This is a segment of the 0xResearch newsletter. Subscribe to read the full edition.

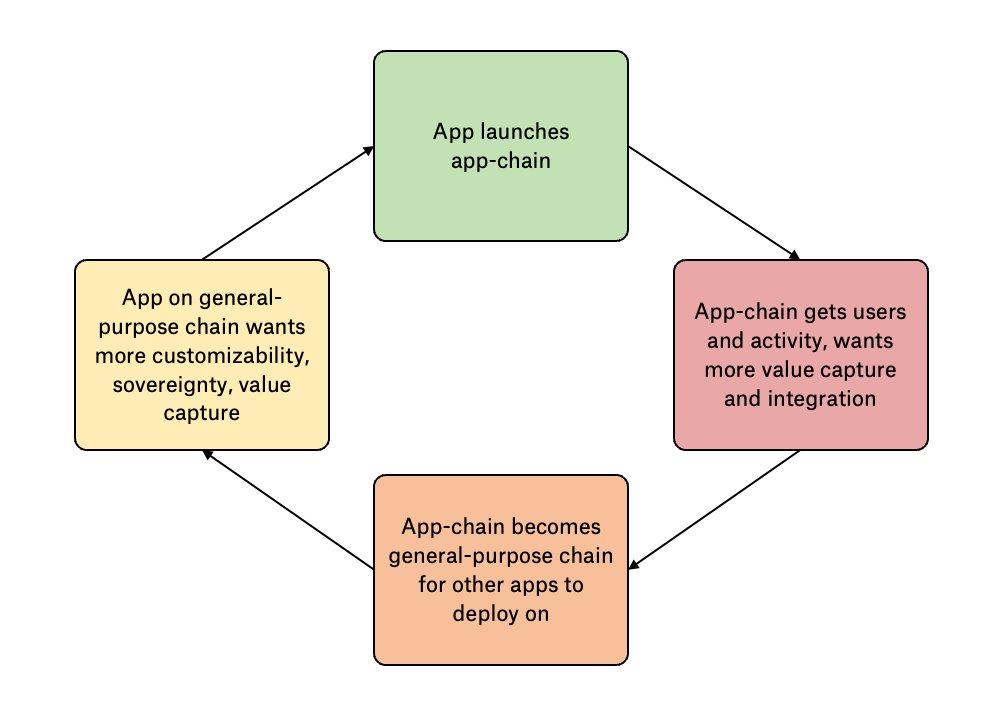

This is the face of today’s common paradox L1:

L1S wants to enable application-specific L2 chains, as all apps cannot coexist in the same blockchain environment. Builders want to customize their freedom.

However, if all Appchains make their own independent design decisions, there is fragmentation. After that, they leave your L1.

Ethereum, Cosmos, Avalanche and Polkadot all suffer from similar problems.

Initial architecture

Initia, who is running the mainnet today, is determined to run the same AppChain Vision, avoiding the pitfalls of fragmentation.

Apps that choose to build on Initia benefit from tightly integrated and opinionated tech stacks. Initia calls it “woven weave stacks.”

All initia apps are built with the same stack and standard. They share Canonical Bridge (Layerzero), Cross-Chain Messaging (Cosmos IBC), the underlying framework (Cosmos SDK), and standardized gas tokens (though native USDC via Noble is the default, but chains can change it).

AppChains can be run in your preferred environment. Of the 18 announced teams built on woven stacks, they are generally evenly divided between EVM, MoveVM, and WASMVM.

You can also leverage common MEV infrastructures such as POB (Protocol Owner Builder) and ProtoreV to capture non-toxic MEVs and use common Enshrined Oracle (Connect), Common Multisig (Initia Multisig), Block Explorer (InitiaScan), and Domain Name Service (Initia Username).

You get the idea – it is all the important public good possible to enable differently oriented builder ecosystems to execute on a common standard without suffering from fragmentation.

So, what about L1?

Initia L1 runs with single slot finality and 500 ms block time with MOVEVM and CometBFT consensus.

The L1 is intended to serve as a fluidity hub that is very similar to what Cosmos Hub wanted.

What maintains L1 fluidity? INIT token holders can earn ININT in L1 to earn inflation staking rewards and trade fees on MinitsWap, the native DEX of L1.

There are no fees charged to go through the Hub, but that could be integrated in the future, the Initia team said.

This is called “Enshringed Ryutivity.” This allows INIT token holders to wager rewards and act as liquidity providers.

What prevents Initia Appchains from leaving Initia and creating their own chains?

For one, AppChains already has full customization across the environment, allowing you to internalize your own MEVs.

Secondly, since the initia app is not the same as the generic L2 rollup chain, there may be native tokens in the most liquid L1.

“They don’t intend to fire Dex on their chains because that’s not their app chine purpose,” said Stan, co-founder of Initia.

Finally, INITIA explicitly rewards AppChains with INIT rewards based on TVL and governance metrics as part of its Vested Interest Program (VIP). Users will obtain init based on criteria set by L2S.

The VIP program is what Initia hopes to stem the lack of value generation that Atom suffered.

“Atom’s biggest downfall was the fact that Cosmos users didn’t care about the tokens themselves. CosmosAppchains had no strong reason to integrate Atom.”

To be fair, these are not particularly original mechanisms. Initia’s VIP rewards have a noticeable similarity to Berachain’s “Proof of Skiing” or Blast’s “Gold” campaign. MEV Capture is pursued by many other ecosystems/apps. Arbitrum today announced its custom gas token.

Perhaps the original is the overall combination of all these design choices From the first day To avoid many of the problems with value generation that plagued atoms or ETH.

Initial Rounch

Initia raised a total of $25 million in September 2024 through three private rounds and a $2.5 million echo round.

According to an Initia press release, it is based on a stack with at least 18 teams woven into it. These teams have raised $28 million, particularly over Initia’s own pay raise. I noticed a similar pattern Megaeth. Is Fat Protocol paper dead?

Anyway, Inishi lives today. here it is Tocononomics.