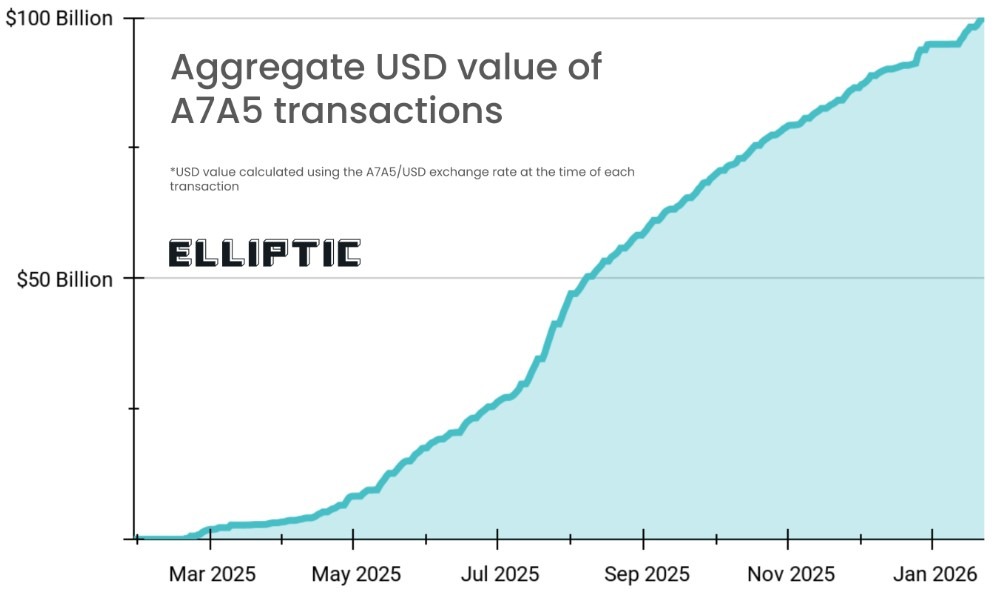

A ruble-backed stablecoin linked to a sanctioned Russian financial network has processed more than $100 billion in on-chain transactions in less than a year, according to a new report from blockchain analysis firm Elliptic.

In a report released on Thursday, Elliptic said the A7A5 stablecoin is designed to operate within a broader framework aimed at mitigating the impact of Western financial sanctions. This structure allows Russian-linked companies to move value through the cryptocurrency market while reducing the risk of asset freezes.

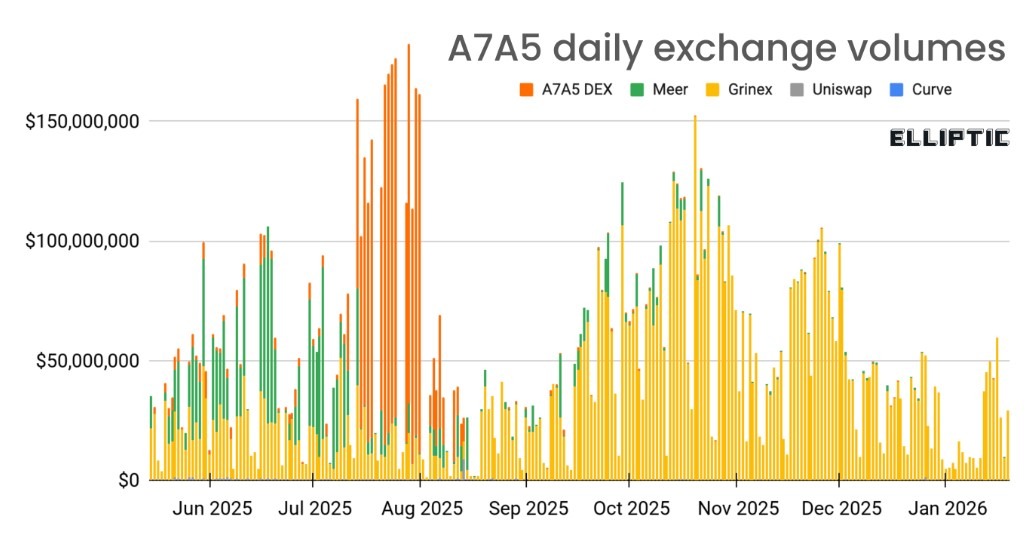

Elliptic found that A7A5 activity spiked after its launch in early 2025, but slowed in the second half of the year as sanctions and compliance measures taken by exchanges and token issuers began to limit its use.

Elliptic said the scale and structure of this flow highlights how non-USD stablecoins can be designed to support sanctioned trade, and how enforcement pressures can still disrupt such systems.

A7A5 Total USD value of the transaction. Source: Oval

A7A5’s $100 billion figure and the role of A7A5 USDT bridge

Elliptic said the $100 billion figure represents the cumulative value of all A7A5 transfers recorded on public blockchains, including Ethereum and Tron.

“This is the combined value of all A7A5 transfers,” Elliptic founder and chief scientist Tom Robinson told Cointelegraph.

“We do not have a subjective view on whether each transaction constitutes a separate economic activity. However, the fact that transaction fees are paid on all A7A5 transfers suggests that they all benefit the transactor.”

Elliptic’s analysis shows that A7A5 primarily acts as a bridging asset between the ruble and Tether’s USDt (USDT), remains the world’s largest dollar-pegged stablecoin.

The company said this structure allows users to transfer value. USDT Protect your market without maintaining long-term exposure to wallets that are susceptible to freezes by Western authorities.

The report noted that stablecoin trading activity was concentrated in a limited number of locations, including Kyrgyzstan-based exchanges and project-related infrastructure. This strengthens the token’s role as a purpose-built payment tool rather than a widely adopted retail stablecoin.

Daily replacement amount of A7A5. Source: Oval

Related: Global sanctions related to records flow into illegal crypto addresses

Sanction pressure and exchange controls constrain growth

Elliptic said stablecoin expansion slowed from around mid-2025, with no large-scale issuances since July and trading volume dropping from a peak of $1.5 billion to about $500 million.

Robinson told Cointelegraph that US sanctions imposed in August 2025 had the most immediate and significant impact on stablecoin functionality.

“The US sanctions in August 2025 appear to have had the most impact,” Robinson said. “Immediately after the U.S. designation, USDT The liquidity supply to A7A5’s DEX has been significantly reduced, eliminating one of the key benefits of stablecoins: easy on-chain access. USDT”

Additional constraints follow as actions of the replacement tool. In November 2025, decentralized exchange (DEX) Uniswap added A7A5 to its token blocklist, prohibiting trading through its web interface.

Elliptic also cited reports from users such as: USDT The deposit was frozen by the exchange after being traced back to a wallet linked to A7A5.

On October 23, the European Union formally sanctioned the A7A5, saying it was a tool used to circumvent financial regulations tied to Russia’s war economy.

Robinson said A7A5’s trajectory shows both the potential and limitations of non-dollar stablecoins built for sanctions-era finance.

“While the US dollar dominates the global economy, there are structural limits to how far these stablecoins can grow,” he told Cointelegraph. “But if circumstances change, all bets are off.”

magazine: How will cryptocurrency law change in 2025 and how will it change in 2026?