Bitcoin is trading sideways when August ends, and Crypto traders do what they do every year around this time: Pain preparation.

Known as “Red September” or “September Effects”, this phenomenon has had a market for ghosts for almost a century. The S&P 500 has averaged negative returns in September since 1928, making it a consistent negative month for the index. Bitcoin’s performance is getting worse. Cryptocurrency has dropped to an average of 3.77% each year since 2013, crashing eight times, according to Coinglass data.

“The patterns are predictable. Negative social media chatter spiked around August 25th, followed by an increase in Bitcoin deposits in exchange within 48-72 hours,” said Yuri Berg, consultant at a Swiss-based crypto liquidity provider. Decryption.

“Red September has gone from anomalies in the market to a monthly psychological experiment. We are selling the whole market story based on history rather than on current basis.”

Image: Coinglass

The mechanism behind Red September returns to structural market behavior that converges in the fall each year. The mutual fund concludes its fiscal year in September, causing tax declines and portfolio rebalances, which will flood the market with sell orders. The summer season is over, bringing traders back to their desks and reassessing positions after months of thin liquidity. Bond issuances surge on post-labor days and draw capital from stocks and risky assets as institutions turn into bonds.

The Federal Open Market Committee will hold a September meeting, creating uncertainty that freezes purchases until policy directions are clear. In the crypto, these pressures mean that 24 hours a day trading of compounds: Bitcoin means there is no circuit breaker when selling. Altcoin.

Cascades start in traditional markets and get leaked into crypto within a few days. When the S&P 500 drops, institutional investors will first throw away Bitcoin to meet margin calls or reduce portfolio risk. Futures markets amplify damage through a liquidation cascade. 5% spot movement allows 20% triggering with a derivative wipeout. Social sentiment indicators will be negative by late August, with traders selling preemptively to avoid expected losses. Option dealers hedge exposure by selling spot bitcoin as volatility increases, adding mechanical pressure regardless of the foundation.

And, like in other markets, some believe this will be a pattern out of purely rational expectations.

