TL;DR

- Sharps Technology earns an annual yield of 7% by owning Solana stock.

- The company partnered with Coinbase to launch Solana validator.

- Introduced a 90-day advisor lock-up and a $100 million stock repurchase program.

sharps technology disclosed The first performance statistics from the Treasury holding in Solana Inc. were released on Monday, revealing that the Nasdaq-listed medical device company is profitable. Annual gross profit of approximately 7% Through staking before fees. This update marks the company’s first quantitative report since it began accumulating. $SOL token.

Nearly all of Sharps’ Solana holdings are currently participating in staking, according to the statement. The company views yield as ordinary income, rather than speculation on token price fluctuations.

$SOL is down nearly 60% from its peak a year ago, and STSS stock is trading more than 80% below its peak last summer. Despite the price deterioration, Sharp hasn’t stopped expanding its involvement in Solana’s network infrastructure.

The 7% yield is higher than the average staking return across the Solana network, making Sharp one of the better performing validators. The company attributes this strong performance to its partnerships with institutional-level staking providers.

Coinbase partnership deepens network participation

Sharps released the Institutional Validator Solana In partnership with Coinbase earlier this month. The company delegated some of its finances to new validators and moved from passive ownership to direct network operations.

Validator represents a change in the way Sharp approaches its digital asset strategy. The company now operates an infrastructure that secures the network and earns validation rewards, rather than simply buying and staking tokens through third parties.

“STSS continues to $SOL holdings through integration with institutional quality staking infrastructure,” said James Chan, Strategic Advisor at Sharps.

The company emphasized that Maintains sufficient working capital and has no corporate debt. A clean balance sheet provides financial flexibility as the crypto market remains volatile.

Sharp also implemented governance measures aimed at restoring investor confidence. In January, the company entered into a 90-day lock-up agreement with its strategic advisers, prohibiting them from selling or hedging advisory warrants or underlying stock.

The adviser confirmed that it did not sell or hedge any warrants or shares before signing the deal. This limit eliminates potential selling pressure during the lockup period.

Additionally, Sharp acknowledged that: Share buyback program worth up to $100 million. This approval signals management’s confidence in the current valuation, potentially supporting the stock price.

This approach differs from other publicly traded companies that hold digital assets. While strategy firms and similar companies primarily bet on rising Bitcoin prices, Sharp emphasizes staking income generation as a core component of its total profit.

A 7% annual yield provides predictable returns regardless of short-term price fluctuations.. This interest rate exceeds the yield on investment grade corporate bonds and provides diversification from traditional financial strategies.

However, this model involves technical and market risks. Validators can be penalized for downtime and malicious behavior. $SOL Price declines also reduce the nominal value of your holdings, but do not affect your staking rate yield.

Sharp positions Solana shares as part of a long-term financial approach focused on generating recurring cash flow. The company treats staking fees as operational income rather than speculative profits.

Sharps did not disclose what percentage of its total revenue comes from its staking and medical device businesses. The company has not disclosed its exact size either. $SOL The dollar value of your holdings or the staking income you have generated to date.

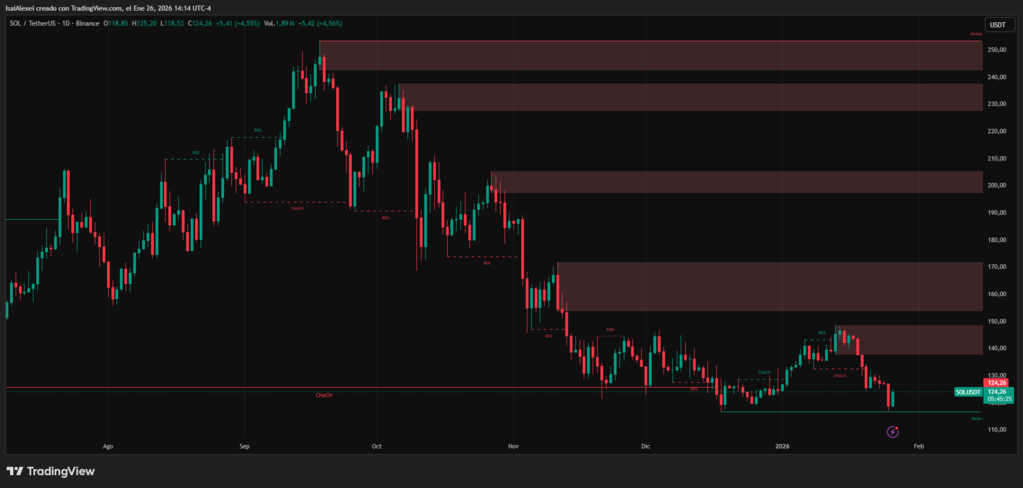

Solana is currently trading around $122-$125 USD per token – Tradingview

Solana now ($SOL) is trading at approximately USD 124 per coin, within a range of roughly between USD 118 and USD 125 per day, reflecting active intraday volatility around this zone. The current price is only a few dollars above the recent open and close of around $118.7, indicating that this move is a modest short-term rebound rather than a major breakout. Looking at it from a bigger perspective, $SOL is well below recent year-to-date highs around $253-$300, effectively valuing the market at about half the peak level from the last big rally, highlighting both the potential upside and drawdown risks of new entrants.