carry trades have been tested and tested in the crypto space, particularly using native markets such as HTX, OKX and Binance. However, regulated products may need to use the CME futures market that does not provide the same volatility dynamics.

The facility’s deal wiped out some of the inefficiencies that allowed crypto-indigenous people to draw out price differences between spots and future. Binance spot traders can easily tap Exchange futures contracts, but Defiance must achieve similar results using more liquid and efficient regulated ETFs and futures markets.