Bitcoin’s $BTC$65,998.81 The February 5th crash will be remembered as one of the most historic falls on record. Below are key statistics that help define the event and indicate how much further declines are likely to occur.

Bitcoin prices started the day around $73,000 and fell to a low of around $62,000, with the decline (or what some market participants call a candlestick) of more than $10,000. The 14% drop on the day was the largest single-day drop since November 2022, when the implosion of the cryptocurrency exchange FTX occurred.

The Fear and Greed Index has fallen to single digits, a level seen only a few times in Bitcoin’s 17-year history. At the same time, Bitcoin became the third most oversold index of all time on the RSI, an indicator that measures the speed and change of price movements.

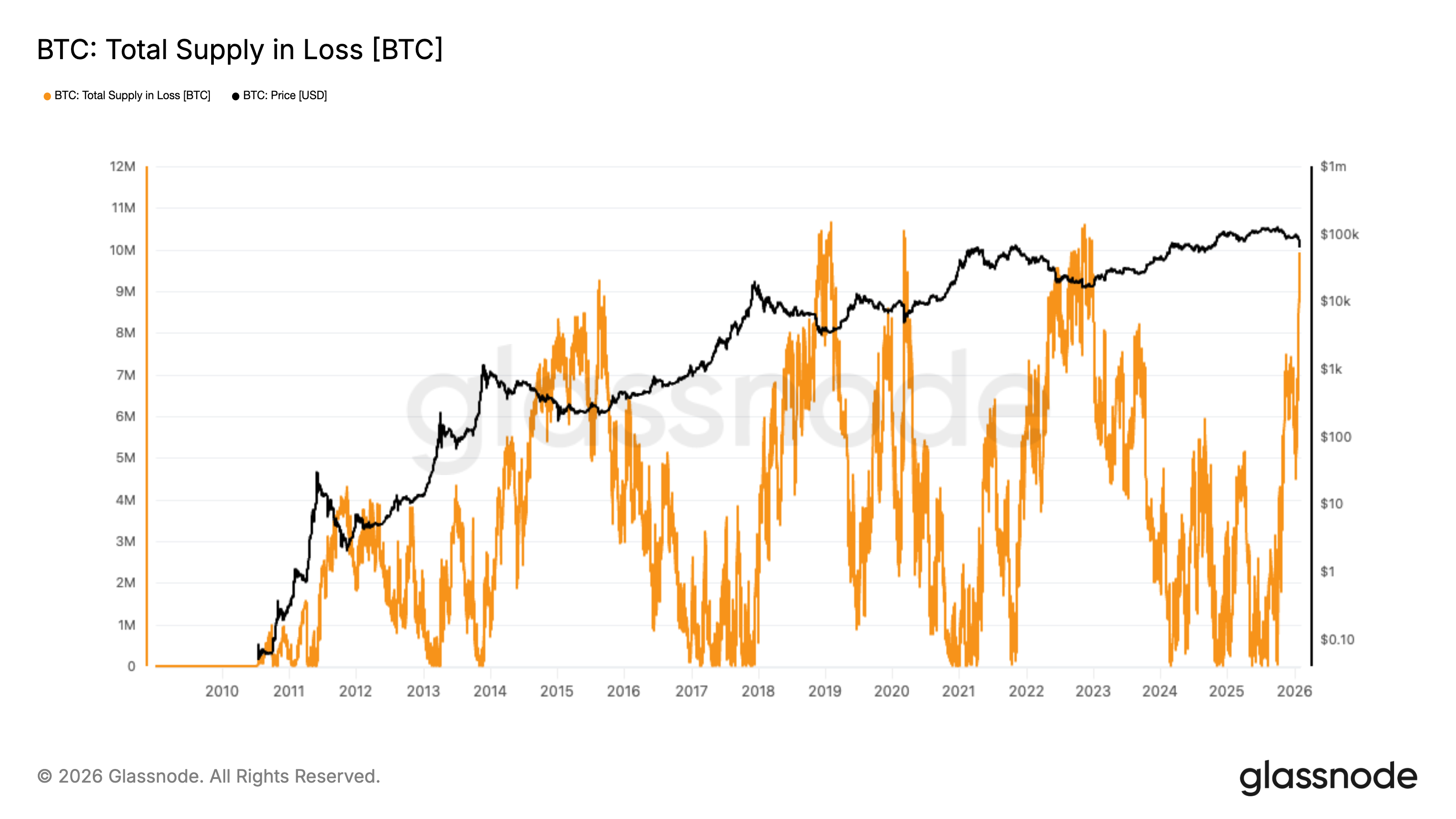

Supply in profit and loss

The circulating supply of losses, or the number of coins last traded at a price above the market price, jumped to nearly 10 million. $BTC. This is the fourth-highest level on record and matches the bear market bottoms of 2015, 2019 and 2022.

