Thailand’s Stock Exchange (SET) will temporarily ban daily price restrictions from April 8th to April 11th starting tomorrow, reducing daily price restrictions. This emergency action addresses key market volatility associated with recent changes in global tariff policy.

A report confirmed by Bloomberg, both Set Futures Exchange (TFEX) approved a temporary measure late Monday, curbing excessive price fluctuations driven by global trade uncertainty and giving investors time to assess terms.

Emergency trading rules have been established

In the context, short selling involves borrowing shares to sell the stock at a higher price and then buying back at a lower price later to make a profit. In light of market stress, Thailand temporarily halted its practices to reduce volatility.

The Governor’s Committee of Set has approved a set of emergency trading rules that TFEX has adopted promptly. These measures are to stabilize the market over the next three days, from April 8th to April 11th, 2025.

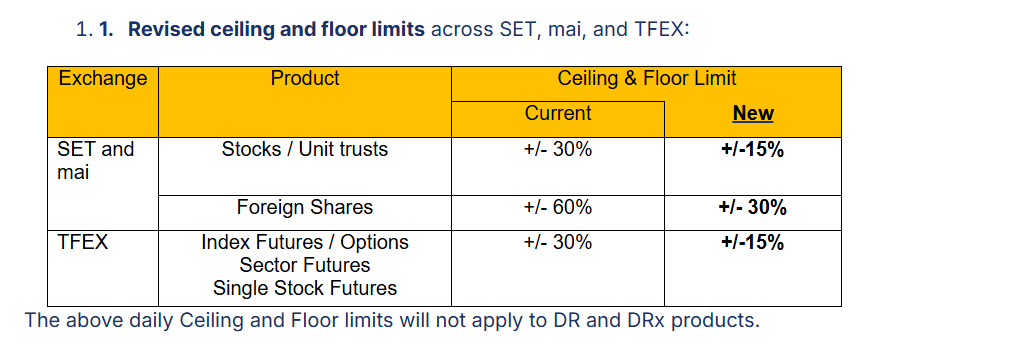

One major change is reducing the restrictions on daily price transfers. The stock and unit trusts of sets and MAI range from ±30% to ±15%. Foreign stocks are reduced from ±60% in the range of ±30%.

Furthermore, futures contracts in TFEX, including indexes, sectors and single inventory futures are limited to movements of ±30% to ±15%.

Related: Thailand turns its eye on Bitcoin to boost the economy of tourist hotspot Phuket

The short-term ban applies to all securities, but registered market makers are exempt and may continue to operate during suspension.

Set says these measures aim to give investors time to assess the market situation and make more informed decisions. The exchange monitors the situation and adjusts its approach as needed.

Turbulence in global markets due to large-scale crypto liquidation

Thailand’s intervention occurs against the backdrop of widespread turbulence in global markets. Investors responded with caution, urging regulators around the world to intervene to prevent further market declines.

In related developments, stocks plummeted across the global market, sparking emergency measures in Asia and Europe. In France, trading in major bank stocks has been suspended after a sharp decline in open markets.

Related: Thailand – $2.5 million code stash related to human trafficking seized in Chinese bust

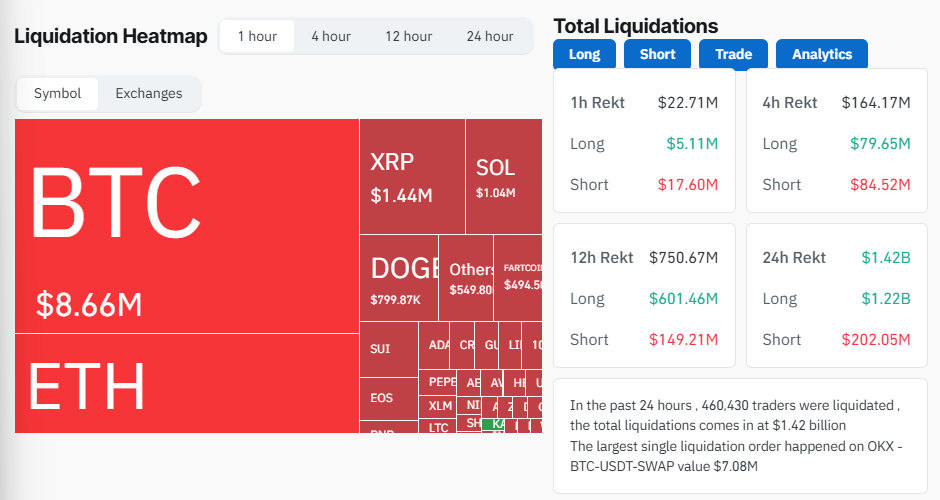

In particular, the crypto market is also feeling the heat of global financial market turmoil. Today, Bitcoin collided with $74,000 for the first time since November 2024. In particular, 46,427 traders have been liquidated with losses of over $1.46 billion.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.