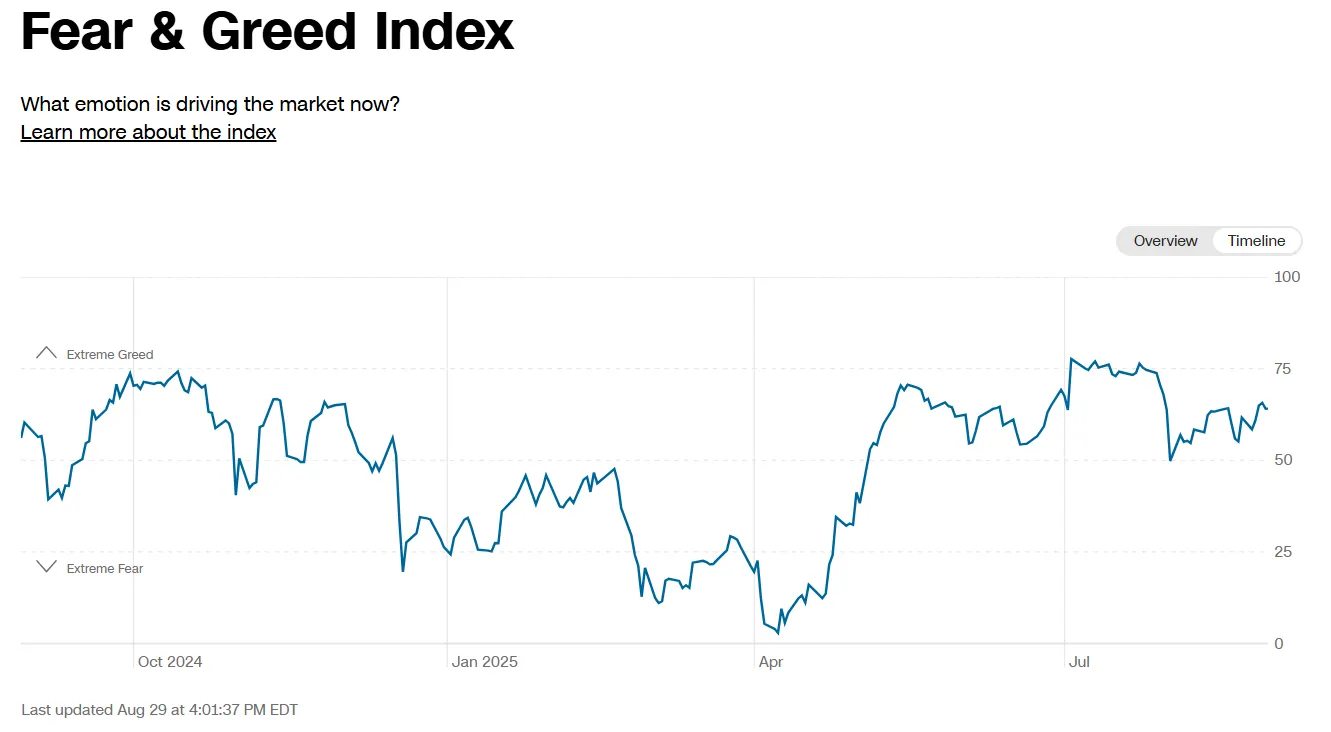

The numbers confirm Berg’s observations. The Crypto Fear and Greed Index fell from 100 to 52 despite a more optimistic view at 64 points, despite the global stock market showing a more optimistic view. The boundary is neutral, but still in the “greed” zone.

Image: CNN

However, this September, we arrive in an unusual cross-current. The Federal Reserve shares a positive statement, with market prices on another cut in the September 18 meeting. Core inflation is stuck at 3.1%, but two active wars disrupt the global supply chain. These conditions create what Daniel Keller, CEO of Influx Technologies, considers the perfect storm.

“We have two combat theatres that define two history: one in Europe and the other disrupts the important supply chain,” Keller said. Decryption. “In addition, the US has launched a global trade war with almost all major allies. The modern state of global geopolitics positions BTC perfectly due to a sharp decline in September 2025.”

In other words, the market currently does not consider Bitcoin as a hedge. This was the main story as an asset as the dominant pre-Covid story of the BTC. The market sees it like a risky asset.

Technical indicators are beginning to draw scary pictures for traders. Bitcoin has fallen below the key support level of $110,000, which has been locking up the rally since May. The 50-day moving average is $114,000, and now the 200-day EMA offers support near the $103,000 price range and serves as a resistance.

Technical traders may be looking at $105,000 as a line in the sand. In Myriad, a forecast market developed by Decrypt’s parent company Dastan, traders now impose the possibility that Bitcoin will return to $105,000 at nearly 75%.

A break below $105K targets sub-100K levels below the 200-day moving average. If you exceed $110,000 until the first two weeks of September, the seasonal curse can finally break.

The relative strength index reads 38, meaning at least some Bitcoin investors are trying to remove the coin as quickly as possible. Volume is 30% below the July average. This is typical of late trading, but is potentially problematic if volatility spikes.

But even if traders seem to be preparing to repeat history, some believe that the foundations of Bitcoin are stronger than ever before. It should be enough for the king of Crypto to overcome this difficult month.

“The idea for ‘Red September’ is more myth than mathematics,” said Ben Kurland, CEO of Crypto Research Platform Dyor. Decryption. “Historically, September has looked weak due to portfolio rebalancing, retail momentum and macro jitter, but these patterns have been important when Bitcoin is a smaller and thinner market.”

Kurland points to liquidity as the current driver. “Inflation is low and not glided, so the core reading still creeps high, but even that headwind is under pressure for the Fed to ease as growth cools.

The traditional warning sign is already flashing. The FOMC will take place between September 17th and 18th, and the market will split over whether authorities will hold or cut fees.

Keller recommends carefully looking at indicators of fear and greed. “Traders in the coming weeks will need to monitor fear and greedy metrics to determine general market sentiment, and decide whether it’s better to hold it in case the price jumps or sells as ‘red September’ approaches,” he said.

As the code matures, seasonal patterns may weaken. Bitcoin’s September losses eased from an average negative 6% in the 2010s to minus 2.55% over the past five years. Institutional adoption by the ETF and the Ministry of Corporate Treasury has added stability. In fact, over the past two years, Bitcoin has recorded a positive profit in September.

Berg sees the whole phenomenon as self-reinforcement psychology. “A few years after the selloff in September, the Crypto community trained to expect debilitating, creating a cycle in which the fear of dips becomes the dip itself,” he said.

It seems the outlook is dark, so don’t worry: October after the red in September, or “Uptober” is historically the best month for Bitcoin.

Disclaimer

The views and opinions expressed by the authors are for informational purposes only and do not constitute financial, investment, or other advice.