Total supply at loss (Glassnode)

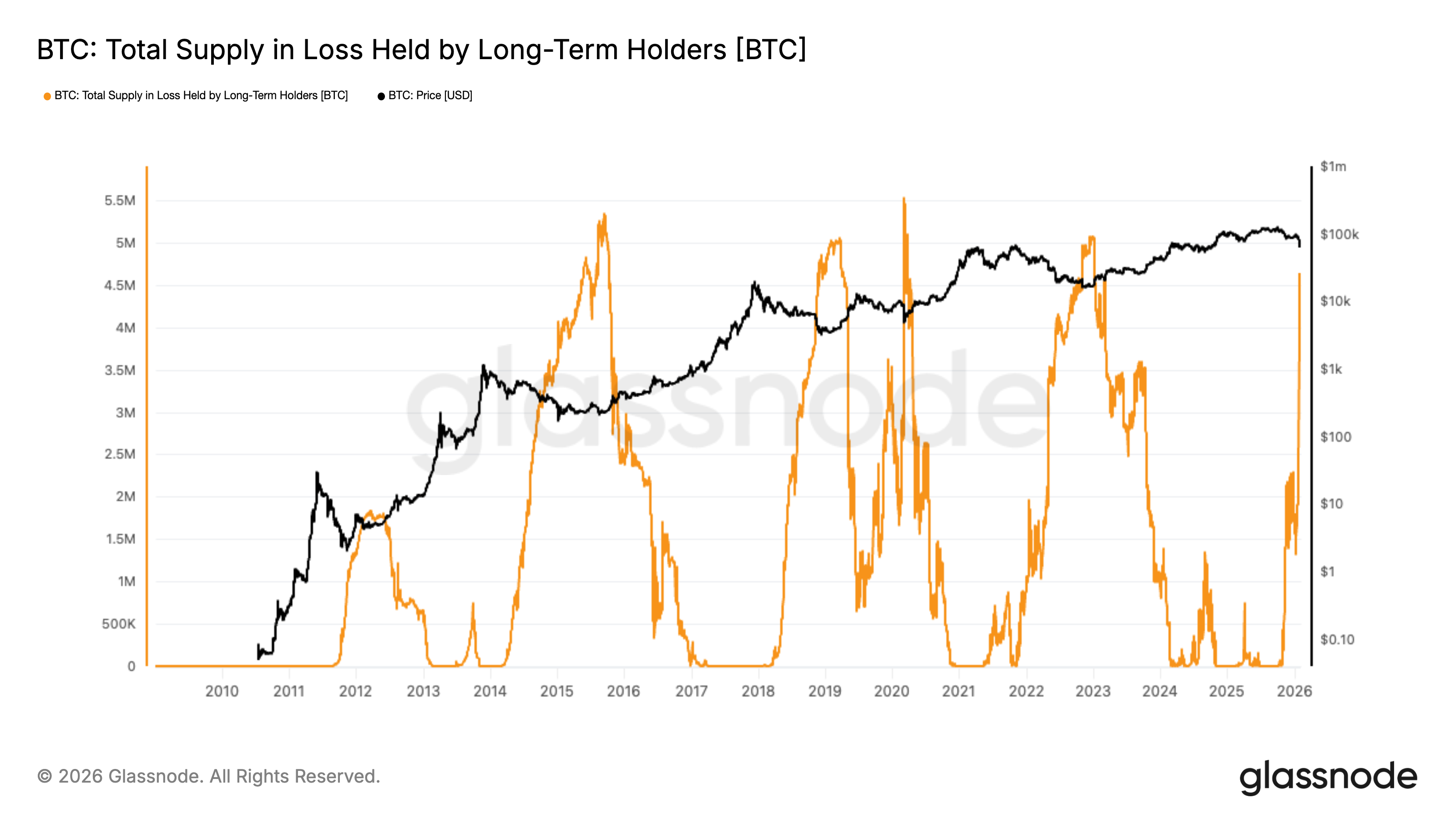

Another indicator is the amount of deficit in the circulating supply of long-term holders, which reached 4.6 million shares. $BTC. At previous bear market lows, that number exceeded 5 million $BTCsuggesting that this indicator is approaching its previous extremes, but not yet fully matched.

Total supply loss due to LTH (Glassnode)

Supply in profits and supply in losses have nearly converged, a situation that has historically coincided with the bottom of major market declines. Currently about 10 million $BTC Profit and sit on 10 million $BTC I sit there at a loss.

No one knows if Bitcoin’s bottom is near, but history suggests it is likely near, especially considering Bitcoin has already rallied towards $68,000.

Still, market participants may be waiting for Bitcoin to test its 200-week moving average, which is currently near $58,011.